Market Overview: EURUSD Forex

The EURUSD Forex sell-off is strong and in a tight bear channel – A EURUSD potential final flag. Bears want a test of 2017 low and a strong breakout below. Because of the strong selling pressure, odds slightly favor sideways to down.

However, because of the 1) oversold conditions, 2) trend channel line overshoot, 3) parabolic wedge and 4) potential final flag, traders should be prepared for a 2-legged pullback (bounce) which can begin at any moment.

EURUSD Forex market

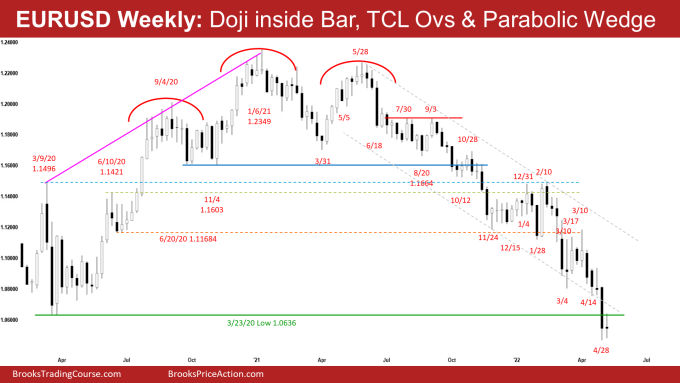

The Weekly EURUSD chart

- This week’s candlestick on the weekly EURUSD Forex chart was an inside bear doji bar.

- Last week, we said that odds slightly favor sideways to down to test the 2017 low magnet below. However, because of the 1) oversold conditions, 2) trend channel line overshoot, 3) parabolic wedge and 4) potential final flag, traders should be prepared for a 2-legged pullback (bounce) which can begin at any moment.

- This week traded sideways in a small trading range. An inside bar late in the trend can be the final flag of the move.

- The bears got a downside breakout and exceeded the 1.072 measured move at the end of April.

- The bears have another measured move target based on the height of the 3-week trading range (March 7 to March 31) which will take them to around 1.4268 which is near the 2017 low. It is close enough to be a magnet below.

- The bulls hope that this is simply a sell vacuum test of the March 2020 low or the 7-year trading range low. They see a parabolic wedge (August 20, November 24, April 29) and a trend channel line overshoot.

- Al has said that the market has been in a trading range for seven years. It is now near the bottom of the range. Reversals are more likely than breakouts.

- Therefore, as strong as the selloff has been, it is still more likely a bear leg in the seven-year trading range than a resumption of the 15-year bear trend.

- If the bears can get another bear close below the March 2020 low, the selloff should continue down to the 2017 low, which is the bottom of the 15-year bear trend. A couple of closes below that low would probably be the start of a measured move down based on the height of the seven-year trading range.

- For now, the odds of a reversal from the bottom of the trading range around the March 2020 low or around the January 2017 low are slightly higher than a strong breakout below the 2017 low and a measured move down.

- Since this week was an inside doji bar, it is a breakout pattern.

- Because it is appearing late in the trend, it can potentially be a one bar final flag of the move. That means we may get a breakout below the final flag followed by a reversal higher after that.

- If there is a breakout, a downside breakout is slightly more likely to test the 2017 low magnet below.

- However, as said above because of the market context, traders should be prepared for a 2-legged pullback (bounce) which can begin at any moment.

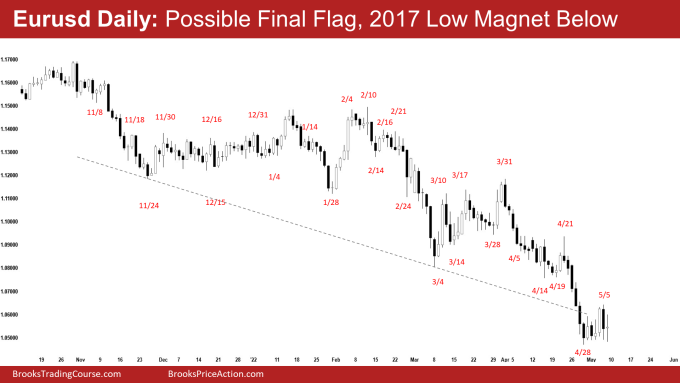

The Daily EURUSD chart

- The EURUSD traded sideways in a tight trading range throughout the week.

- Bears reached the 400-pip measured move based on the height of the 4-month trading range (Nov 2021 to Feb 2022 – 1.072) during the spike down on April 28.

- They have not yet reached the measured move based on the height of the 3-week trading range (March 7 to March 31) which will take them to around 1.4268 which is near the 2017 low.

- The bulls see a trend channel line overshoot and a parabolic wedge (April 5, April 14, and April 28).

- They want at least a 2-legged sideways to up pullback (bounce).

- However, the bulls have not been able to create strong consecutive bull bars with follow-through buying since the sell-off on March 31st.

- Bears want a strong break below April 28 low and follow-through selling to reach the next measured move and the 2017 low.

- The targets below are near enough for it to become a magnet.

- The move down is in a tight bear channel. That represents persistent selling and strong bears. However, it is also climactic.

- The tight trading range in the last 8 days, late in the trend, is a potential final flag of the move. It increases the chance of a reversal higher after a breakout below.

- For now, odds slightly favor sideways to down.

- Again, because of the market context, traders should be prepared for a 2-legged pullback (bounce) which can begin at any moment.

- It may begin after a failed breakout below the final flag around the 2017 low.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.