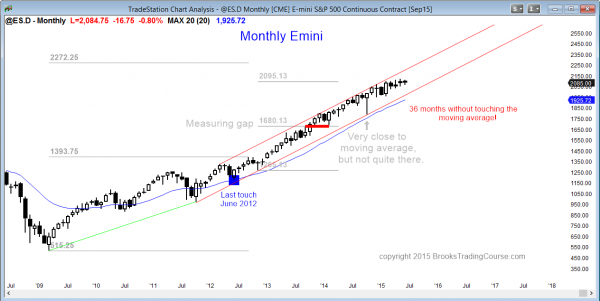

Monthly S&P500 Emini futures candlestick chart: Strong bull trend, but overbought

The monthly S&P500 Emini futures candlestick chart is in an overbought bull trend and the odds favor a test of the moving average over the next few months.

The monthly S&P500 Emini futures candlestick chart is exceptionally overbought and it has an 80% chance of a 10% pullback this year. Although a small pullback bull trend can continue for many more bars, it has done so only twice in the past 50 years, and those times were followed by 22% and 36% corrections. No one knows what news event will cause the initial bear breakout, but once institutions see a strong bear breakout, they will sell out of longs quickly and this technical selling will lead to the 10 – 20% correction.

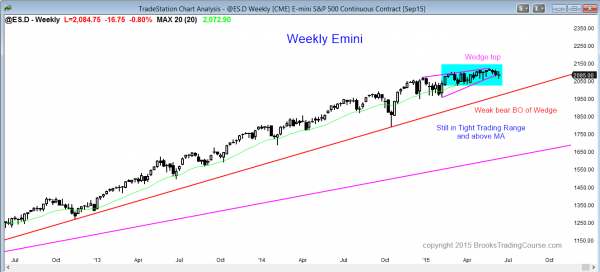

Weekly S&P500 Emini futures candlestick chart: Breakout mode

The weekly S&P500 Emini futures candlestick chart is in a tight trading range and in breakout mode.

The weekly S&P500 Emini futures candlestick chart is in a 6 month tight trading range just above the moving average. While the bulls have a slightly greater chance of a breakout, the odds are that the breakout will fail within about 5 bars (weeks) and that the trading range will become the final bull flag before a correction of 10% or more.

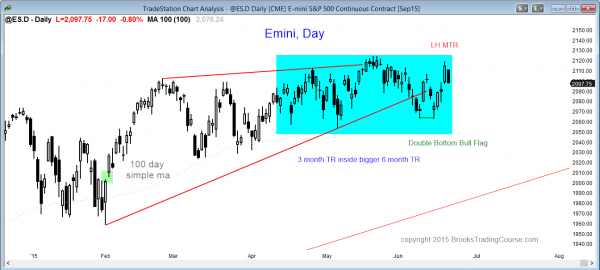

Daily S&P500 Emini futures candlestick chart: Rallying, but still within the 6 month round top

The daily S&P500 Emini futures candlestick chart is in the middle of a 6 month trading range and close to the all-time high.

The daily S&P500 Emini futures candlestick chart is in a trading range. It is a round top candlestick pattern, but it has an equal chance of a bull or bear breakout. If there is a bull breakout, it will probably be limited because the monthly chart is so overbought.

This week’s rally was strong, and there might be follow-through to a new all-time high, but until there is a bull breakout, there is no breakout. The bears have almost a high a probability of creating a lower high major trend reversal and a bear breakout. June 25 to July 5 is one of the most reliably bullish times of the year, and there might be a small pullback going into that bullish window.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.