Market Overview: S&P 500 Emini Futures

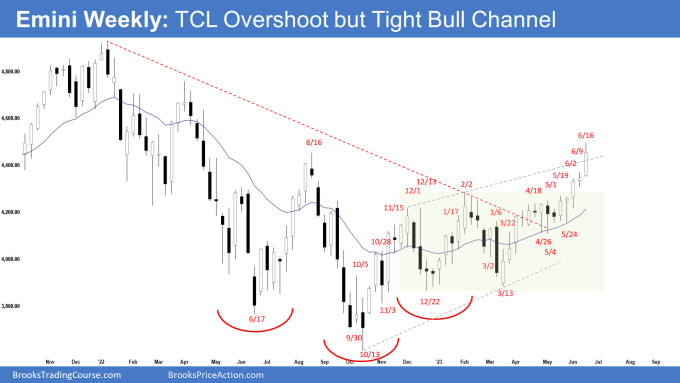

The S&P 500 Emini futures traded higher and formed a TCL Overshoot (trend channel line). The bulls want a strong breakout above the August high and a measured move up to around the March 2022 high area. The bears want a failed breakout above the August high and at least a pullback following the trend channel line overshoot.

S&P500 Emini futures

The Weekly S&P 500 Emini chart

- This week’s Emini candlestick was a big bull bar closing in the upper half with a prominent tail above.

- Last week, we said that while the odds slightly favor the market to still be in the sideways to up phase, a minor pullback can begin at any moment.

- This week traded above the August high but did not close above it.

- The bulls got a strong leg up creating the wedge pattern with the first two legs being December 13 and February 2.

- The move up is in a tight bull channel and a 4-bar bull microchannel. That means strong bulls.

- They want a breakout far above the August high followed by a measured move using the height of the 6-month trading range which will take them to the March 2022 high area.

- They will need to create follow-through buying trading far above the August high.

- If there is a pullback, they want at least a small second leg sideways to up retesting the current leg extreme (June 16).

- The bears want a reversal down from a wedge pattern (Dec 13, Feb 2, and Jun 16) and a double top with the August high.

- They hope to get a failed breakout above the August high. If there is a failed breakout, it would usually occur within 5 bars after the breakout.

- They want at least a small pullback from the TCL Overshoot (trend channel line).

- The problem with the bear’s case is that they have not been able to create credible selling pressure since the March low.

- They will need to create strong bear bars with follow-through selling to convince traders that a deeper pullback could be underway.

- At the very least, the bears will need a strong reversal bar or a micro double top before they would be willing to sell more aggressively.

- Since this week was a bull bar closing in its upper half, it is a buy signal bar for next week, albeit weaker because of the prominent tail above. It is not a strong sell signal bar.

- While the odds continue to slightly favor the market to still be in the sideways to up phase, a minor pullback can begin at any moment.

- Traders will see if the bulls can continue creating consecutive bull bars or will the Emini stall around the August high and begin the pullback phase.

The Daily S&P 500 Emini chart

- The Emini traded higher for the week. Friday opened higher but reversed to close as a bear bar near its low.

- Previously, we said that the odds continue to slightly favor sideways to up. This can change if the bears manage to create strong consecutive bear bars closing near their lows.

- This week continued the move up and broke above the trend channel line.

- The bulls want a measured move up using the height of the 6-month trading range which will take them near the March 2022 high.

- They will need to break far above the August high with follow-through buying to increase the odds of reaching the measured move target.

- The move up since May 24 low is in a tight bull channel which means strong bulls.

- However, the move up is also slightly climactic and has the shape of a parabolic wedge (May 30, Jun 5, and Jun 16).

- Thursday’s big bull bar late in a trend could be a sign of climactic price action.

- A minor pullback can begin at any moment. If there is a pullback, a reasonable target would be the 20-day exponential moving average area.

- Traders will still expect at least a small leg to retest the current leg extreme high (Jun 16).

- The bears have not yet been able to create credible selling pressure.

- They see the move up from October 2022 simply as forming a large wedge (Dec 13, Feb 2, and Jun 16) within a broad bear channel.

- The longer they fail to create the trend resumption lower (the more candlesticks in between) from the selloff from January – October 2022 to now, the less relevant the effects of the prior move down would have on the current price action.

- The bears want a failed breakout above the August high and a reversal from a trend channel line overshoot.

- They will need to create follow-through selling early next week to increase the odds of a deeper pullback.

- Because of the lack of strong bear bars with follow-through selling, odds continue to slightly favor sideways to up.

- However, the move up is also climactic and a minor pullback can begin at any moment.

- The market is closed on Monday for Juneteenth National Independence Day.

Trading room

Al Brooks and other presenters talk about the detailed Emini price action real-time each day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.