Market Overview: Weekend Market Update

The Emini is in an early bear trend on the daily chart and probably the weekly chart. The bulls want a double bottom with last week’s low. However, the best the bulls can probably get over the next several weeks is a trading range. There is at least a 50% chance of a 20% correction, which would be a bear market.

Bond futures are rallying strongly far above the prior all-time high. While this is a buy climax, there is no top. Traders will buy the 1st reversal down.

The EURUSD Forex market has rallied strongly for 2 weeks. Traders believe that the 2 year bear trend has finally ended. The rally is either the start of a bull trend or a bull leg in what will become a trading range.

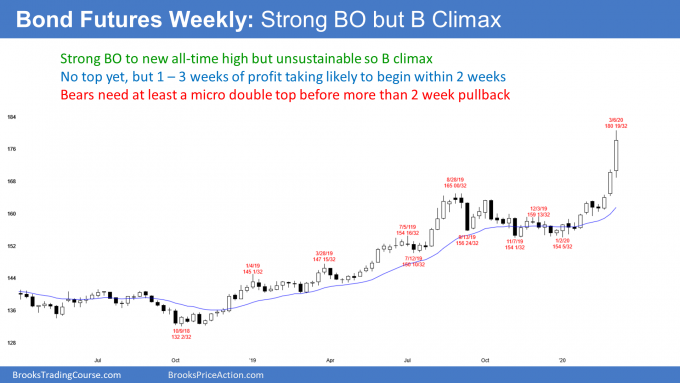

30 year Treasury bond Futures market:

Surprisingly strong bull breakout

The 30 year Treasury bond futures has rallied strongly to a new all-time high over the paste 3 weeks on the weekly chart. A strong breakout makes at least slightly higher prices likely.

However, the rally on the weekly chart is unusually extreme. Yes, traders will buy the 1st pullback. And yes, at least a small 2nd leg up is likely. But the stop for the bulls is now far below. Traders therefore have unusually big risk. The easiest way to reduce the risk to acceptable levels is to take some profits. Traders therefore should expect some profit taking to begin within the next couple of weeks.

Minor profit taking soon

As I said, the bulls will buy the 1st pullback. It will therefore likely only last 1 – 3 bars (weeks on the weekly chart). But the bulls will probably then take profits again after the 1 – 3 bar (week) rally that will likely follow the pullback. If that 2nd rally reverses down, there would be a type of higher high double top. It would also be a consecutive buy climax, which typically attracts profit takers. When the two highs of a double top are only a few bars apart, it is a micro double top.

Once the bulls take profits a 2nd time after an extreme rally, they will not be eager to buy again a few bars later. If that was there plan, it would not make sense to take profits.

When they take profits, they wait to see how strong the profit taking will be and how aggressive the bears will be. Traders typically like to give the bears at least 2 chances to begin a swing down. If the bears try twice to reverse the trend but fail, the bulls will buy again and the trend up will resume.

When I say that the bulls will give the bears two chances, I mean most bulls will not buy until after at least a couple legs sideways to down. That process often takes about 10 bars. Sometimes more, sometimes a little less.

Brief pullback soon and then another brief leg up

Traders should expect a brief pullback within a couple weeks on the weekly chart. It will probably last 1 – 2 weeks. There will then typically be a 1 – 3 bar rally to a new high. At that point, profit taking will probably result in a 5 – 10 week, sideways to down move.

What about the nested wedge top on the monthly chart?

The monthly chart formed a nested wedge top from 2008 to 2016. That typically results is at least 2 sideways to down legs. Also, the pullback usually has about half as many bars as there were in the rally.

The selloff from the 2016 high had 2 legs and lasted 3 years. It met the minimum objective of the bears. However, the nested wedge top made a deeper and longer correction likely. The odds favored a trend reversal lasting a decade or more. This breakout is therefore a low probability event, a Surprise Breakout.

When there is Surprise Breakout above a reasonable top like this, traders expect at least a couple legs up. Consequently, they will look to buy the 1st 1 – 2 month pullback on the monthly chart.

Furthermore, when there is a strong breakout above a credible top, traders also look for a measured move up based on the height of the top. A measured move up from the 2018 low to the 2016 high is above 190. While that might seem unreachable, it is a logical target for this rally over the next couple years.

What about negative interest rates?

I have said that I do not believe that Americans will allow negative interest rates. While this huge rally increases the chance, I still do not think it will happen. But, the 10 year and 30 year U.S. interest rates could fall very close to zero or even to zero.

EURUSD weekly Forex chart:

Likely end of 2 year bear trend

The EURUSD weekly Forex chart reversed up violently over the past 2 weeks after testing the gap from April 2017. It turned up from just 1 pip above the bottom of the gap.

The past 2 weeks were surprisingly big bull bars. A Surprise Bull Breakout typically has at least a small 2nd leg up. Consequently, traders should expect the bulls to buy the 1st 1 – 3 bar pullback on the weekly chart.

The rally broke far above the 18 month bear trend line. That is the top of the bear channel and it is resistance. It also broke above the high of a 7 month trading range. This is therefore a logical area where the bears might begin some profit taking.

But as I said, this rally is surprisingly strong. Because the breakout was far above, it increases the chance of at least a small 2nd leg up. Traders will buy the 1st 1 – 3 bar (week) pullback.

Likely end of 2 year bear trend

The reversal up from the gap to above the top of the bull channel and trading range is an unusually strong sign that the bears are losing control. It is strong enough to make it likely that the 2 year bear trend ended. When a bear trend ends, either a bull trend or trading range begins.

The 2 year selloff retraced most but not all of the 2017 rally. The bear channel is therefore is a bull flag. This week is starting to break above the bull flag.

If there are several more big weeks like the past 2, traders will conclude that the 2017 bull trend is resuming. More often, the 1st rally above a bear channel is the start of a trading range and not a bull trend. The EURUSD is now in search of the top of the trading range.

It is often at the start of the bear channel. That is the top of the 1st pullback from the strong reversal down from the top of the bull trend (February 2018). That 1st pullback’s high is the September 2018 high of 1.1816. The rally of the past 2 weeks is already half way there.

Bear channel usually evolves into a trading range

A rally after a bear channel usually ends up as a bull leg in a trading range. A leg in a trading range typically stalls after a few bars. After pulling back for a few bars, it begins another leg up. Traders should expect pauses at the lower highs in the 2 year bear channel. This is unlike the start of a bull trend where the pullbacks are brief and the rally can last 5 – 10 bars before there is more than a 1 bar pullback.

The bear channel is now probably evolving into a trading range. The current rally is therefore probably a bull leg in what will become a trading range.

The top of the range is typically around the start of the bear channel. Consequently, the EURUSD might go sideways for the next couple years between the February 2020 low of 1.0778 and the September 2018 high of 1.1816 (approximately 1.08 to 1.18).

Coronavirus update

The impending coronavirus pandemic is getting all of the attention

The developing coronavirus pandemic is a shiny object and we cannot take our eyes off it. It is constantly in the news. It will affect the stock market for many months and possibly until a vaccine comes out next year. The bulls will not aggressively buy until they are confident that there will not be a geometric increase in the number of cases.

If there is, that will significantly alter everyone’s habits. In particular, people will spend less money and many will get laid off. They will go on fewer trips and they will avoid crowds like at the malls, movie theaters, concerts, and sporting events. They will also buy fewer unnecessary things for fear of being laid off in what they will see as a slowing economy. Consequently, a pandemic would probably cause a recession later this year.

Ignore the news, and think for yourself

The news media are not thinking this through. Instead, they are blindly accepting the best case scenario that government officials around the world are promoting. Everyone knows that there is a significant risk of widespread infections until there is a vaccine. That is a year away.

What we are doing now is medieval. They used containment in the middle ages during the plague. How well did that work for them?

The problem with containment is that the virus is already in too many places. That means that thousands of government officials around the world have to handle containment perfectly. No way.

It is very important to note that we are behaving differently

The coronavirus is changing our behavior much more than the swine flu did. Why? Because the American people sense that the news reports are underplaying the story. They believe that the government is not protecting us adequately because the government sees the problem as much less dangerous than we do. I bet the American people have it right. The news should be watching us and instead of us watching the news.

Worse than the 2019 H1N1 (swine) flu

The real goal this year is to “contain” the rate of spread. I think it is more likely that the number of cases will begin to increase geometrically like it did with the H1N1 (swine) flu in 2009. So far, 100,000 people worldwide have tested positive for the coronavirus. That is similar to the 1st few months of the swing flu. But within a year, more than 10 million people were infected worldwide with the swine flu and at least 100,000 died.

Currently, coronavirus appears at least as contagious than the swine flu. Although many infected individuals have no or mild symptoms, the percentage of very sick patients appears to be greater. It is reasonable to assume that it ultimately will kill more people than the swine flu.

I have heard people say that coronavirus is not serious because as many as half of people infected (tested positive) with the coronavirus have no symptoms. That is not a valid conclusion. Compare this with the common flu. More than the 75% of people infected with the flu virus have no symptoms, yet 500,000 people die each year from the flu.

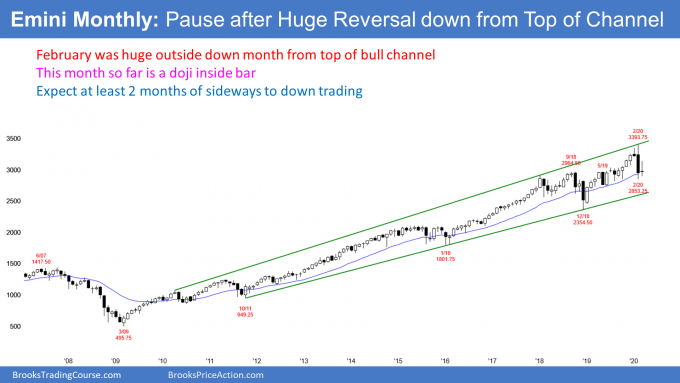

Monthly S&P500 Emini futures chart:

Bear inside bar after extremely big bear bar

In December, the Emini was breaking above the top of a 13 year bull channel. I said that there was a 75% chance of a reversal down to the middle or bottom of the channel beginning within 5 bars (months). It began 2 months later.

The Emini is already back to the middle of the bull channel. Since February was a Bear Surprise Bar, there will probably be at least a small 2nd leg sideways to down after the 1st pause.

Bear inside bar and 2nd leg down likely

The monthly S&P500 Emini futures chart so far has a bear inside bar after February’s collapse. Look back over the past 2 years. There were several bear bars, but no consecutive big bear bars.

Also, the 11 year bull trend is still in a tight bull channel. This selloff still could end up as a pullback in the bull trend or the 2 year trading range instead of the start of a bear trend on the monthly chart. But even if it is, traders should expect a bear trend to begin within a couple years.

The bulls see February as simply a brief, sharp pullback to the 20 month EMA. That has been support for 4 other selloffs since December 2018 low. There are probably enough bulls expecting it to be support again to prevent March from becoming a 2nd consecutive big bear bar. However, it will probably not be enough to prevent at least one more leg down if there is a 1 – 2 month pause or bounce.

Technical problems are more important than the coronavirus

There are some significant technical problems for the bulls. They will probably limit the upside for many months and possibly several years. During the 2017 buy climax, I repeatedly made the point that the rally was the most extreme buy climax in the history of the stock market. I said that there would soon be profit taking and it could last a long time. It lasted a couple years.

It is important to note that during each strong selloff, I said that each selloff was likely to be minor because the bull trend was so strong. However, I also made the point that the resumption up after an extreme buy climax is typically brief. It is then often followed by a deeper correction. The 2019 rally was the resumption up. February might have ended the 12 year bull trend.

Trading range for the next 10 years

For 3 years, I have been saying that the market would likely top out within 5 years and that the next 10 years would probably be in a trading range. This happened in the 1970’s and again in the 2000’s. Both trading ranges lasted about a decade and both followed strong bull trends. That is what is likely this time as well.

How do we know if the bull trend is over? It is still to early to tell. We need more information. For example, if the Emini sells off to the 2018 low and then fails to get above this year’s high for a year or more, traders will begin to conclude that the bull trend had evolved into a trading range.

When the market is in a trading range, it often makes one or more new highs, but fails to break far above the old high. Traders lack confidence that the bull trend will resume. Instead of buying a strong breakout to a new high, the bulls take profits. Also, the bears short, confident that the breakout will fail.

The opposite happens at the bottom. The result is a series of strong legs up and down that can last a long time.

How tall will the trading range be?

The trading ranges in the 1970’s and the 2000’s both had at least a couple selloffs of 40 – 60%. If the market is entering a trading range, that will probably be our future over the next decade.

It will be more of a trader’s market and a stock pickers market. There will always be another Amazon or Netflix, but far fewer than over the past 10 years. Finding the next hot stock will be impossible for most people.

Buying and holding will probably be disappointing. This is unfortunate because the baby boomers are starting to retire. They were counting on consistent, modest profits on their stocks. If the next decade is a trading range, they will make little or no passive income from their portfolios.

It’s the economy, stupid, not coronavirus

These technical forces have been working for several years. The coronavirus scare caused the selloff to come now and made it extremely big and fast. But it was going to come regardless. No one knew what black swan would start it or precisely when it would start.

Once there is a vaccine, the coronavirus will no longer be a problem. That means it could affect the market for a year.

But what if I’m right and the market is in a trading range for a decade? Can you still blame the coronavirus? Of course not. The economists will come up with all kinds of economic explanations.

I have a simple explanation. The stock market was the most overbought in history. It needs a long time for the fundamentals to catch up with the price. It will probably take a decade.

Weekly S&P500 Emini futures chart:

Big bear inside bar after huge bear bar

The weekly S&P500 Emini futures chart formed an inside bar this week. It is a Low 1 sell signal bar for last week. Because it was a doji bar, it is a less reliable sell setup. There might be more buyers than sellers below its low. This could result in several sideways bars on the weekly chart.

Last week’s selloff was a Bear Major Surprise Bar. Traders should expect at least a small 2nd leg down. There is a 40% chance that it will be a spike in a Spike and Channel Bear Trend. That means that it would have at least 2 more additional legs down.

A Bear Major Surprise typically leads to some type of measured move. For example, traders look for a measured move based on the size of the bear body. That would be around 2700.

It would also be around the 2019 March/June double bottom. The selloff does not have to get there. If it does, it does not have to stop there. If it gets there, traders will watch to see if there is a reversal up. They will buy a reasonable looking buy setup.

But if the 12 year bull trend has ended, rallies will not lead to a resumption of the bull trend. Traders will sell rallies, expecting the market to continue sideways to down for years.

It is important to understand that when a bull trend ends, a bear trend does not have to begin. The market can do sideways for a year or two before a bear trend begins.

Therefore, there might not be clarity for a long time. Some will say that the trading range is a bull flag. Other will call it a developing top. Until there is a breakout of the range, traders will buy low, sell high, and take quick profits.

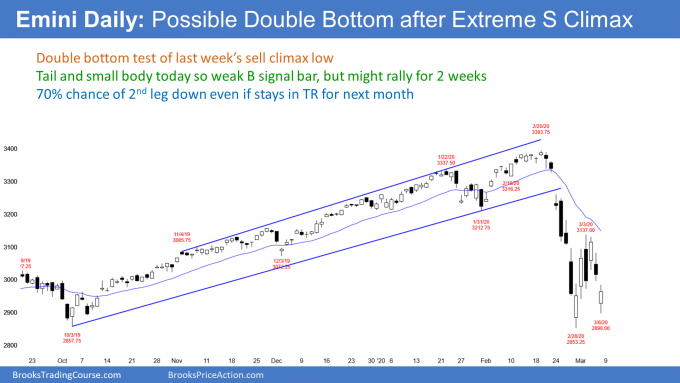

Daily S&P500 Emini futures chart:

Bear trend, testing last week’s low

The daily S&P500 Emini futures chart is testing last week’s low. Friday was a relatively small day. It is therefore a weak buy signal bar for a higher low double bottom with the February 28 low.

The February selloff was surprisingly strong. It will therefore probably dominate the price action for more than a couple weeks. That reduces the chances that a double bottom reversal will lead to a resumption of the bull trend. The best the bulls can probably get over the next few weeks is a bear rally. That means a leg up in a developing trading range.

It could retrace more than half of the selloff. But traders should expect sideways to down trading for at least another month.

At least 50% chance of bear market

What is the difference between a bear trend and a bear market? Over the past couple decades, institutions have come to agree that the term “bear market” means at least a 20% selloff from the all-time high. This is true for any market. They are not looking at anything else. Therefore, this has nothing to do with charts or technical analysis.

When you hear the word “trend,” you immediately picture a chart. It is therefore a term that chartists use and everyone has his own definition. There is agreement that a bear trend means a series of lower highs and lows.

However, trends have major and minor highs and lows, and it is often not clear if something is major or minor. Traders are free to use the terms bear trend and bull trend in any way that they would like. No one will question your definition as long as the highs and lows are trending in a fairly obvious way.

I believe the daily and weekly charts are probably in the early stages of bear trends. I said last week that there was at least a 50% chance of a 20% correction. That means a bear market. I suspect a bear market is more than 50% likely.

Furthermore, I said that there was a 30% chance of a 30 – 50% correction. That is still true. If there are consecutive closes below last week’s low, the probability will go up to at least 40%. Also, if there is a 40 – 50% correction, traders should assume that a decade-long trading range has begun.

Wednesday was weak Low 1 sell signal

The daily chart broke below Wednesday’s low. That triggered a Low 1 sell signal. But Wednesday was a bull bar and and it was in a strong 4 day rally. It is therefore a weak sell signal.

When that is the case, some bulls will scale in as the Emini falls, expecting a rally back to above Wednesday’s low. That is what often happens when the sell signal bar is weak. Consequently, the bulls have a reasonable chance of a bounce back up to Wednesday’s low this week if there is no bad coronavirus news over the weekend.

However, traders believe that any rally will be a pullback in a bear trend or the start of a bull leg in a trading range and not the start of a bull trend. The bulls only have a 30% chance of getting a new high within the next few months.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Market Update page.