Market Overview: Weekend Market Analysis

The SP500 Emini futures monthly candlestick closed at all time high after an Emini outside-outside pattern (OO) and is in breakout mode. November likely to trade above October, and we could get a rare gap up on monthly, weekly and daily charts on Monday.

The EURUSD Forex big bull bar on Thursday was a bull trap. Bears want a 2nd sideways to down leg from a wedge bear flag. EURUSD may need to test 1.15 or 1.14 before we see a stronger reversal attempt.

EURUSD Forex market

The EURUSD monthly chart

- October’s candlestick was a bear doji with tails above and below the bar. It closed below September’s close but a fraction of a pip above the September low.

- The bears got follow-through selling, but it is weak follow through.

- The bears want a 700-pip measured move lower based on the height of the yearlong trading range.

- While the move down since September is in a tight channel, many of the bars are overlapping the prior bars.

- The bears are not having as strong follow-through as they would like. Odds are the move down is a bear leg in the 7-year trading range.

- The bulls want a reversal higher from a failed breakout below the bottom of the yearlong trading range. They hope that the selloff is simply a pullback from last year’s breakout above the bear trend line.

- March 2020 high and June 2020 high are breakout points for the strong rally last year and are therefore magnets.

- Al has been saying for several weeks that the EURUSD should fall below March 9, 2020 high or the June 10, 2020 high. This could happen in November.

- Since most trading range breakouts fail, this selloff will probably be simply a test of those two support levels.

- However, if the bears get a few consecutive big bear bars closing on the lows, the odds will shift in favor of a successful breakout of the trading range and the EURUSD may then evolve into a bear trend.

- If there is a reversal up within a few months, the 7-year trading range will be a triangle, beginning with the 2017 low.

The EURUSD weekly chart

- This week’s candlestick on the weekly EURUSD Forex chart was an outside bear bar with prominent tails above and below.

- The low was above the low from 2 weeks ago. This is less bearish than it could have been.

- The bears want a 2nd sideways to down leg from a micro wedge bear flag over the past 3 weeks.

- They also want a 700-pip measured move down based on the height of the yearlong head and shoulders top.

- The EURUSD has been in a trading range for 7 years. When there is a trading range, traders look for reversals.

- However, 2020 broke strongly above the June 10, 2020 and the March 9, 2020 highs. Those are therefore very important support levels, and they are within reach. That means that they are strong magnets below.

- Al has been saying that when a market is in a trading range and it gets near support or resistance, it usually goes beyond it before reversing. Therefore, the EURUSD should fall to 1.15 or possibly 1.14.

- The bulls want a reversal up from a wedge bull flag (with the March 31 and August 20 lows) and a micro double bottom with the October 12 low.

- The current selloff since September is more likely a bear leg in the trading range.

- The recent pullback (bounce) followed 5 consecutive bear bars, which means relentless selling. That increases the chance that the bulls will need at least a micro double bottom before they can get a reversal up.

- Last year’s rally was stronger than the current reversal down from the May high. That makes it likely that the selloff is just a big pullback from last year’s rally.

- Therefore, there should soon be a reversal up lasting at least several weeks, and it might reach the September 3 high. It should begin after a dip below one or both of those breakout points, but the reversal up can begin at any time.

- There is always at least a 40% chance that the opposite of what is likely will happen. Consequently, there is at least a 40% chance that the selloff will continue down to near the bottom of the 7-year trading range.

- If the bears get consecutive bear bars closing near their lows and below the June 10, 2020 high, the odds of the selloff continuing to near last year’s low will be more than 50%.

The EURUSD daily chart

- After a big bull breakout on Thursday, there was an even bigger reversal down on Friday. Thursday was therefore a bull trap. It was also a 2nd failed attempt to get back above the August 20 low.

- We have been saying that the tight channel down since September indicates strong sellers and makes it likely that any pullback (bounce) would only be minor, even if it goes above the August 20 low.

- The bears want a 2nd sideways to down leg from a wedge bear flag (with October 4th and 14th) and a measured move down.

- The bulls want a reversal up from a double bottom with the October 12 low and a major trend reversal even if EURUSD trades slightly below October’s low.

- The EURUSD has been in a trading range for 7 years. March 9, 2020 high and the June 10, 2020 high were breakout points for last year’s strong rally therefore strong magnets.

- When a market is in a trading range and it gets near support or resistance, it usually goes beyond it before reversing.

- Friday’s big bear bar increased the chance that it will happen within a couple of weeks.

- For now, odds slightly favor a test of 1.15 or possibly 1.14 before we see a stronger reversal attempt by the bulls.

S&P500 Emini futures

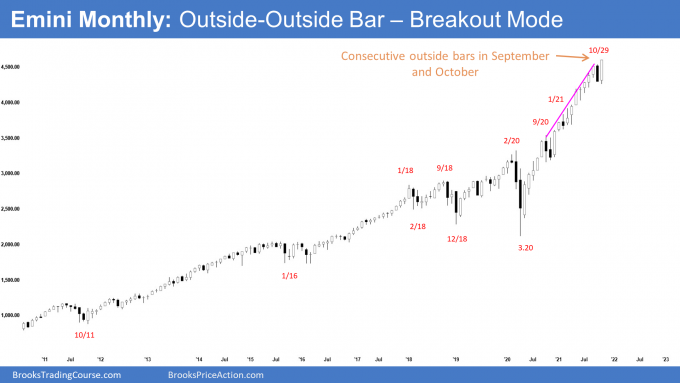

The Monthly Emini chart

- The October monthly Emini candlestick was a second consecutive outside bar at new high. An OO (outside-outside) pattern means the Emini is in breakout mode.

- November will likely trade above October’s high. Monday could gap up, creating a rare gap on the monthly chart. However, small gaps usually close early.

- Theoretically, bulls will buy above and bears will sell below October’s bar. Both will look for at least a measured move based on the height of the pattern. For the bulls, a measured move up is 4934.50.

- September was the third time that a bear bar interrupted the strong rally on the monthly chart. A third reversal attempt has a higher probability of being successful.

- Most prior bear bars in buy climaxes on the monthly chart led to a 2nd bear bar within a bar or two. That means the bears hope that November rallies and then reverses down at the end of the month to close below the open of the month.

- Will that happen? With October being surprisingly strong, November will likely be another bull bar. Traders will begin to wonder if the Emini will reach the 5,000 Big Round Number before there is more than a one-month reversal.

- How much higher can the buy climax continue? Climactic rallies often last far longer than what might appear reasonable.

- An OO pattern is a pause and a brief area of agreement. It is usually an expanding triangle on a smaller time frame.

- Three sideways bars are often a magnet, which tends to draw the market back to it after a breakout. Therefore, there is an increased chance that it will be the Final Bull Flag before there is a correction lasting at least a few bars (months).

- However, the breakout above the OO often lasts several bars before there is a reversal. That means traders should expect higher prices at least into early November, and probably for at least a measured move up based on the height of the OO.

- The bears want a reversal down, even if there is first a breakout above the monthly OO pattern.

- An inside bar after an outside bar is common. If November is a bear inside bar closing near its low, there would be an ioi Breakout mode pattern (August is inside of September’s range). That, or any bear bar closing near its low in November or December, would be a credible sell signal on the monthly chart.

- For now, the odds favor at least slightly higher prices in November. However, there is always a bear case, and a 40% chance of it happening.

The Weekly S&P500 Emini futures chart

- This week’s Emini weekly candlestick was the 4th consecutive bull bar, and it closed at new high.

- Since this week closed near the high of the bar, next week could gap up on the weekly chart. If the gap is small, it is important to remember that a small gap usually closes early.

- The next targets for the bulls are the trend channel line around 4700 and 4802.00 That is the measured move target based on the height of the 4-month trading range (Jul-Oct).

- Al has said that while there was a 50% chance that the Small Pullback Bull Trend was ending in September, there was also a 50% chance that it would continue. The strong rally over the past 3 weeks shows that the trend is intact.

- A Small Pullback Bull Trend is a bull trend where the pullbacks are small. This one began with the pandemic crash. The biggest pullback was 10% and it came a year ago.

- A Small Pullback Bull Trend ends with a big pullback. That means a pullback that is at least 50% bigger than the biggest prior pullback. Here, the trend will remain intact until there is at least a 15% correction.

- Once it ends, the bull trend typically converts into a trading range. Initially, the odds are that it will be a bull flag. Traders expect the trend to resume. If it does, it is usually a weaker bull trend.

- If the trading range lasts 20 or more bars, the probability of a reversal into a bear trend begins to get close to 50%.

- The bears want a higher high double top major trend reversal with the September high but the 4 strong bull bars after a 6-bar bear microchannel was a low probability event. A surprise typically has at least a small 2nd leg sideways to up.

- Therefore, the bears would need a surprisingly strong bear bar and a micro double top before traders would look for a reversal.

- For now, odds slightly favor sideways to up for November.

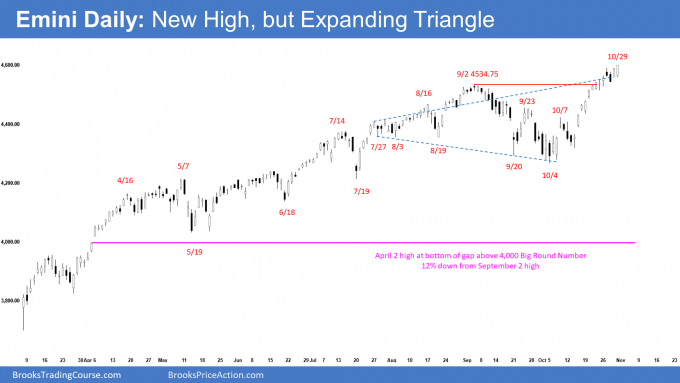

The Daily S&P500 Emini futures chart

- Friday made another new all-time high and it was another bull bar closing near its high. It also closed just above the 4600 Big Round Number.

- Since Friday closed near the high, Monday could gap up to a new all-time high.

- The move-up since October 13 is in a tight bull channel which means relentless bulls.

- Traders are still deciding if the breakout above the 4-month trading range will succeed.

- The bears want a reversal down from a higher high major trend reversal and an expanding triangle top (remember, the OO on the monthly chart was likely an expanding triangle on a smaller time frame).

- But the bears will need at least a micro double top or a few consecutive bear bars closing near their lows before traders will think about a possible reversal down.

- The bulls want a measured move up to 4802.00 based on the 4-month trading range.

- That is close enough to the 5,000 Big Round Number to make traders begin to think that the rally will reach it before there is more than a small correction.

- Will the Emini reach the 4800 magnet, or will the breakout above the September high fail?

- At the moment, traders should expect higher prices, possibly for the rest of the year.

- However, the rally to the September high has been extreme. That increases the chance of several sideways days over the coming week. There will probably be a trading range lasting at least a couple weeks at some point before the end of the year.

- But unless the bears get consecutive big bear bars closing near the lows, the odds continue to favor at least slightly higher prices. Trends usually successfully resist reversal attempts.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Weekly Reports Archive

You can access all weekly reports on the Market Analysis page.