Market Overview: S&P 500 Emini Futures

The weekly chart formed an Emini ii pattern (inside inside). The market is in breakout mode. The first breakout from an inside bar can fail 50% of the time. Traders will see if the bears can get a breakout below with follow-through selling or will the market trade slightly lower but reverse to close with a long tail below or a bull body.

S&P500 Emini futures

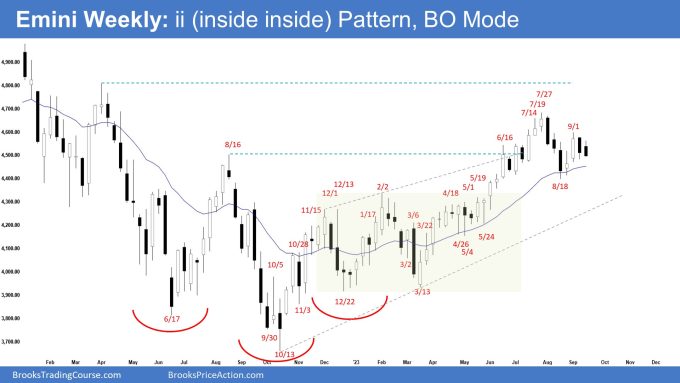

The Weekly S&P 500 Emini chart

- This week’s Emini candlestick was an inside bear bar with a small tail above.

- Last week, we said that the bulls want a breakout above while the bears want a breakout below the inside bar and sometimes, the candlestick after an inside bar is another inside bar, forming an ii (inside inside) which is a breakout mode pattern.

- Previously, the bulls got a strong trend up (since March) in a tight bull channel.

- That increases the odds of at least a small second leg sideways to up after a pullback. The second leg sideways to up formed (Sept 1) but did not get to the July 27 high.

- They hope that this week was a continuation of the small pullback from last week and want a breakout above the ii (inside inside) pattern.

- They want a retest of the July 27 high followed by a strong breakout above.

- The next targets for the bulls are the March 2022 high area and the all-time high.

- If the market trades lower, they want a reversal up from around the 20-week exponential moving average or from a double bottom bull flag with the August 18 low.

- Previously, the bears got a pullback from a climactic move and tested the 20-week exponential moving average.

- They want another leg down from a lower high major trend reversal.

- They will need to create follow-through selling trading far below the 20-week exponential moving average to increase the odds of a deeper pullback.

- The bears want a breakout below the ii (inside inside) pattern with follow-through selling.

- The ii (inside inside) pattern means the market is in breakout mode.

- The bulls want a breakout above while the bears want a breakout below the ii (inside inside) pattern.

- Because this week’s candlestick was an inside bear bar closing near its low, the market may first break out below the inside bar.

- The first breakout from an inside bar can fail 50% of the time.

- Traders will see if the bears can get a breakout below with follow-through selling or will the market trade slightly lower but reverse to close with a long tail below or a bull body.

- While the Emini could still trade a little lower, odds slightly favor the market to still be Always In Long.

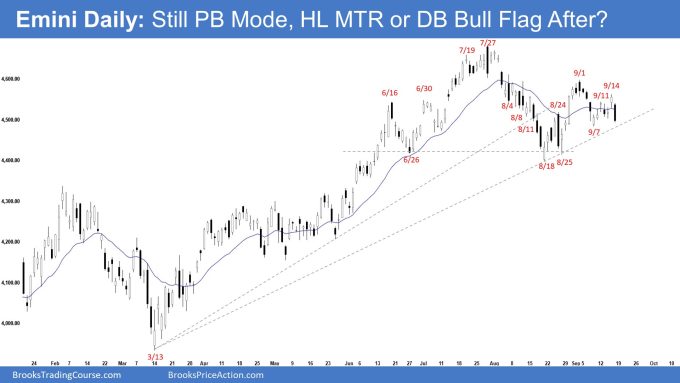

The Daily S&P 500 Emini chart

- The Emini traded sideways to down for the week. Thursday traded higher but there was no follow-through. Friday was a big bear bar closing near its low.

- Last week, we said that while the Emini could still trade a little lower, odds slightly favor the market to still be Always In Long.

- The bears got a reversal from a climactic move and a wedge pattern (Dec 13, Feb 2, and Jul 27).

- They want a second leg sideways to down from a lower high major trend reversal and a double top bear flag (Sept 1 and Sept 14).

- They want another strong leg down testing the August 18 low.

- They will need to create consecutive bear bars closing near their lows, trading far below the August 18 low to increase the odds of a reversal down.

- The bulls want a reversal up from a higher low major trend reversal followed by a retest of the July 27 high and a strong breakout above.

- If the market trades lower, they want a reversal up from a double bottom bull flag with the August 18 low.

- Since Friday was a bear bar closing near its low, it is a sell signal bar for Monday.

- Odds slightly favor the market to still be in the sideway to down pullback phase and to trade at least a little lower early next week.

- Traders will see if the bears can create follow-through selling or will the market trade slightly lower but find buyers near the August 18 low area.

- For now, while the Emini could still trade a little lower, odds slightly favor the market to still be Always In Long.

Trading room

Al Brooks and other presenters talk about the detailed Emini price action real-time each day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.