Market Overview: Weekend Market Update

The Emini had a Bear Surprise breakout this week. Traders expect lower prices over the next couple weeks.

The bond futures market reversed last week’s selloff. It is back in the middle of its 3 month trading range. Traders expect more sideways trading, even if the market rallies next week.

The EURUSD Forex market has rallied in a minor parabolic wedge buy climax on the daily chart. It should pull back for a week or two.

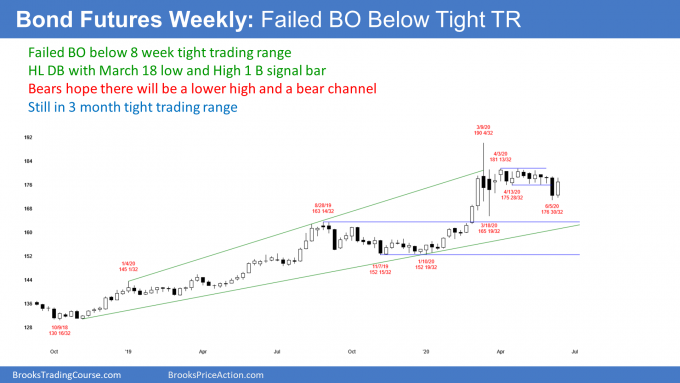

30 year Treasury Bond futures weekly chart:

Failed bear breakout

The 30 year Treasury bond futures on the weekly chart reversed last week’s selloff. For the bulls, last week was simply a sharp pullback to the 20 week EMA. The bond futures are now back in their 2 month tight trading range.

For the bulls, this week is now a buy signal bar. They see this week’s reversal as a failed breakout below a tight trading range and a triangle.

Furthermore, this week is reversing up from a higher low double bottom with the March 18 low. They want the this week to be the start of a resumption of the January to March rally.

Is this a resumption of the bull trend on the weekly chart?

What do the bulls need to do to convince traders that the bull trend is resuming on the weekly chart? They need many more bars in the trading range and then a strong breakout above that trading range. Then, traders will think that the bulls might get a new all-time high.

Alternatively, the bulls need a strong break above the March high. Then traders will wonder about a measured move up, possibly based on the March range.

At the moment, there is a 70% chance that this week’s reversal will be just a leg in the 3 month trading range. There is only a 30% chance that it will lead to a series of bull bars and a break above the March high.

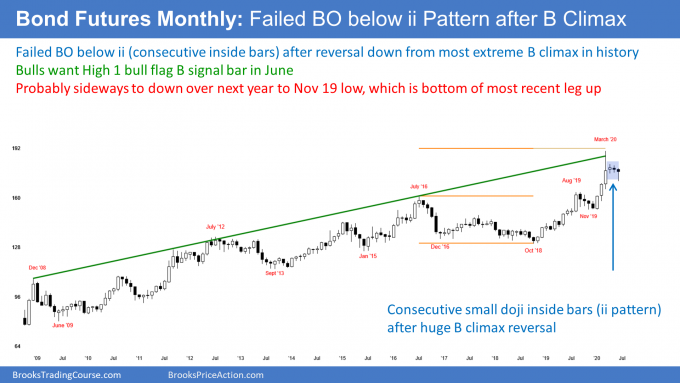

Strong reversal up, but the monthly chart is a problem

While the reversal up on the weekly chart is strong, the monthly chart is a problem for the bulls. The reversal down in March was strong. Additionally, the 3 month rally was the most extreme buy climax in history on the monthly chart. A 3 bar (month) pullback is probably not enough to lead to a resumption of the bull trend. Traders wanting to buy typically expect a couple legs sideways to down and lasting about 10 bars.

On the monthly chart, that means about a year. Therefore, this week’s reversal up will probably be the start of a bull leg in the trading range that began 3 months ago and not of a resumption of the 20 year bull trend.

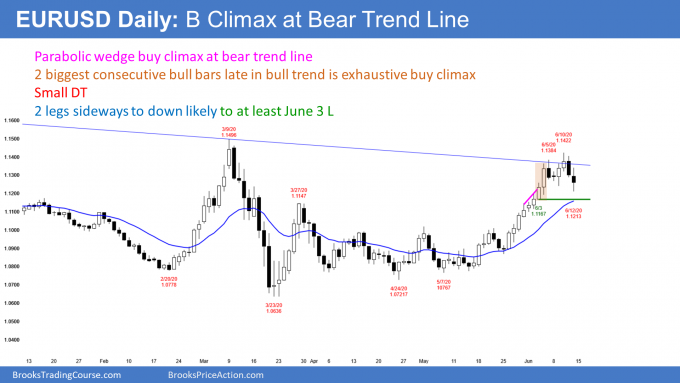

EURUSD Forex weekly chart:

Profit taking after minor parabolic buy climax

The EURUSD Forex weekly chart rallied strongly for 3 weeks. This week stalled at the bear trend line from the February 2018 high to the March high.

The bears see this week as a sell signal bar for another lower high in the 2 year bear channel. They want next week to trade below this week’s low. That would trigger the weekly sell signal.

But the 3 week rally was exceptionally strong. Consequently, there probably will be more buyers than sellers not too far below this week’s low. Traders expect a 1 – 3 week pullback and then at least one more test back up.

If the EURUSD reverses down a 2nd time, there would be a micro double top. The bears then would have a better chance of a reversal back down to below the middle of the yearlong tight trading range.

Parabolic wedge buy climax on the daily chart

The daily chart of the EURUSD Forex market rallied strongly for 3 weeks. Last week had consecutive big bull bars closing near their highs. In addition, they were the 2 biggest consecutive bull bars in the rally. They therefore formed a likely exhaustive buy climax.

When there is a pair of big bull bars coming late in a bull trend, traders see them as a great opportunity to take profits. The bulls now have what they believe will be a brief chance to lock in windfall profits.

At the close of the 2nd big bull bar, there is a 60% chance that either the 2 bull bars will be the end of the rally or that there will one more brief leg up. There was a brief leg up this week that reversed down on Thursday.

First downside target is bottom of most recent buy climax

Traders now expect at least a couple legs sideways to down. The 1st downside target is the bottom of that 2 bar buy climax. That June 3 low is just below 1.1200 and about 200 pips down from this week’s high.

Many bears who sell the buy climax will take profits there. Additionally, the bulls see that the market rallied strongly at that price a couple weeks ago. They wonder if there will again be strong buying there.

The pullback to the bottom of the most recent buy climax typically results in at least a bounce. If the selloff is strong, many bulls will wait for at least a micro double bottom before buying again.

Can the reversal down be the start if a bear trend? A strong bull trend usually does not reverse into a bear trend without 1st transitioning into a trading range. Consequently, traders will assume that the 200 pip selloff will be a bear leg in a trading range or a bull flag instead of the start of a bear trend.

Monthly S&P500 Emini futures chart:

Reversal down at top of 2 1/2 year trading range

The monthly S&P500 Emini futures chart has been in a bull trend for 11 years. However, the huge January/February selloff was a Bear Surprise. A Bear Surprise has a 70% chance of a 2nd leg sideways to down. In 80% of cases, the 2nd leg begins from a lower high. That is why I have been saying that the strong 3 month reversal up was likely to fail.

June so far is a reversal bar on the monthly chart. It rallied and sold off. The Emini is currently near the low of the month. If the month were to close here, it would be a sell signal bar.

This month is bad follow-through after a good entry bar in May. May triggered a High 1 bull flag buy signal bar. It closed on its high, which was bullish. But so far, June is not providing follow-through buying. That weakens the prospects for the bulls.

They had a good buy signal bar in April, a good entry bar in May, but bad follow-through in June. Disappointment is a hallmark of a trading range. June is a reminder that the monthly chart is still in a trading range

Trading range for the rest of the year

Remember, I have been saying that the monthly chart has been in a trading range for 2 1/2 years and that it will probably remain in the range for the rest of the year. Therefore, if the Emini trades down next month, the selloff will likely be minor.

There is plenty of time remaining in June. It could look very different from what it does now. For example, the stock market often rallies at the end of June. That is the end of the quarter and just before the 4th of July holiday. Holidays generally come with some euphoria.

At the moment, June is unlikely to close on its high. However, it could close in the middle of its range. It would then be less bearish going into July.

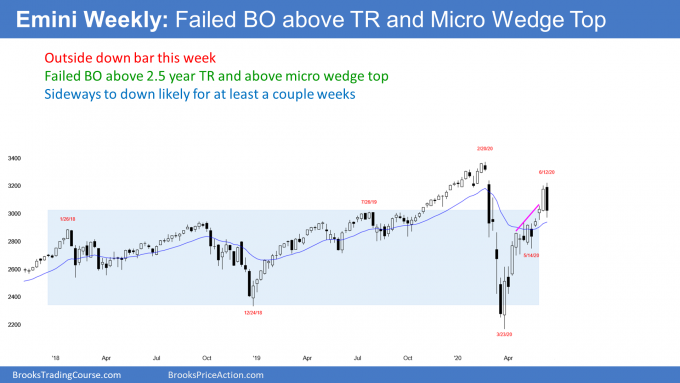

Weekly S&P500 Emini futures chart:

Last week’s bull breakout has failed

The weekly S&P500 Emini futures chart reversed down strongly this week. Last week was a breakout above 6 weak bars on the weekly chart. The bulls were hoping that the breakout would continue up to a new all-time high.

As a rule, 50% of all breakouts fail. Sometimes the context and size of the breakout makes it more likely to be successful. However, I wrote last week that there was still less than a 50% chance that it would lead to a new high.

This week totally erased last week’s rally. In fact, this week traded above last week’s high and then below its low. This week is therefore an outside down candlestick. That is bearish when it comes late in a bull trend.

This week’s selloff has created a 2 week reversal on the weekly chart. While bearish, the Emini is a tight bull channel. If this is the start of a selloff, the selloff will probably not fall below the March low. This is similar to the rally, which I have been saying would probably not go above the February high.

Markets have inertia

The Emini has been in a trading range for 2 1/2 years. Trading ranges often look the most bearish at the low, like in March, and then reverse up. They also look the most bullish near the high.

Traders should expect reversals and not breakouts. This is because of my 80% rule. Markets have inertia. They have a strong tendency to continue what they have been going. In trends, 80% of reversal attempts fail. In trading ranges, 80% of breakout attempts fail and reverse.

How low will it go?

One target is a measured move based on the height of this week’s outside down range. That target 2750. Another is the bottom of the most recent leg up or trading range. That is the lows below 2800.

Traders typically look for a 50% retracement. That is around 2700.

Ten percent corrections are also common. But with how extreme the buy climax was, 15% is more likely. That would be around 2750.

Finally, the market is now more than 10% down from the high. It is therefore back in correction territory. If it falls 20% down, which is 2700, it would be back in a bear market. I have written many times that I think the approximate trading range for the remainder of the year will probably be around 10 to 20% down from the high.

The low of that range is around 2700. Since there is a cluster of magnets around 2700 to 2800, traders should expect the Emini will get there this summer.

Daily S&P500 Emini futures chart:

Double top with the February high

The daily S&P500 Emini futures chart reversed down sharply on Thursday. Friday was the 4th day in the selloff. This is the 1st 4 day pullback since the rally began in March.

This could be the start of a reversal down from a double top with the February all-time high. When there are double tops, the 2nd high is rarely exactly at the same price as the 1st high. This is a lower high double top.

A big bear bar like the one on Thursday is a Bear Surprise breakout. Friday’s bear body confirmed the reversal down. Traders expect at least a small 2nd leg sideways to down.

I mentioned last weekend that last Friday”s gap up was exceptionally big and it was testing the top of the 2 year trading range. That increased the chance that it was an exhaustive move.

I said that the Emini might gap down some day this week and create an island top. Thursday’s gap down did just that. Island tops and bottoms are usually minor reversal patterns.

However, this one is after an extreme buy climax. That buy climax followed a huge sell climax. Therefore the rally was probably going to form a lower high.

What happens if there is a gap up some day next week? That would create an island bottom with Thursday’s gap down. If there was a strong rally, traders will see Thursday as a bear trap and wonder if the rally will resume up to the February high.

The 3 month bull channel has been strong. There is therefore still a 40% chance that Thursday was a bear trap and the bull trend will resume next week.

Why did the market sell off?

The news always reports that every market move is caused by the news. That is because they believe they are the center of the universe and they do not believe that technical forces exist.

They therefore are now claiming that the Fed’s comments this week and an increase in Covid-19 cases caused the selloff. That influenced many traders to sell.

But why is it that I have been saying that the rally would fail to break above the February high? It is because of technical factors, which control all moves lasting a few months or less.

Markets constantly search for the ever-changing fair price

The market is always testing up and down. It needs to find out how far up and down are too far. The market is probing to find the current fair price.

That price changes constantly with every second. The result is that the fair price is a range and not any one price.

I have been saying that no one knew where the top of the rally would be. But, I said with 70% certainty where it would not be. The March selloff was so strong that the rally only had a 30% chance of making a new high. It got near the old high this week.

That meant it was likely to go sideways and then down or simply down. It chose down.

The news is the catalyst but not the cause

Some selling was created by the news, but the selling was going to happen regardless. This is the same as in February when I said the market was going to selloff or in March when I said traders should expect a big V bottom rally.

There is always news at every second of every day. When the market moves, the reporters look at the current news and claim that it was the cause of the move. Nonsense.

Think of the impending move as a bomb. The news flipped the ignition switch.

If it was not this news, it was going to be some other news. The news can affect the speed and size of the move, like how our bungling of the pandemic led to the March crash. But there was going to be a selloff regardless of whether there was a pandemic. It might have come a month or two later, but it was going to come.

Bulls and bears were looking to sell near the February high

I said that there was a lot of supply around the February high. All of the traders who bought in January and February and did not exit watched a 35% selloff. That is huge.

Many were going to be afraid that the market might not make a new high for a long time. They were hoping that the rally would get near their entry price so they could exit with a smaller loss. They did that this week.

Many bulls bought around the March low. They knew there would be supply around the old high. Many took profits this week.

Finally, the bears knew that the selloff was so extreme in March that many bulls would sell near the old high. They therefore sold as well.

All of these sellers created Thursday’s crash.

The 3 month rally went higher than what was likely. Because it was stretched far, traders will expect a bigger reversal down over the next few weeks.

Sideways to down is likely for a few weeks

Can Thursday be a bear trap and will the Emini immediately reverse back up? The bulls have a 20% chance.

It is important to remember that the Emini has been in a trading for 2 1/2 years. Traders should expect disappointing follow-through after any move up and down. This week was disappointing for the bulls after last week’s exceptionally strong rally. The selloff will probably not fall in a strong bear trend. That will disappoint the bears.

However, there is a 60% chance that this selloff is the start of a 15% pullback to around 2750. I talked about the reasons for this in the section above on the weekly chart.

March 31 high just above 2600 is a magnet below

There is an additional reason for a possible 15% correction on the daily chart. The March 31 high was never adequately tested.

There is a gap between the April 21 low and that high. Gaps in trading ranges typically close. Consequently, if this selloff gets near 2700, it will probably continue down to below the March 31 high.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Market Update page.