Al added some comments

Market Overview: Weekend Market Analysis

SP500 Emini Breakout Mode with both double top and double bottom flags on the daily chart. There is a 50% chance of a successful bull breakout and a 50% chance of a successful bear breakout.

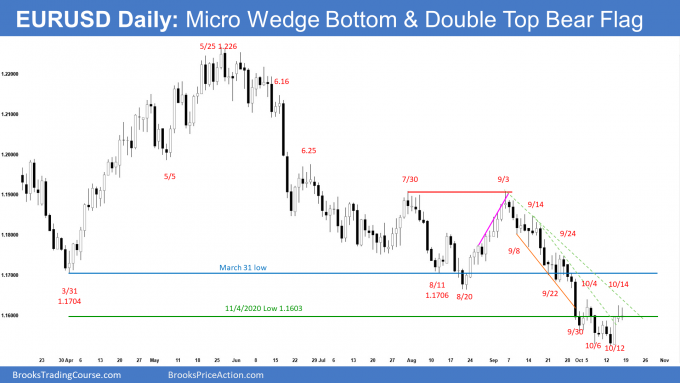

The EURUSD Forex is in a 2 week tight trading range. Bulls want a reversal higher from a micro wedge bottom from below the yearlong trading range. The bears want resumption and a measured move down from a lower high.

EURUSD Forex market

The EURUSD weekly chart

- This week’s candlestick on the weekly EURUSD Forex chart traded below last week’s low but reversed up to close as a bull doji.

- Al has been saying a streak of 6 consecutive bear bars has not happened in 3 years. That made it likely that the weekly chart would have a bull body either this week or next week.

- The bears hope that the small, sideways bars of the past 2 weeks is just a pause in the 7-week bear micro channel.

- They want a 700-pip measured move down, based on the height of the yearlong head and shoulders top.

- They also want a measured move down to 1.1420, based on the height of the July 30/September 3 double top bear flag. That would also be an exact test of the June 8, 2020 breakout point.

- The bulls want the breakout below the yearlong trading range to fail. They also want a reversal up from the wedge bottom created by the March 31 and August 20 lows.

- A small bull body with a tail above following a tight 7-bar bear microchannel is a weak setup for a strong reversal up. A pullback (bounce) from here would likely only be minor.

- Traders are deciding if the selloff will reach targets below before reversing up, or if the reversal up began this week.

- The odds still favor a dip below the March 9, 2020 high within the next few weeks. This is true even if the EURUSD rallies for a couple weeks first.

- The EURUSD has been in a trading range for 6 years. In a trading range, when a pullback gets near support or resistance, it usually goes through it before reversing.

- The August 20 low is the breakout point for the September selloff and therefore a magnet above.

- Consequently, traders should expect a rally for several weeks to at least above the August 20 low and maybe to the September 3 high (July 30/September 2 double top).

- However, it might first fall to 1.14, which is June 10, 2020, high and the measured move down from the double top.

The EURUSD daily chart

- The EURUSD Forex daily candlestick chart traded below October 6 low on Tuesday and then reversed higher on Wednesday from a micro wedge bottom (September 30/October 6) to test the October 4’s high.

- The bulls hope that this 3rd reversal up from below the yearlong trading range will be successful.

- They want Thursday and Friday to be a pause from Wednesday’s strong reversal up. They then want at least a second leg sideways to up move.

- The Aug 20 low is the breakout point for the September selloff and therefore a magnet above.

- The bears want the 2-week tight trading range to simply be a 2-legged sideways to up pullback from the tight channel down from September 3.

- The tight channel down indicates strong sellers and makes it likely that any pullback (bounce) would only be minor, even if it goes above the August 20 low.

- The bears will sell the lower high for a test of the trend’s extreme and a measured move lower.

- The measured move from the July 30/September 3 double top bear flag is around 1.4.

- If the EURUSD reverses down next week, there would also be a smaller double top bear flag with the October 4 high.

- The daily chart is oversold and almost at important targets below. There should be a reversal up lasting several weeks from around here or from a test of the 1.14 measured move and the June 8, 2020 breakout point. The rally could reach the September 3 lower high.

S&P500 Emini futures

The Monthly Emini chart

- The candlestick on the monthly Emini chart so far is a bull bar closing near its high.

- If the month remains like this, it will be a High 1 buy signal bar for November. November then would probably trade above the October high.

- September was a big outside down bar. It was the third time there was a bear bar in the rally from the pandemic crash.

- Look at all prior buy climaxes over the past decade. Most of the time, once there was a bear bar, there was another bear bar within a month or two. That should therefore happen this time.

- The month after an outside down bar rarely is an outside up bar. That would create an OO (outside-outside) Breakout Mode Pattern. While unlikely, October could rally strongly to above the September high before the end of the month.

- Either November or December should be a 2nd bear bar.

- The bar after an outside bar often has a lot of overlap with the outside bar. So far, this remains true.

- It is in the middle of the month and the monthly candlestick will look different by the close of the month.

- At the moment, traders should expect sideways to down trading for a couple more months, even if there is a rally to the September high in October or November.

The Weekly S&P500 Emini futures chart

- This week’s Emini candlestick was a bull bar closing near the high with a long tail below. It is reversing higher from a micro wedge bottom.

- Because the week closed near its high in a bull trend, there is an increased chance of higher prices next week. Next week might gap up on the weekly chart.

- This week followed a 6-bar bear microchannel which means persistent selling. The bears want a lower high or a double top with the September 2 all-time high.

- Although the Emini broke below the weekly bull channel in September, the Small Pullback Bull Trend is still intact. There is now a broader bull channel, and the trend line is about parallel with the line at the top of the channel.

- The Small Pullback Bull Trend ends once there is a pullback that is at least 50% bigger than the biggest prior pullback in the trend. That pullback was the 10% pullback in September and October last year.

- Unless next week is a big bull bar, there will still be a 50% chance that September 2 will be the start of that bigger pullback.

- The bulls want a breakout to a new all-time high. The next targets for the bulls are the trend channel line around 4700 and measured move at 4800 based on the height of the July-Sept trading range.

- A 50% chance of September 2 being the high of the year means a 50% chance there will be a new high.

- The bulls know that most reversal attempts in a strong bull trend are minor. That means they become either bull flags or the start of a trading range.

- The Emini has been in a trading range for 4 months. If it reverses down from slightly above the September high, it will still be in the trading range.

- If there is a new all-time high in the next couple of months, it will probably fail to go much above 4,600. Traders should not expect a big leg up until after there has been a 15% correction.

The Daily S&P500 Emini futures chart

- Emini breakout mode with double top and double bottom.

- Monday was big outside down bear bar and the Emini reversed lower from the 50-day MA and bear trend line.

- The Emini then reversed back higher from a test of the 100-day MA to above the 50-day MA on Thursday and Friday.

- Traders do not know yet if Thursday and Friday’s rally was a buy vacuum test of resistance at the September 23 high or all-time high, or a resumption of the 18-month bull trend.

- Al has been saying that the Emini would probably form a trading range between the 50-day MA and the 100-day MA and that the Emini would rally to at least a little above the 50-day MA within a couple of weeks. The Emini is now far above the 50-day MA. It might now be support.

- If the Emini stalls here for a few days and then turns down, it would form a double top bear flag with September 23 lower high.

- The Emini is in a month-long trading range between September 23 high and October 4 low.

- It is also within a bigger range that began in July.

- As long as the Emini is in the trading range, it is in Breakout Mode. That means there is a 50% chance of a successful bull breakout and a 50% chance of a successful bear breakout. There is also a 50% chance that the 1st break above or below will fail.

- Traders need to see a strong break below the October 4’s low or above the September 23rd lower high before believing that the trading range is converting into a trend.

- A bear breakout would be from a head and shoulders top or a double top.

- A bull breakout would be from a triangle that began on July 19.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Weekly Reports Archive

You can access all weekly reports on the Market Analysis page.