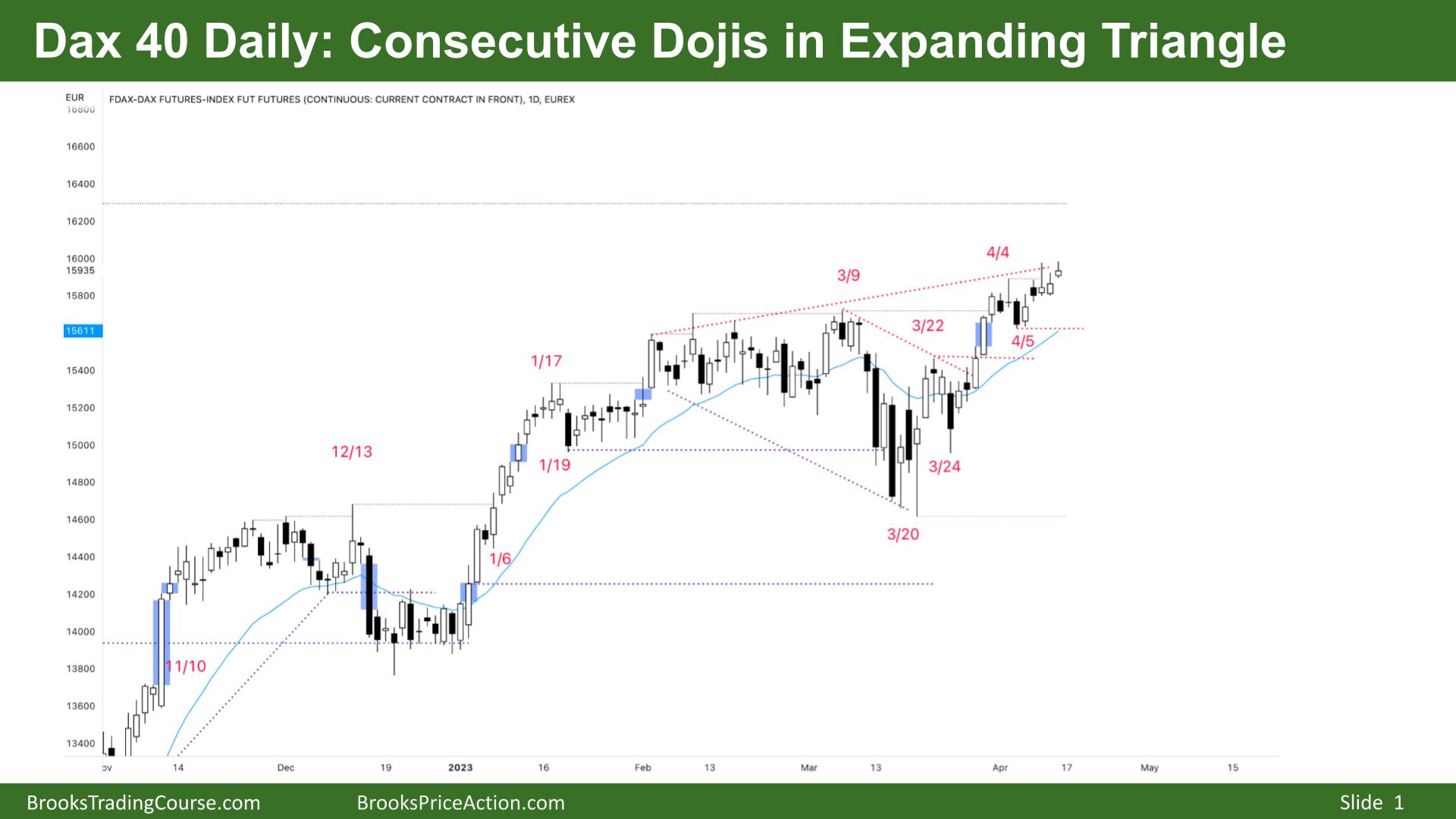

Market Overview: DAX 40 Futures

DAX bad follow-through with two dojis now after a bull breakout from the moving average. The bulls moved the price higher, but with dojis now expect some trading range price action. We have already begun an expanding triangle, so we could even get a fast move down. But without any bear bars, bulls will probably buy below.

DAX 40 Futures

The Weekly DAX chart

- The DAX 40 futures was a small bull doji last week.

- We gapped up last week as expected after a bad sell signal and following a bull climax bar.

- So it is a bull breakout with follow-through but in an expanding triangle. Expanding triangles create new highs and lows with fast moves in between.

- The bulls see a tight bull channel with at least 3 legs. The channel is a bit above where we are, so expect some more sideways to up next week to touch it.

- There has not been a bar below the moving average in 20 bars, so the trend is strong. Traders expect the first bar to trade below the MA to be a buy setup.

- You can see how the bulls started buying above bars urgently in the first leg – strong gaps between consecutive bull bars. They bought small pullbacks and the moving average in the second leg.

- Now bulls might be waiting for 2 legs sideways to down to buy again.

- Bears see a final flag and a possible wedge top, and they are looking for a decent sell signal – the bear doji was not it.

- The bulls have about a 25% chance of getting a bull BO above the final flag. Most become wider trading ranges and then a broad bull channel.

- We are always in long, and now with a bull micro channel on the weekly, there is a buy setup below the low of a prior week’s bar. So nothing to sell yet.

- We might need to get up the All-time high and 16000 area to set a possible top for the remainder of the year.

- The bears see an 18-month trading range and will be looking for a decent second entry sell near the highs. But the first move down will likely be minor with such a tight channel. The bad follow-through is an example of this.

- The best the bears get is probably the 15000 Big Round Number and a double bottom with March 13th.

- The bulls need consecutive bull bars with good closes here to get a measured move of the triangle range. But with doji’s in between the bars, it might turn into a parabolic wedge top and need a larger correction.

The Daily DAX chart

- The DAX 40 futures was a small bull doji closing below its midpoint on Friday, so some computers will see it as a bear bar.

- Thursday was an inside bar, so it was reasonable to sell above it. But Friday had a large gap up which is currently open.

- We might come back to test the lows of the inside bar and close the gap. The bears wanted the bulls to get bad follow-through selling, but the reversal will likely be minor.

- For the bulls, it is a tight channel, and we had a deep pullback to below the moving average – it is an expanding triangle on the weekly timeframe.

- We struggle to find buyers above the highs, so bulls are buying pullbacks. But with a lack of strong bear bars, it is better to be long or flat.

- The bears see they closed the gap above Feb 10th, so a measured move is less likely.

- There might be trapped bears from 2 Fridays ago, so any pullback will likely get down to let them out.

- The bears also see the dojis and expect some sideways price action to encourage them to sell above the highs. However, stop-entry bears have had a hard time making money.

- Until the stop-order bears make money, it is better to be long rather than short.

- Bulls can get out below a reasonable bear bar closing below its midpoint. It is too early to short.

- Although the bars are not strong, it is a kind of small pullback bull trend – many open tick gaps on the index may suggest urgency and that we will go higher before pulling back.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.