Market Overview: DAX 40 Futures

DAX futures was a bull micro channel and a possible wedge top. It is a low probability sell signal, taking a chance that it is a wedge and failed breakout above a double top. But most traders expect higher prices, so bulls will scale in lower, knowing it is unlikely to reverse strongly without a test of the highs. Bulls will probably buy below the big bull bar and down to the moving average.

DAX 40 Futures

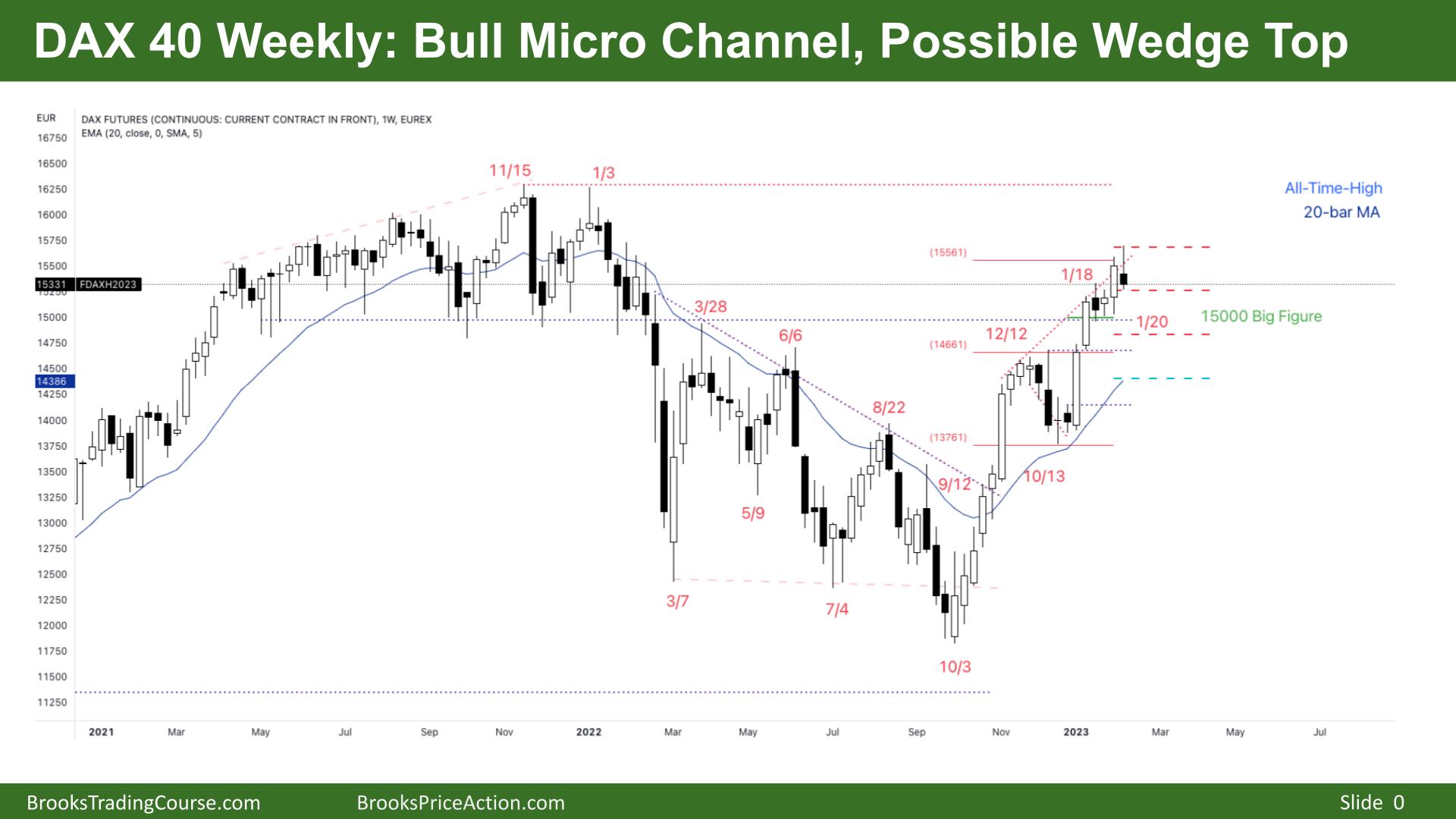

The Weekly DAX chart

- The DAX 40 futures last week was a bear doji bar closing below its midpoint.

- It’s a bull micro channel and a possible wedge top, and we are sitting around several measured move targets, so we might go sideways here.

- The bulls see a tight channel and large gaps below swing points, so we are always in long.

- We broke above the Dec 12th high, so bulls will buy pullbacks with a stop below the prior low.

- The bulls see a breakout above the prior trading range and are looking to move to the top of the prior range. The range was tight on the left of the chart, so we might go sideways here as traders decide.

- The bears see a deep pullback from a prior breakout of the range. They believe they have converted the trend into a trading range for the time being, and selling high in a trading range is a profitable strategy.

- It is a decent sell signal, but the location is bad, in a tight channel. The first bar to go below the low of a prior bar in a bull micro channel is usually a buy signal.

- But swing entries can often look bad, so some traders might take a chance we will get back to the moving average. It is not a high probability in a bull micro channel.

- The bears see a breakout and bad follow-through, so there is a possible reversal. If next week is also a bear bar, more bears will likely sell for a move down to the moving average.

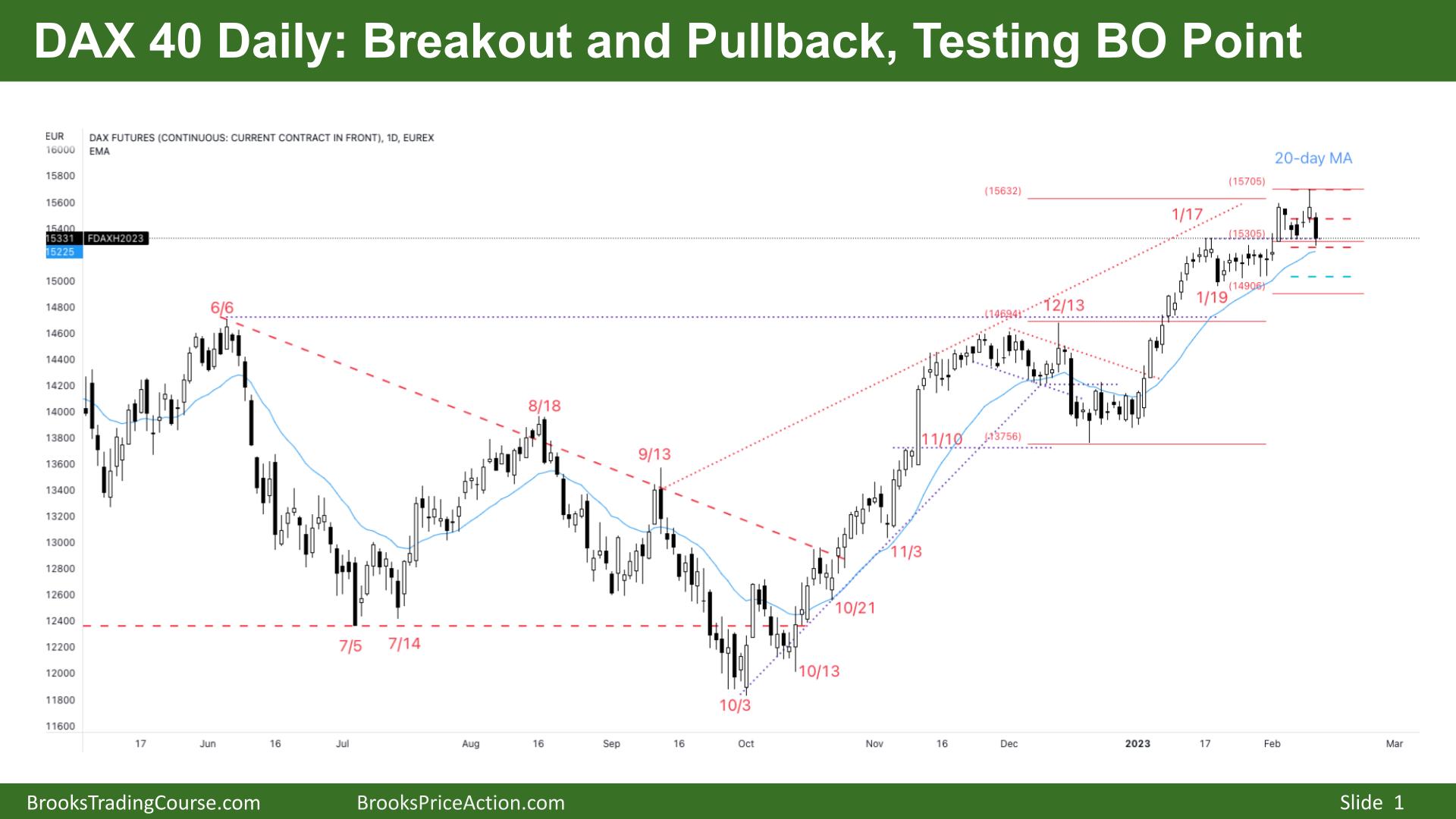

The Daily DAX chart

- The DAX 40 futures on Friday was a bear bar closing on its low, so we might gap down on Monday.

- The move is a breakout and pullback, a test of the breakout point as traders decide if we have more up to go.

- The bulls see a bull channel and have bought every bear bar near the moving average for several months. They know the math is reasonable to buy and scale in lower at the moving average.

- The bears see a final flag and a final push-up and are now sideways. They are expecting two legs sideways to down, past the moving average.

- Stop-order bears have not made money for a while, but limit bears sold the last high and made money on Friday. So we are probably transitioning into a trading range.

- The strong breakout from the December bull flag was strong enough for traders to expect a second leg, but it might have finished.

- Although it is a strong bear bar, in a tight bull channel, most traders should only buy, so traders must be willing to scale in higher if they sell.

- Bulls might have exited during Friday or will be below Friday and look to buy lower down.

- There is a low probability swing I have marked on the chart. If bears can reach that, we have moved back into a trading range for the time being. It may be a bear trap, and we will reverse Monday.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.