Market Overview: DAX 40 Futures

DAX futures was a bear bar last week, a DAX 40 pause at a measured move target. The bulls know the channel is tight and expect another leg up, and they will probably get it. We are also at the underside of the prior trading range breakout, so we are testing that range. We might need to go sideways here for traders to decide whether we are going back in and above that range, or it’s a double top short below. We are always in long, so better to be long or flat.

DAX 40 Futures

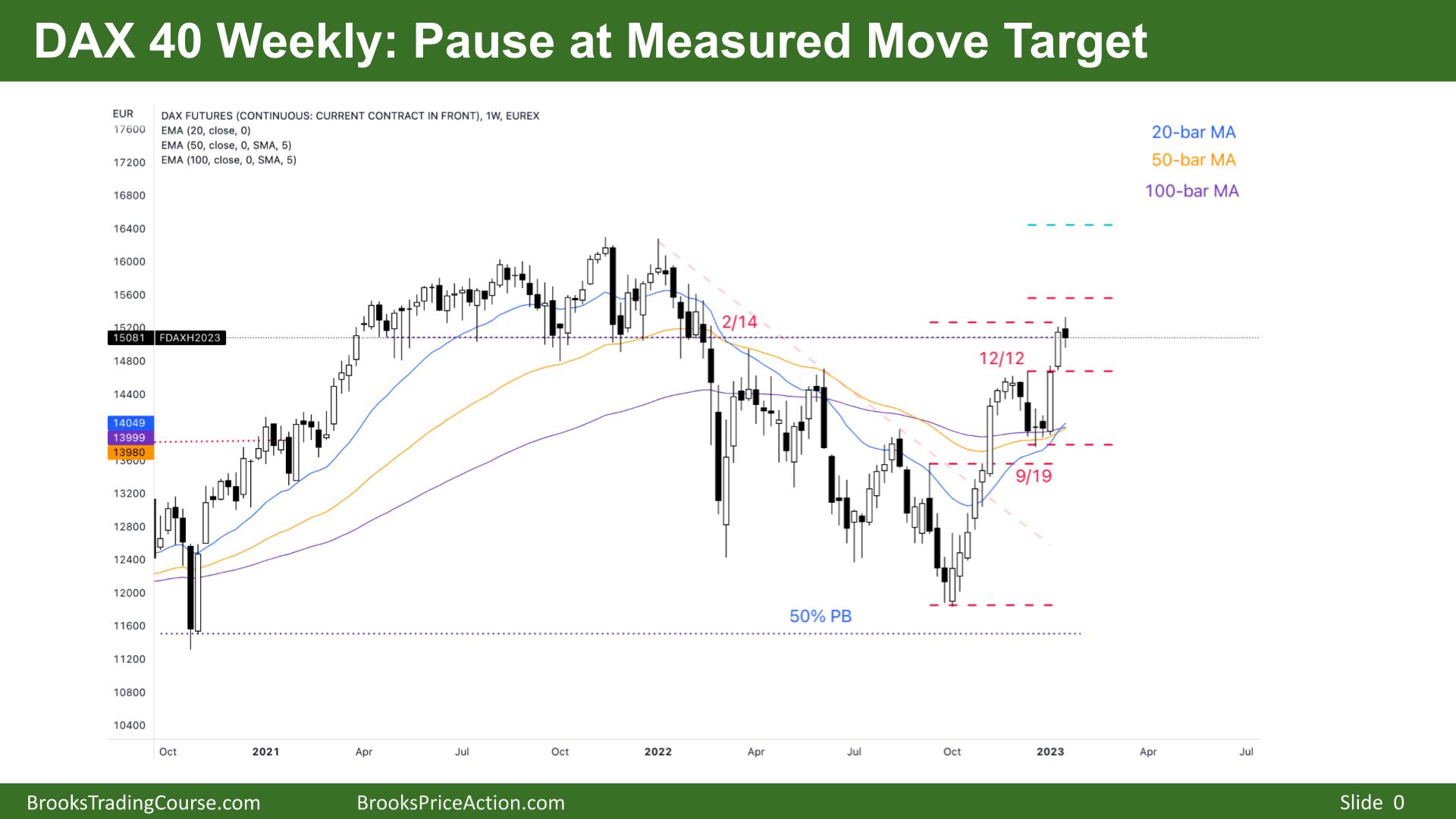

The Weekly DAX chart

- The DAX 40 futures was a bear bar last week, and it was a pause at a measured move target.

- The bulls who bought the wedge bottom breakout at the lows of the range hit their target, and some closed.

- Other bulls who waited for a pullback on Sept 19th are waiting to hit their 1:1 measured move, and they might get it.

- The bulls want the breakout test to stay above or around the Dec 12th prior swing high.

- The bears see a bear trend and a breakout, so they expected two legs sideways to up before selling again. Last week could be the end of the second leg.

- It is a bear bar but not a strong sell signal yet because of the tail. Some bears will wait for a second consecutive bear bar before considering selling.

- The bears also see a deep pullback and a breakout test of the prior range above. They know the best the bulls can get is probably a trading range, and we are near the highs of that range.

- Selling at the top of a trading range, especially a second entry short, is a reasonable sell signal.

- Most traders should be long or flat, as we are always in long. The channel is tight, so better to wait for a stronger sell signal to sell.

- Always in bulls might exit below a bear bar closing below its midpoint and look to get back in again on a High 1 or High 2 pullback and follow through.

- If the bulls can break back into the trading range above, then the breakout below failed. But at this point, it is more likely a pause and a trading range, so traders will respect the highs and lows of that range before scaling in.

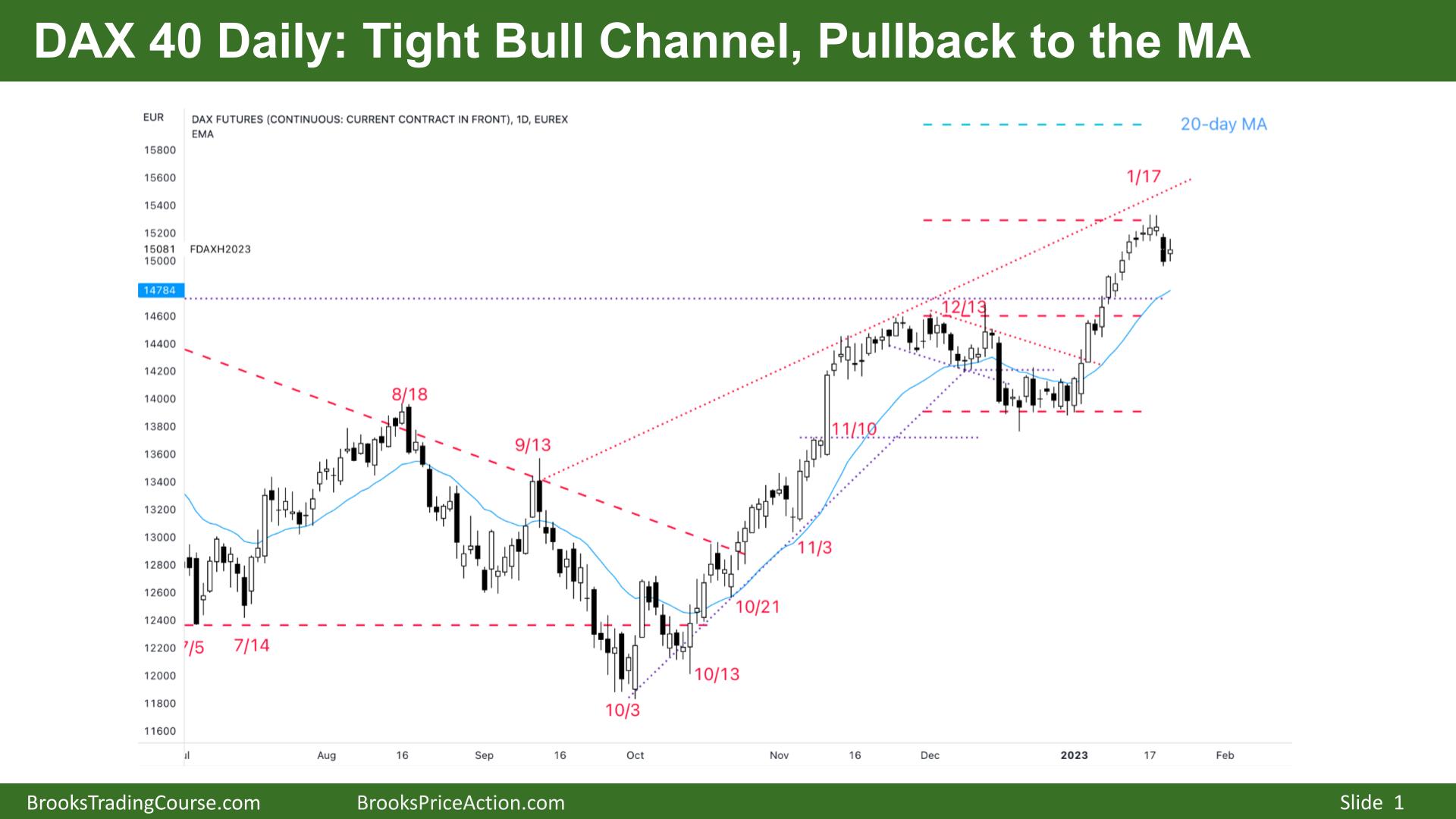

The Daily DAX chart

- The DAX 40 futures was a small bull inside-bar on Friday.

- Traders see a tight bull channel, a pause and a pullback towards the moving average.

- The bulls expected two legs sideways to down to the moving average, and we might have just had the first leg.

- There was a lot of buying urgency since passing the prior swing high, so some bulls are waiting to buy back at the moving average.

- Bulls see a breakout and pullback and expect a test of Dec 13th to hold before another leg long. The last bull leg is tight, so it is reasonable to expect another move.

- Interestingly, strength in later legs is often climactic, which can cause concern for traders who don’t want to buy too high or sell too low.

- The bears see a higher time frame trading range and hit the top of that range. They want the gap above Dec 13th to be an exhaustion gap, not a measuring gap for a reversal down.

- But shorting such a tight bull channel is a low-probability strategy, and most traders should wait to short.

- Thursday was a bear surprise and might scare bulls out of holding. Some bulls will be trapped above, waiting for the price to get back before selling out of longs.

- Some bulls will see the pause as a chance to buy again lower and scale in, so breakeven on their first entry and profit on their second entry.

- The bulls want a test and measured move up, so how far does that test need to go before the bulls give up?

- Some bears shorted the prior triple top to the left and will sell more below a bear bar, maybe Thursday, to scale into their shorts. They see the trend as having late acceleration, possibly climactic and selling new highs.

- Most traders should be long or flat. A High 2 buy around the moving average is a higher probability long. Waiting for a second entry short near the highs of this leg is a more reasonable short.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.