Market Overview: DAX 40 Futures

DAX futures went lower last week with a bear outside down bar, after a big bull spike. It’s such a strong, bullish move, so there should be a second piece to it. The bears are trying to sell the double top here. They want a deep pullback and a continuation of the TR price action to the left. Hoping the expanding triangle will fade down. More likely buyers below and at the MA.

DAX 40 Futures

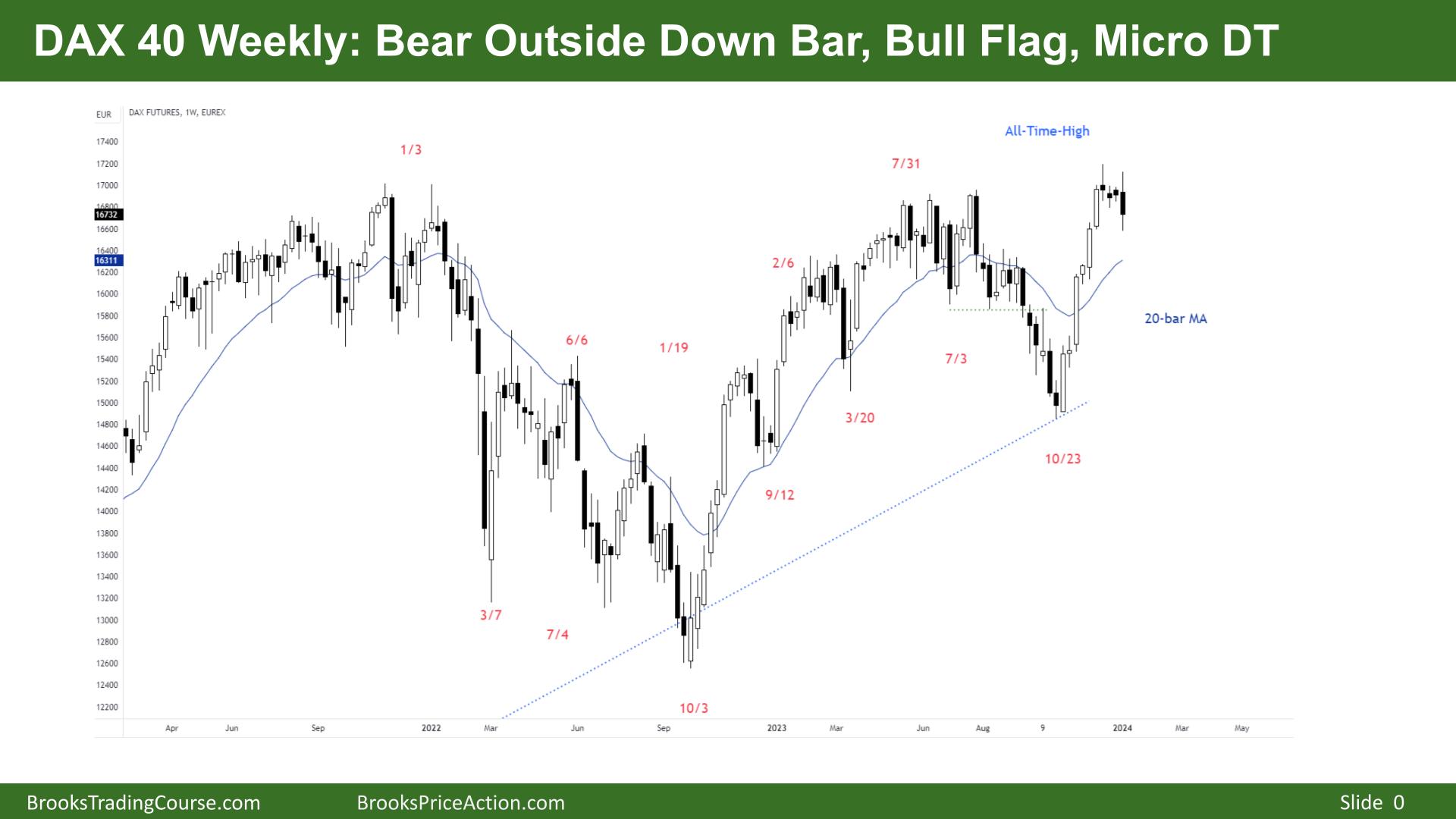

The Weekly DAX chart

- The DAX 40 futures chart last week was a bear outside down bar with a tail below.

- It triggered buys above the week prior but then moved larger towards the downside.

- It is the fourth consecutive bear bar, uncommon in a bull spike.

- For the bulls, follow-through is disappointing at the top of a bull spike above the trading range highs.

- But limit order traders could not get in the spike, which is typically climactic behaviour.

- Finally, last week, we went below the low of one of those bull bars, and traders could get in – but how about that for your entry bar? Also disappointing.

- The bulls trapped higher might scale in and take profits on their second entry while breaking even on their first.

- It is a big bar, so likely will pull back. The bears might try and swing it down to the MA.

- But most traders see a parabolic wedge, 3 pushes up. They expect two legs sideways to down. Is this the second leg?

- It is not an ideal limit buy and not a great limit sell, so it will probably go sideways to down next week.

- There is a big risk to sell here; probably more sellers above where the bulls will get out. Outside down bars have a lower chance of breakout.

- If the bulls get a good bar next week, then the bears will scale out in case there is a second leg up.

- It is still always in long, but some always-in bulls might have gotten out last week and will wait for another bull bar to get in.

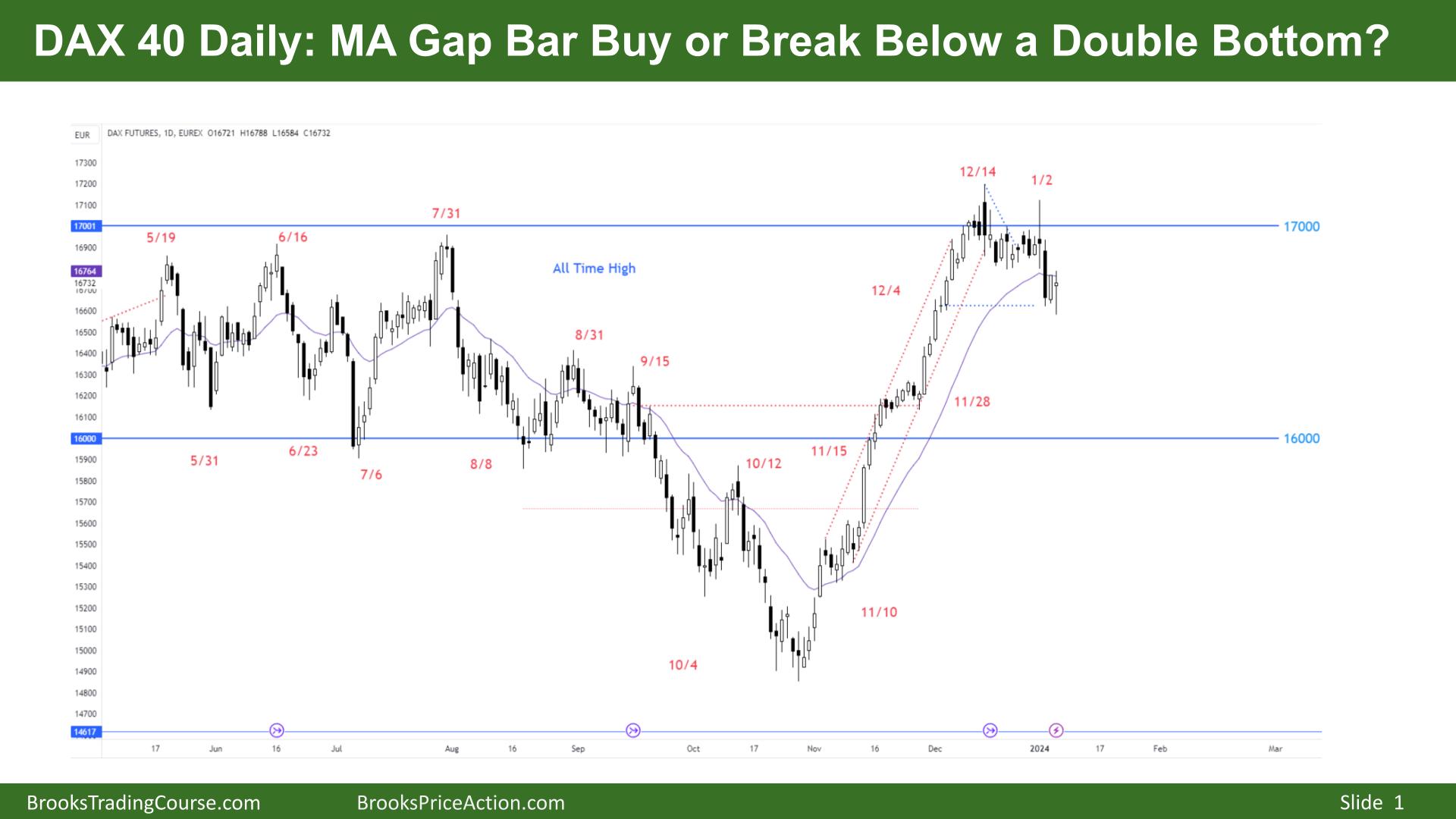

The Daily DAX chart

- The DAX 40 futures chart was a bull doji at the moving average following a bull inside bar.

- Indecision at the MA, after a very strong bull channel.

- There was a bull doji on Dec 4th, which usually indicates the start of a channel in a breakout. So this was the first target to come back to, which we reached.

- The bulls tried to get a double bottom, a High 2 and a trend resumption, but it reversed as soon as the price got to the highest stop entry. We broke below the DB and now might be in a MM down.

- The sell climax bar was big, but the follow-through was bad.

- Most bears that shorted that doji were probably happy with their 2:1 and got out.

- Its difficult to get long here, bodies below the MA now, so there are likely sellers above at the midpoint of that bear bar and at the BO point.

- It is a limit-order trading environment. so there is nothing for stop-order bears or stop-order bulls.

- The bears might give up if the bulls can get consecutive bull bars again above the MA.

- But we might be on a swing down, at least to create a credible double bottom with Dec 4th.

- Are we always in short? We might be. Consecutive bear bars with one big and closing below the MA. We also broke two prior swing points.

- Bulls want a failed breakout below this doji and a good reversal bar up.

- Bears want a tail above this bar and a bear bar below the MA for a Low 1.

- It is an outside bar, so it is a weaker signal, but context is good for a little more down to see what is below.

- Expect sideways to down next week.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.