Market Overview: DAX 40 Futures

DAX futures went lower last month with a bear outside bar closing on its midpoint. It is sideways after a strong bull spike and possibly two legs up. It could be time for a correction, but without a decent sell signal, it might transition into a broader channel instead.

DAX 40 Futures

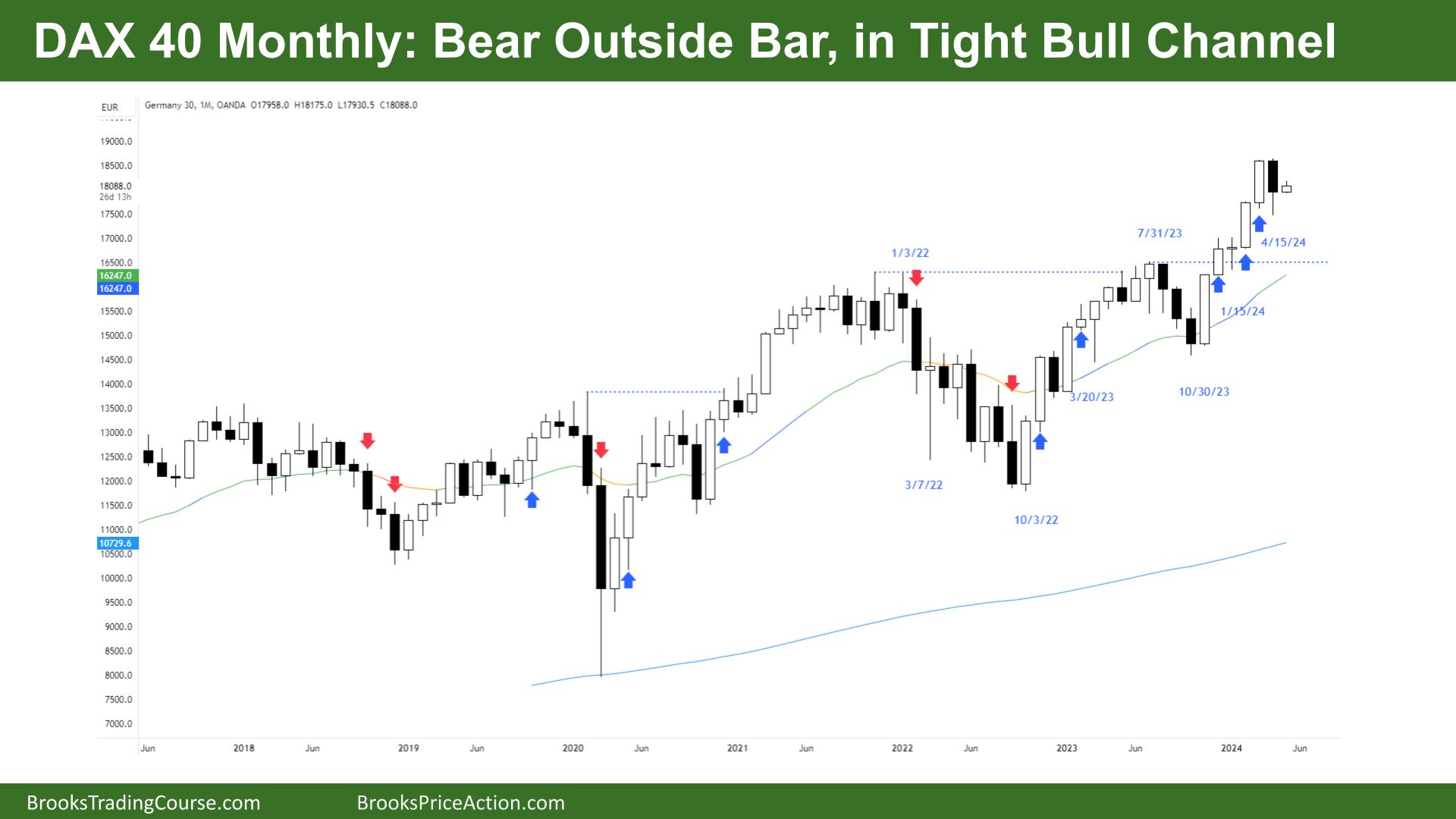

The Monthly DAX chart

- The DAX 40 futures was a bear outside bar, closing on its midpoint last month.

- It was a bull microchannel, where every low was above the prior low. So, the first time we go below the low of a prior bar is a buy signal. Bulls bought.

- But it is likely for a scalp back to the monthly close area.

- Is it big enough of a surprise for always-in bulls to exit? I think most bulls had targets that were hit around here.

- But on this chart, that bear bar is weak. We still triggered the buy above. Typically when we trigger the stop entry buy, those bulls will be able to exit without a loss.

- The bears need a double top or something stronger to convince the bulls not to scale in lower.

- The bulls see a breakout above the longer-term bull channel. They also see a trading range with closed gaps and a break above it.

- The move up was so strong it could be the first leg of something larger. But the stop is far away on this chart, and we hit several measured move targets. It might be time for sideways to down.

- The bears got a bear bar but a weak sell signal in a tight bull channel, so there is a low probability of selling below that bar. There might be more bears selling above it.

- Most traders should be long or flat because we are always in long.

- The bulls want to test the support back at the breakout point or keep a gap open.

- There was a lot of trading range price action up to this point so it will likely continue.

- Two legs up, so this might be the two legs sideways before the final leg of the bull move before a larger correction.

- Always in, bulls will get out below the low of a good bear bar, closing below its midpoint. Do they have to get out below that outside bar? Some won’t because of the tail below.

- The bulls also have open micro gaps—gaps between the first and third bars in a set. These gaps become support areas in strong trends.

- Expect sideways to up next month.

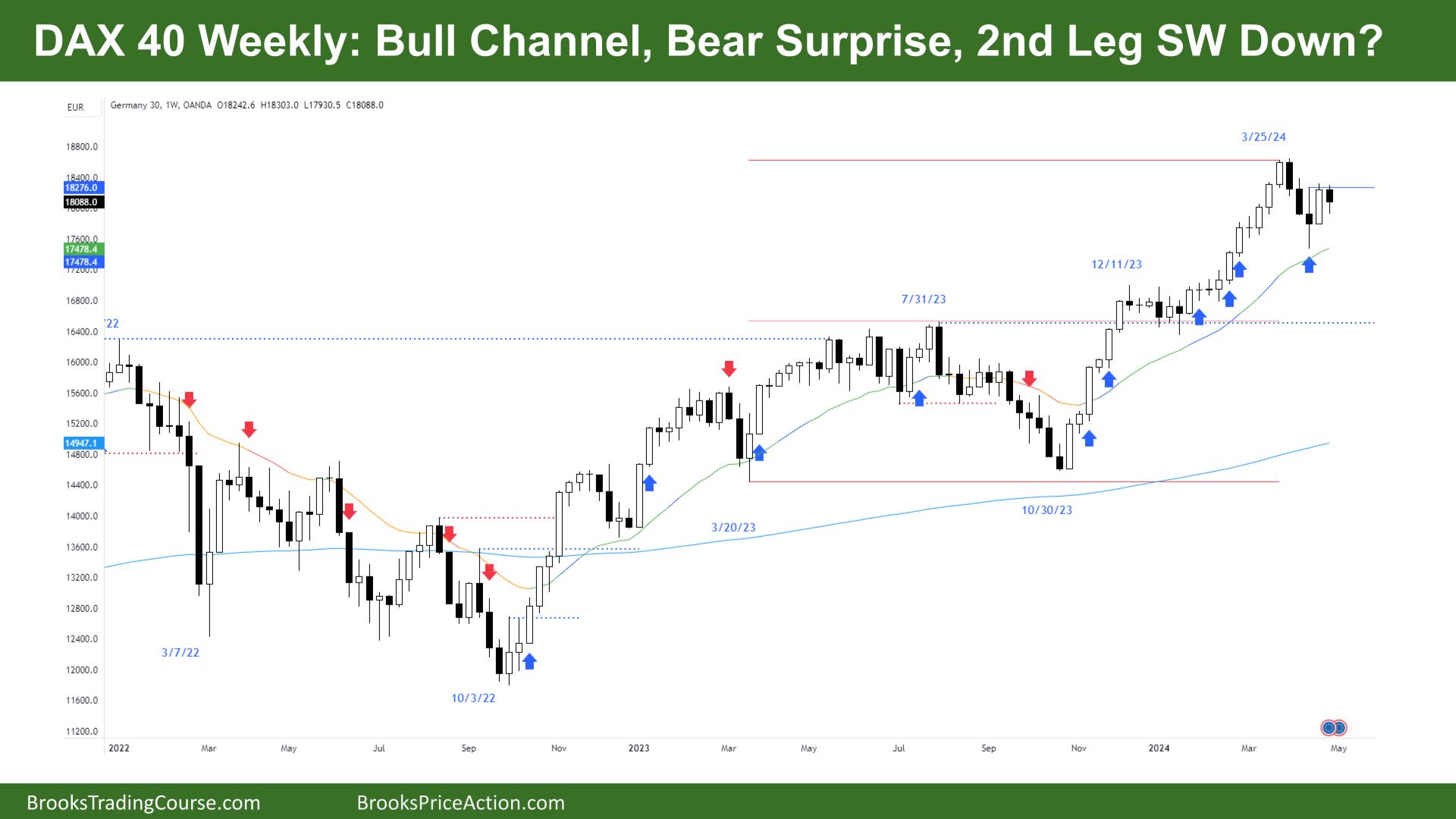

The Weekly DAX chart

- The DAX 40 futures was small bear inside bar last week closing on its midpoint.

- It was an indecision bar which was likely.

- There was a reasonable sell above the high of that bear doji that worked – we called it last week and hope traders took it!

- Bulls see a High 1, but after 3 bear bars not great. Bears had a sell scalp but would prefer to sell higher.

- It is confusing because bull trends don’t have a lot of 3 consecutive bear bar pullbacks.

- It is a Low 2 sell below that bear bar, but I’m not going to take it. The bull bar last week was strong and has no lower tail.

- Which means there were too many buyers at the open of it.

- I suspect they will still be around looking to scale in for the next part of the move.

- Bears want a big bar next week to trap all those bulls into a bad long. But again, they are likely to exit at the moving average.

- Always in long still, though you can argue trading range with a bear surprise.

- Always in bulls are out and looking for a good bull bar to buy above. They might have orders above the high of last week.

- The High 1 didn’t trigger, so a High 2 will be more likely to succeed, but the location is important. The bulls want it low enough to get the profit back to the highest close.

- Expect sideways to up next week.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.