Market Overview: DAX 40 Futures

DAX futures was a doji and a double bottom at the 13000 big round number. We are always in short but a pause here at the bottom of a trading range will make bears consider whether they want to swing below. Bulls will start to scale in and a High 1 buy signal this week will likely lead us back up to the middle of the range where we might remain.

DAX 40 Futures

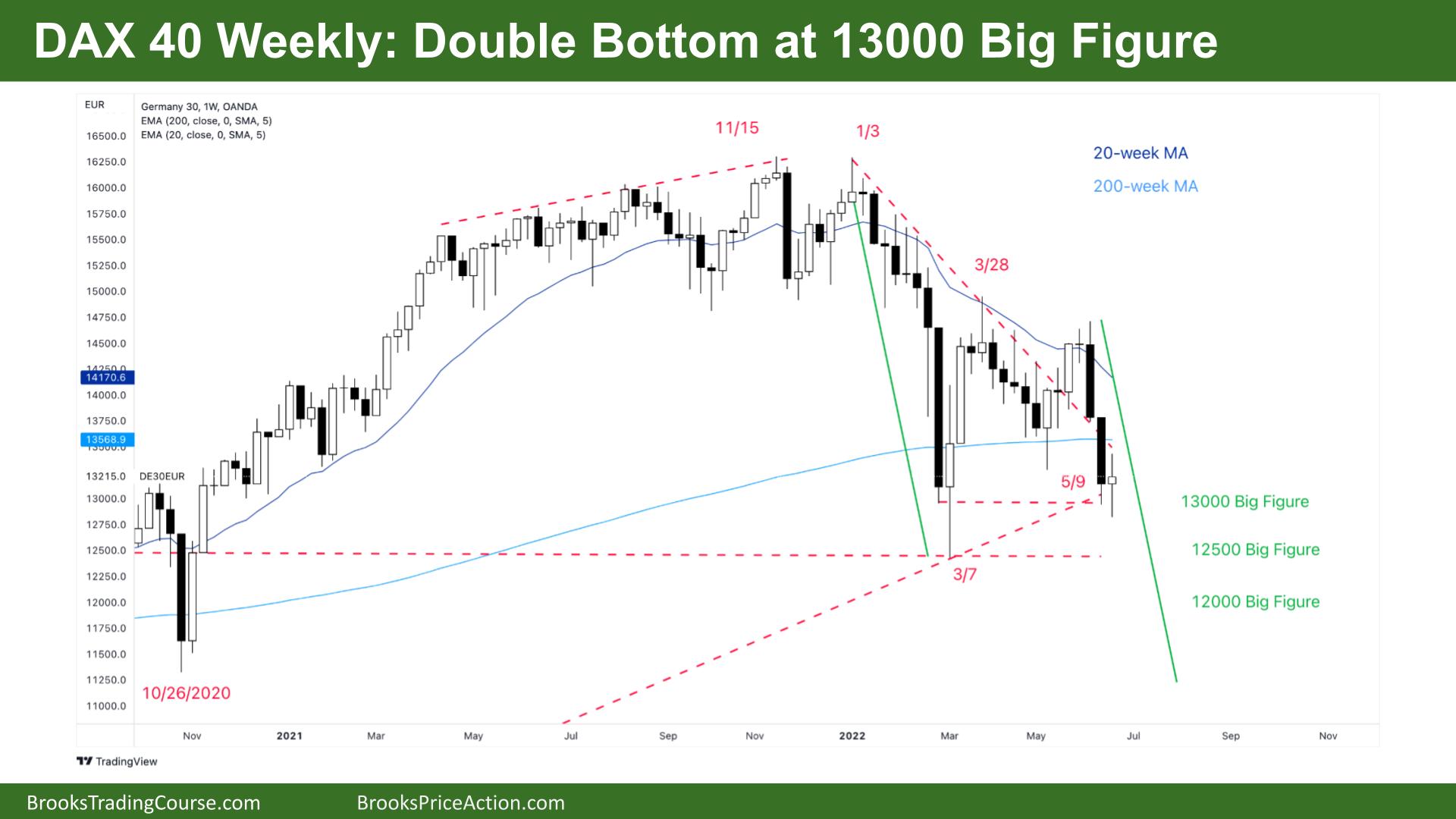

The Weekly DAX chart

- The Dax 40 futures was a bull doji with large tails above and below pausing at 13000 big figure.

- It was a pause bar after two consecutive large bear bars closing on their lows so we are always in short.

- The bulls see a higher low, double bottom at the 200-week moving average. We said last week that bulls would buy here and that remained true.

- We also said traders would expect lower prices and we briefly traded below last week before reversing up.

- The bulls know the bottom of a trading range is a reasonable swing buy, especially a second entry.

- They want a High 1 buy above this week’s bar back up to the middle of the range.

- But bulls might be disappointed as after two strong bear bars traders might expect a small second leg down first. Trading ranges look most bearish at the bottom.

- Bears see their chances of a larger second leg down, a harmonic of the January move increasing, but they needed a close below March lows.

- They see we are in a trading range and expect bulls to scale in but are happier to sell higher as this was profitable beforehand.

- There is a small gap with May that we failed to close this week and that will give bears confidence to short above, but perhaps not below.

- The market might need to pause here at 13000 while it decides.

- Bears know bulls will buy the High 1 but a High 1 is a pullback in an always in short bear trend so they will sell there as well.

- Probably sideways to down next week unless the bulls can get a strong High 1 close early in the week.

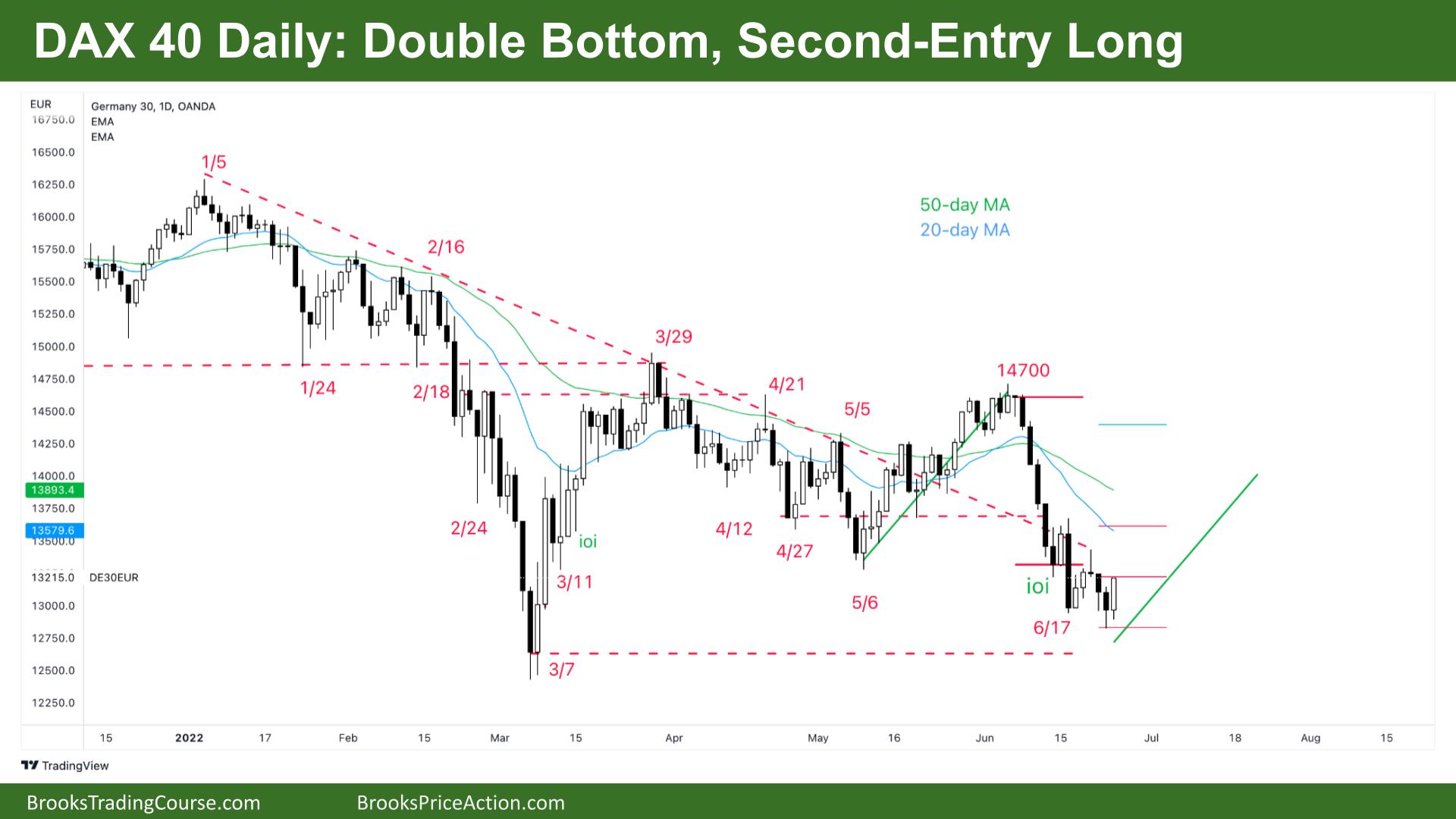

The Daily DAX chart

- The Dax 40 futures was bull bar closing on its high so we might gap up on Monday.

- The bulls see a double bottom, a second-entry buy at the bottom of a trading range. It’s a reasonable buy, but bulls are likely to still be scalping and bears are selling above bars.

- They see last week as a sell climax and a possible higher low major trend reversal.

- Bulls see we retraced Wednesday and Thursday close, so they expect at least a measured move up. But they need consecutive bull bars closing on their highs.

- Trading ranges are full of disappointment and we might need to go sideways here at the 13000 big round number for a while until traders decide.

- Bears see a tight bear channel and we are at the bottom of a tight trading range. They know that bulls will start to scale into longs but bears have been selling above bars for weeks and that is likely to continue.

- Bears see we are respecting the bear trend from January and the failed breakout keeps endlessly pulling back which will keep bears scaling in.

- If you look left, all the largest bars are bear bars so we might need to go sideways until the bulls can get consecutive bull bars.

- If the bulls can get that next week, we might go up to the middle of the range.

- The bears want failed follow-through buying and another push down below March lows.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.