Market Overview: Crude Oil Futures

Crude oil gap up above the 20-week exponential moving average on the weekly chart and formed a bull doji. The bulls need to create a strong breakout above the trading range high with follow-through buying to increase the odds of a reversal up. The bears want the market to stall around the trading range high.

Crude oil futures

The Weekly crude oil chart

- This week’s candlestick on the weekly Crude Oil chart was a bull doji after gapping above the 20-week exponential moving average.

- Last week, we said that odds slightly favor Crude Oil to trade at least a little higher, likely retesting the 20-week exponential moving average.

- The bulls want a failed breakout below the 16-week trading range. They hope that the tight trading range is the final flag of the move down.

- They got a reversal up from a lower low major trend reversal and a wedge bottom (Sept 26, Dec 9, and Mar 20).

- They want a breakout above the 16-week trading range and a retest of November and June highs.

- For that, the bulls will need to create a strong breakout above the 16-week trading range high with follow-through buying to increase the odds of a reversal higher.

- If Crude Oil trades lower, they want a reversal up from a higher low major trend reversal (Mar 20).

- The bears got a breakout below the triangle and 16-week trading range but did not get follow-through selling.

- They hope that the current deep pullback will form another lower high (against the November high).

- They want the market to stall around the trading range high and retest of March low.

- Since this week was a small bull doji, it is a buy signal bar for next week,

- The big gap-up is also a sign of strength from the bulls.

- For now, odds slightly favor Crude Oil to trade at least a little higher and at least a small second leg sideways to up after a small pullback.

- Traders will see if the bulls can create a follow-through bull bar following this week’s close above the 20-week exponential moving average, or will the Crude Oil trade slightly higher but stall around the trading range high.

- There are a lot of overlapping price action since November. That means the market is in a trading range.

- Traders will BLSH (Buy Low, Sell High) in trading ranges until there is a strong breakout from either direction with follow-through buying/selling.

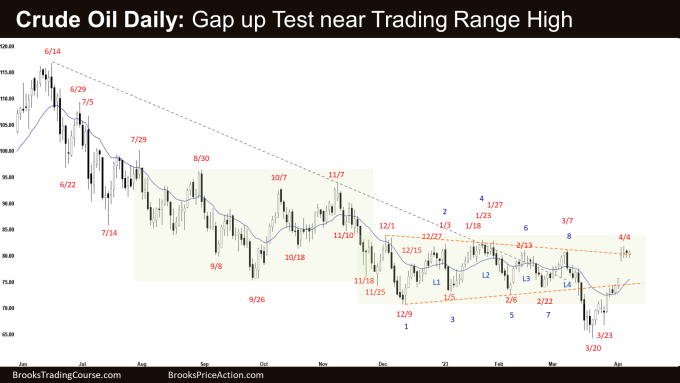

The Daily crude oil chart

- Crude Oil gapped up on Monday followed by sideways trading.

- Previously, we said that odds slightly favor Crude Oil to still be in the sideways to up pullback phase and for at least a small second leg sideways to down after this pullback (bounce) is over.

- This week, the market traded sideways to up with a big gap up.

- The bulls hope that the market has flipped into Always In Long.

- They want a failed breakout below the 16-week trading range.

- They broke the bear trend line by trading sideways.

- They hope that the 16-week trading range will be the final flag of the move down.

- They got a reversal up from a lower low major trend reversal and a wedge bottom (Sept 26, Dec 9 and Mar 20).

- The bulls will need to break far above the trading range high with follow-through buying to convince traders that a reversal up may be underway.

- The move up from the March 20 low is strong enough for the bulls to expect at least a small second leg sideways to up after a small pullback.

- Recently, the bears got a breakout trading far below the triangle and 16-week trading range low with some follow-through selling.

- They want at least a small second leg sideways to down, retesting March 20 low.

- Instead, Crude Oil traded higher in a tight bull channel with bull bars closing near their highs.

- The bears hope that the rally is simply a buy vacuum test of the trading range high.

- They want the market to stall around the trading range high and reverse lower.

- For now, odds slightly favor Crude Oil to trade at least a little higher and a small second leg sideways to up after a small pullback.

- Traders will see if the bulls can create a strong breakout above the trading range high or will the market stall there and reverses lower.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.