Market Overview: Crude Oil Futures

The Crude oil futures reversed lower from a crude oil double top bear flag. The bears need to break far below the major bull trend line to increase the odds of lower prices. Bulls want a reversal higher from a higher low MTR (major trend reversal). The major bull trend line remains as support for now.

Crude oil futures

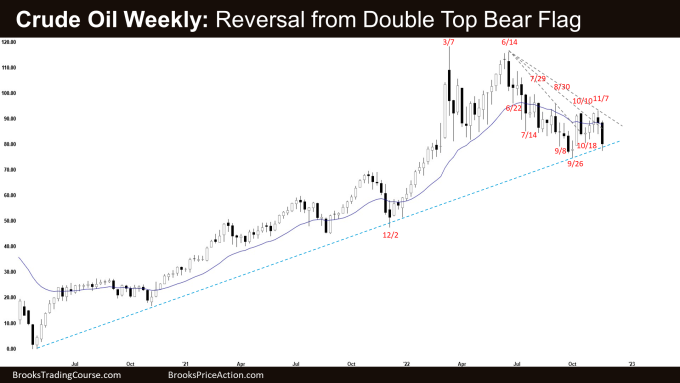

The Weekly crude oil chart

- This week’s candlestick on the weekly Crude Oil chart was a big bear bar with a noticeable tail below.

- Last week, we said that Crude Oil was in breakout mode. If the bulls do not create strong bull bars breaking above October 10 high soon, odds are sellers will return and attempt a retest of the September low within 1-3 weeks

- This week was a breakout below last week’s outside bear bar.

- Bulls got a reversal higher from a wedge bull flag (June 22, July 14 and Sept 26) and a lower low major trend reversal.

- They then got the second leg sideways to up from a higher low major trend reversal (October 18) re-testing October 10 high.

- The bulls hope that this week was simply a retest of the September low and want a reversal higher from a higher low major trend reversal.

- They also want a reversal higher from a double bottom bull flag with October 18 low even though this week traded slightly below it.

- The bulls need to create consecutive bull bars closing near their highs breaking far above the bear trend line, and the 20-week exponential moving average, to convince traders that the correction may be over.

- The bears hope that the recent move was simply a 2-legged sideways to up pullback and want a retest of the September low.

- They want a reversal lower from a double top bear flag with the October 10 or August 30 high or around the 20-week exponential moving average. They got this now.

- The bears got a consecutive bear bar closing in its lower half and below last week’s low.

- This week is a breakout from the outside bear bar. Next week, the bears need to create a follow-through bear bar to increase the odds of a retest of the September low.

- The major bull trend line remains as support for now.

- Since this week was a big bear bar, it is a sell signal bar for next week.

- Traders will see if the bears can create a follow-through bear bar.

- Bulls want next week to close with a bull body even though next week may trade slightly lower first.

- The US Government plans to refill the SPR (Strategic Petroleum Reserve) at some point around $67-72 which will likely provide a floor on price at some point and prevent a catastrophic sharp crash. (Source: US to complete 180 million barrel drawdown…)

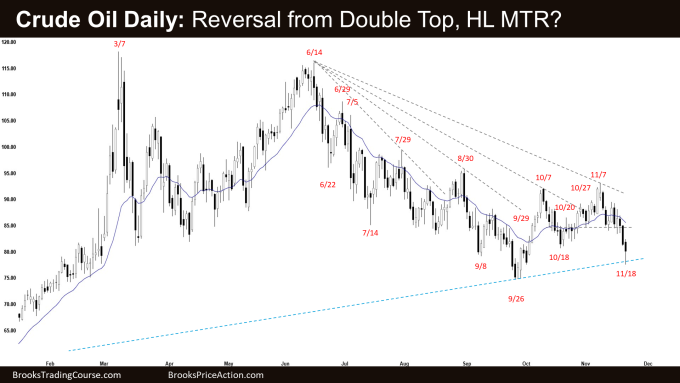

The Daily crude oil chart

- Crude Oil traded mostly lower for the week with a brief pullback on Tuesday. Friday broke below October 18 low but closed with a long tail below around the $80 Big Round Number.

- Last week, we said the sideways to down pullback may continue to test near the October 18 low.

- The bulls got a reversal higher from a wedge pattern (June 22, July 14 and Sept 26) and a lower low major trend reversal.

- They then got the second leg sideways to up from a higher low major trend reversal (Oct 18).

- The bulls see the current pullback as a retest of the September low.

- They want a reversal higher from a double bottom bull flag with October 18 and a higher low major trend reversal with the September low.

- The bulls will need to create consecutive bull bars closing near their highs breaking far above the bear trend line and 20-day exponential moving average, to convince traders that the correction may be over.

- The bears see the previous sideways to up move simply as a 2-legged pullback and got a reversal lower from a double top bear flag with October 7 high.

- They then got the second leg sideways to down this week. The second leg consists of a 6-bar bear microchannel. That means strong bears.

- The last 75 candlesticks had a lot of overlapping price action. That means Crude Oil is in a trading range between 74 and 93.

- Traders will BLSH (Buy Low, Sell High) until there is a strong breakout from either direction.

- Since Friday was a bear bar with a long tail below, it is a weaker sell signal bar for Monday.

- The major bull trend line remains as support for now.

- The bears will need to create consecutive bear bars breaking far below the major trend line to increase the odds of lower prices.

- While the odds slightly favor sideways to down, Crude oil is trading around the lower third of the trading range which is within the buy zone of trading range bulls.

- Traders will see whether the bears can break far below the major bear trend line and September low or the bulls can reverse higher from a higher low major trend reversal.

- The US Government plans to refill the SPR (Strategic Petroleum Reserve) at some point around $67-72 which will likely provide support at some point and prevent a catastrophic sharp crash. (Source: US to complete 180 million barrel drawdown…)

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.