Market Overview: Bitcoin Futures

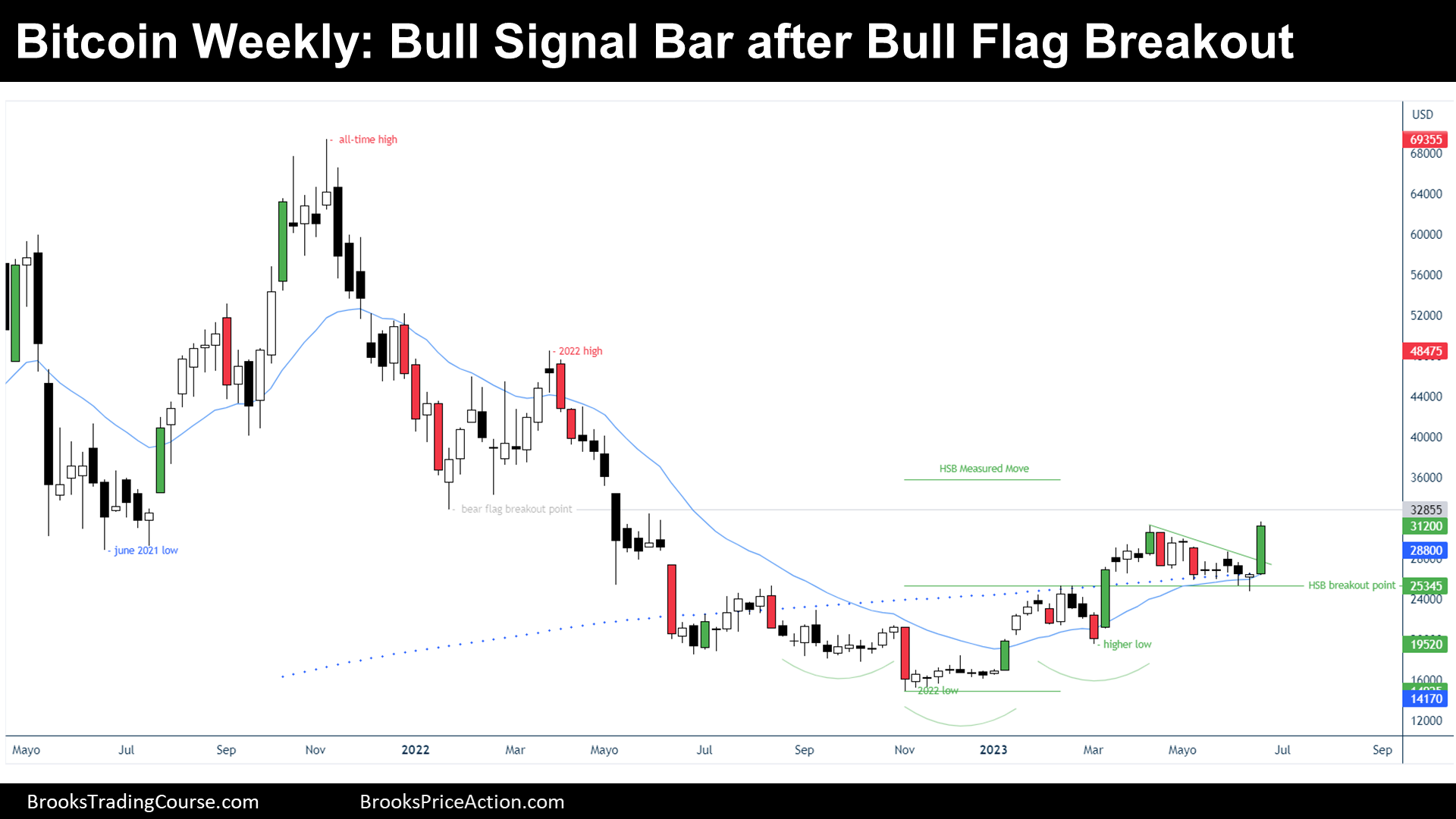

Bitcoin Futures big weekly bull signal and fresh 2023 high. During the week, Bitcoin increased its value by 17.98%. This move it is a serious attempt for continuing the 2023’s bull trend. Furthermore, the sideways trading inertia occurred during the past couple of months is over, and traders will probably be active during the following weeks. The Bulls want a continuation of the bull trend, and for that, they need good follow through next week. Bears want a failed breakout, and for that, they need to close soon the gaps between the current price and prior bars highs.

Bitcoin futures

The Weekly chart of Bitcoin futures

*Green bars are bars with more than 70% of bull body. Red bars are bars with more than 70% of bear body.

Analysis

- This week’s candlestick is a bull breakout bar, that is a weekly bull signal bar since the price is breaking up a bull flag. The context is good for the Bulls, since the breakout is following a bull trend: higher highs and higher lows.

- During the last report, we have said that the price was likely to keep going sideways to down because there was not enough bullish momentum, and that the bulls required a breakout of the bull flag. The bearish thesis ended early this week.

- Bulls:

- Expect a continuation of the bull trend, especially towards a Measured Move (MM) of the Head and Shoulders Bottom (HSB) Breakout.

- Their chances are good, since the price is in a clear bull trend: the price is creating higher lows and higher highs.

- But the gap between the HSB Breakout Point and the price was closed, and that might create some hesitation around the highs: there might be limit order bears above the prior higher high, so they need good follow through next week if they want the weekly bull signal bar to work.

- Bears:

- They require a reversal down next week and close the gap between the price and prior bars high, if they want to convince traders that there might be a reversal down.

- Closing the gap between prior highs could be a sign that there a reversal down is underway.

- Moreover, they hope that this reversal down comes after the price stalls at a resistance like a prior Bear Flag’s Breakout Point.

- The context favors the weekly bull signal bar to work on the upside.

Trading

- Swing Bulls:

- This week’s candlestick is a good bull signal bar with good context. The setup looks fair.

- Stop Loss at the Higher Low, Profit Target, at least partially, at the HSB MM.

- The probability is high for the bulls, but the risk and reward equation is bad, since the main target is closer to the price than the stop loss:

- To balance the trader’s equation, bulls should plan to exit their trade before their stop loss gets hit. Some might exit after a bad follow through. Others might lower their time frame and wait for a bear breakout to happen, or a sequence of lower highs and lower lows to get started.

- Swing Bears:

- A weekly bull signal bar is not a good bar to sell during a bull trend. If the price is within a trading range, it might, but that is not what it looks like with the current information.

- In other words, bears need to wait for a reversal down before thinking about a short.

The Daily chart of Bitcoin futures

Analysis

- During the week, the price did a strong bull breakout after reversing up from a nested wedge bottom the past week.

- Tuesday and Wednesday (Monday the market was closed) there were two consecutive high probability bull signal bars breaking above prior highs and the bull flag. When that is the case, traders should expect:

- Most likely: A second leg sideways to up.

- Possible: Spike and channel bull trend.

- At a minimum: A test of the second bull signal bar (Wednesday close) close if there is a reversal down.

- Not likely (20%): Full reversal to the Bull Flag’s low.

- Bulls:

- They want to achieve a MM up based upon the Bull Flag’s size.

- Another MM is a Leg 1 / Leg 2, Leg 1 being between the March low and the April high, the Leg 2 low being the Bull Flag’s low.

- Bears:

- The first reversal down will be likely bought, so they need to wait for a second reversal down before hoping that the bullish inertia is over.

Trading

- Swing Bulls:

- The context is good for the bulls.

- Since there is a weekly bull signal, they will probably buy a good buy signal bar on the daily.

- Their risk is big, since the stop loss is at the bull flag’s low. A way to minimize such a risk until there is not a fresh higher low, is to lower the position size, and reserve some powder to scale in lower, like at the 50% of the bull flag. If the price falls a 50% from the breakout high, bulls might close an important price of the position at Wednesday’s close.

- Their main profit target is a MM, at least a Leg 1 / Leg 2 MM, but if the price does not create a higher low, traders should reduce their risk by taking partial profits at resistances.

- Swing Bears:

- Before looking to sell, they should wait for a second reversal down from here, or a reversal pattern happening at resistances.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.