Market Overview: Bitcoin Futures

Bitcoin reversal patterns at resistances. This week, the price decreased by -6.13% of its value. The upcoming week is the monthly close, so far, February is a doji bar.

Bitcoin futures

The Weekly chart of Bitcoin futures

Analysis

- This weekly candlestick bar is a bear bar closing around its low. It is an inside bar and forms an ioi pattern.

- The ioi pattern comes after a parabolic wedge top. Furthermore, the price forms an almost perfect double top with the August 15th high, and it is stalling at the May 9th gap price level & the 200-week moving average (SMA 200). Wedge and double tops are reversal patterns.

- The overall context is probably a trading range, and during trading range price action, reversal patterns tend to work. The various reversal patterns occurring at resistances increase the chance of a reversal down during the upcoming weeks.

- Moreover, the price is reversing up for the first time after a strong bear channel, and the first reversal up after a strong bear channel is probably going to fail.

- Nowadays, the price is either:

- Bull case:

- The context is a trading range, but bulls see that this is a possible small pullback bull trend, and hence, they expect that traders will buy pullbacks like the current ioi, and they will continue to trend up, at least until the prior major lower high.

- Bear case:

- They think that this is the start of a bear leg that will test 2022 lows. The odds are on their side, apparently, since the price is facing reversal patterns coming out of a sell zone.

- Bull case:

- If during the next week the price trades below the current week, the price will probably trade down to test, at least, the 20-week exponential moving average within the next months.

Trading

- Bulls:

- The ideal scenario for the bulls is most likely waiting until the bears fail to achieve to trade below 2022 lows and then buy a reversal up, betting on a higher low major trend reversal.

- Bears:

- They can sell reasonably below this week’s low. Their goal is to get to the 2022 close or 2022 lows. Their stop loss is above the past week’s high. Bears have, at least, a 40% chance or more and a 1:2 risk reward ratio. Trader’s equation is good for the bears.

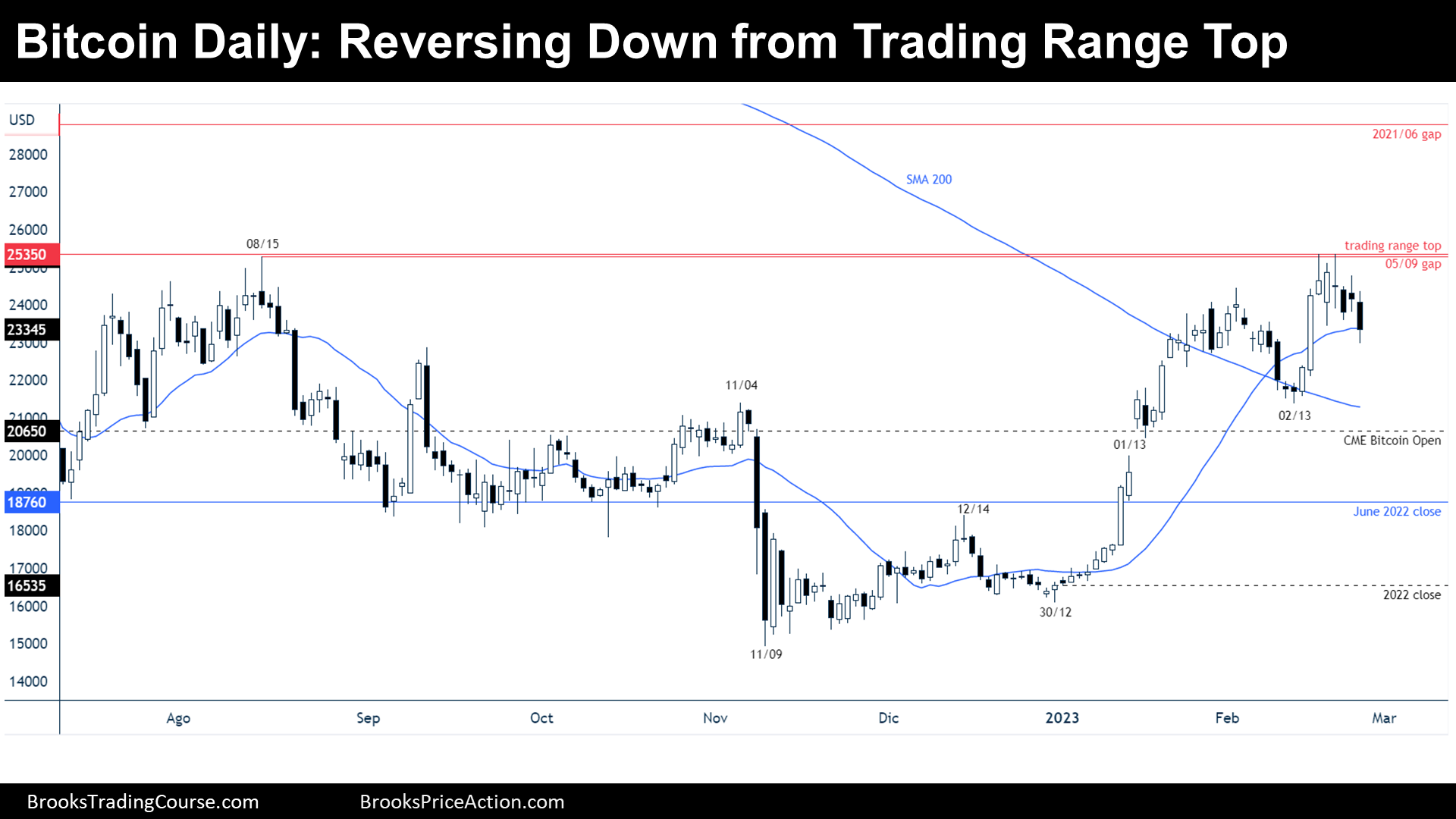

The Daily chart of Bitcoin futures

Analysis

- During the week, the price traded above a High 1 on Monday, but created a micro double top and reversed down from the trading range top.

- On the left of the chart, there is a trading range but during January, the price trended up strongly, hence, even if there is a reversal down, the price will have difficulties to break down supports.

- However, a test to the February 13th low and to the CME Bitcoin Open might be currently underway.

- Nowadays, the price is either:

- Bull case: The bull spike was strong enough to sustain a bull channel that will continue to break resistances until the price reaches the June 2021 low. Even if the price reverses down, bulls hope that it can create a double bottom or a higher low around the February 13th low. They will buy a reversal up if the January 13th gap does not close.

- Bear case: They think that the price is within a trading range, and trading ranges tend to close gaps, and thus, they expect the January 13th gap to be closed during the current reversal down. If that happens, it might prevent bulls to holding their trade in case of a hypothetical reversal up.

- Traders should expect sideways or sideways to down trading during the next week.

Trading

- Bulls:

- They need some kind of double bottom or a higher low before they buy again. There is a lot of trading range price action happening during the past weeks and therefore, they would prefer to buy low, specially around February 13th low.

- Bears:

- They believe that they are at their sell zone, since the price is supposed to be in the top third of a trading range. During the past week, they did not get a good stop entry signal. Limit order traders sold above a High 1, and they might do the same the next time that the price trades above something. Moreover, they will sell if they start to see consecutive bear bars, betting that there will be a deep reversal down.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.