Market Overview: Bitcoin Futures

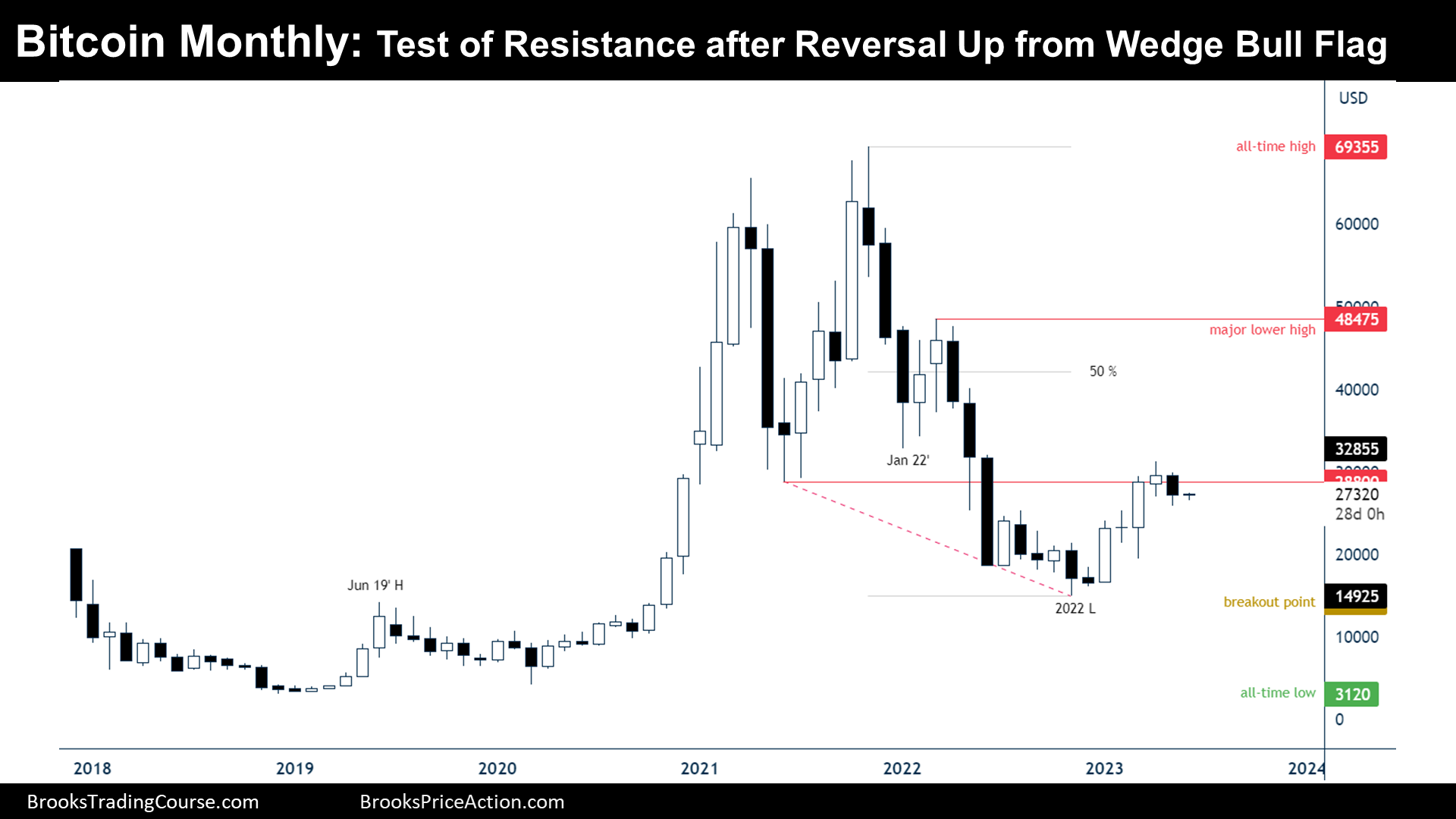

Bitcoin reversal down attempt from a monthly chart resistance. During May, the price decreased its value by 7.89%. At the end of the first quarter of the current year (Q1) we have said that the closing price in March could be the most important price during the Q2; so far, the price is gravitating around there since then. The monthly chart of Bitcoin entered within a buy zone in 2022, when it traded below the June 2021 low; by the end of that year, a wedge bottom pattern was created, and the monthly chart price action for 2023 is a reversal up from a wedge bull flag within a buy zone. Nowadays, the price is attempting to reverse down from a resistance formed by a prior major higher low, and it will likely go sideways to down for a while before resuming the reversal up.

Bitcoin futures

The Monthly chart of Bitcoin futures

Analysis

- May’s candlestick is a bear bar with a prominent tail below. It closed below the monthly resistance formed by a previous major higher low, the June 2021 low.

- Bitcoin is reversing up from a wedge bottom that was formed within a buy zone.

- Now, why that is a buy zone?

- The price did a (strong) breakout (late 2020 until early 2021) surging from a trading range (between late 2017 and late 2020).

- The market cycle theory says that after a breakout comes a channel in the direction of the breakout, and hence, traders expect a retracement.

- If the breakout does not come out from a trading range, it won’t probably be followed by a channel in the direction of the breakout. It will likely just be a leg within a trading range, and traders will expect a reversal.

- Since the Bitcoin breakout was coming out of a trading range, the whole drawdown from the all-time highs is being viewed like a retracement.

- But the June 2021 low is a resistance, and normally, the price will start a minor reversal down when facing a resistance based upon the previous breakout point formed by a prior major higher low that has been broken.

- Bulls:

- The bulls want June to do not trade below the May and create a bull bar. That will be viewed as bullish and may be the resumption of the reversal up.

- They think, reasonably, that the price is more likely to get to the major lower high instead than below the 2022 low.

- Their scenario will be invalidated only if the price gets below the last bull bar of 2020 at $10410.

- Bears:

- They want June to trade below May, since that might prevent bullishness during the start of Q3.

- The market cycle theory does not favor them (a full reversal), I think it is a mistake for them to sell around the current resistance, betting to get to the $10410 level.

- The selling pressure will probably come from trapped longs that were buying all the way down during the drawdown from all-time highs.

- They will have better chances of a swing down if the price gets to the major lower high with signs of weakness.

Trading

- Swing Bulls:

- May is not a good buy signal bar. But bulls can buy reasonably around here, with a stop loss below the 2022 low, first target around being between the major lower high and $60000. It is a trade that might take 2 years to pay out.

- Swing Bears:

- I am not convinced that swing bears should sell around this area, in this timeframe.

The Weekly chart of Bitcoin futures

Analysis

- This week’s candlestick is a bear bar with a small body. The price tested the Q1 2023 close and the June 2021 low and then reversed down.

- The prior two weeks we had dojis. This week we had a small body. Normally, dojis and small bodies precede explosive moves in one direction or the other.

- Since we are at resistance and at the beginning of a month, we should expect a wide range bar happening within the next 1–3 weeks.

- The bears might have the odds on their side, since the price is failing to get closes above the monthly resistance.

- If I were a bull, I would love to buy a reversal up from the Apex of the head and shoulders bottom (HSB). The breakout above the HSB has been weak.

- Furthermore, that kind of move down would trap retail bears into shorts, while stopping out retail bulls who will have their stop loss below the March 10th major higher low. That would be an ideal scenario for a strong move towards the 2022 high.

- However, for the moment, the price even did not close the gap between the price and the HSB breakout point; thus, bulls have their reasonable chances of getting a new 2023 high or even get to the HSB measured move (MM).

- Bulls:

- If they want to get to the 2022 high they might need fuel (liquidity) and hence, a move down to the major lower high won’t invalidate their bull thesis.

- If they achieve fresh highs without reversing down further, traders will see a wedge top formation and around a 50% retracement of 2022’s range, or the HSB MM, the price will probably start a two legged down move towards the March 10th low.

- Bears:

- A reversal down from the monthly resistance might be underway, but their potential run is limited.

- They will likely look to sell if there are fresh highs soon, but for that, they would prefer first a close of the gap between the price and the HSB breakout point. That will give them more confidence to sell above 2022 highs.

- There might be a wide range bar next week, and since this week was a bear bar, and the price reversed down from a test of resistance, bears have more chances of that happening.

Trading

- Swing Bulls:

- This week’s candlestick, it is not a good buy signal bar.

- If the next week the price does not go above the current week’s high, and then the price breaks above it and get a bull bar close, that might anticipate a 1-3 bar upside move.

- Most should wait for other patterns to unfold, or wait until there is a double bottom around the March 10th. That would be my personal choice.

- Swing Bears:

- This week’s candlestick, is not the best sell signal bar, but the context might be good enough for the bears to look to sell below the current bar, with a stop above this week’s bar, and targeting the March 10th low.

- It is not a trade that I would take on this timeframe, but I think that the math is ok. However, I might go to lower timeframes and try to find a greater probability, risk, and reward equation, with this idea in mind.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.