Market Overview: Bitcoin

Throughout the week, there was the closure of the Bitcoin Monthly candlestick, a pivotal event for market participants. Institutions traditionally regard the month of January as a barometer for gauging market trends and sentiment for the remainder of the year. The price action witnessed a shift as Bitcoin closed below the December High after Traders observed how there was a reversal from the 2022 high, raising questions about the formation of a potential Double Top pattern.

The primary concern looming over traders’ minds is whether the recent price action signals the onset of a reversal down from the Double Top pattern. This pivotal question underscores the need for insightful analysis and strategic decision-making to navigate potential market movements effectively.

Bitcoin

The prices depicted on our charts are sourced from Coinbase’s Exchange Spot Price. It’s crucial to note that the spot price of Bitcoin is continuously in motion; trading activity never ceases. This means that market fluctuations and price changes occur around the clock, reflecting the dynamic nature of cryptocurrency trading.

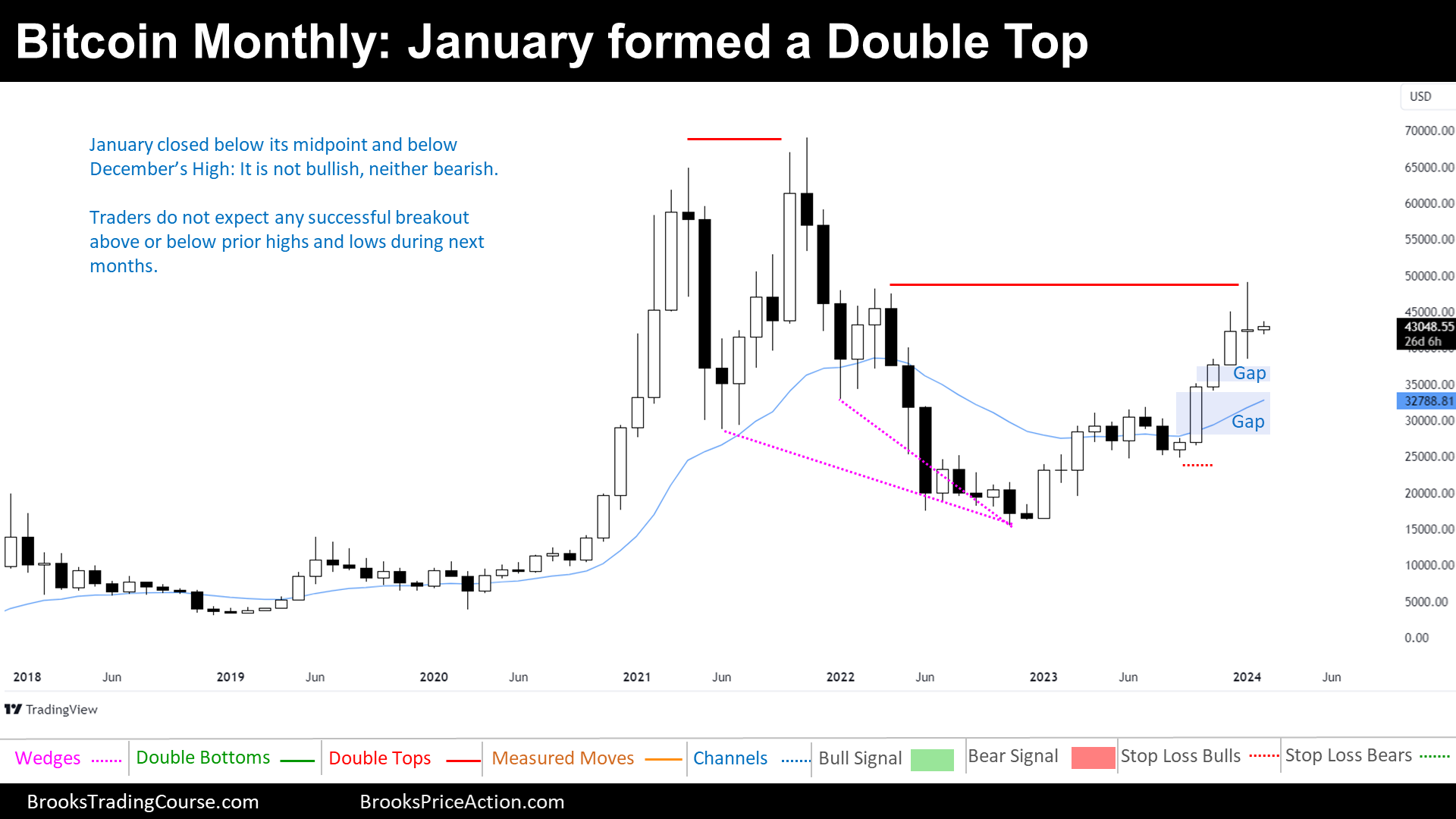

The Monthly chart of Bitcoin

On Bitcoin’s monthly chart, January witnessed notable movements as the crypto asset approached the significant resistance level set by the 2022 High. This juncture has left traders contemplating the future trajectory of prices, particularly in light of recent bullish developments.

The preceding bars on the monthly chart signaled a Bull Breakout, igniting optimism among traders. This bullish momentum was underscored by the creation of gaps between bars, indicating that bears who had sold above bars are now facing losses and are trapped in short positions. Consequently, the likelihood of these bears buying back their shorts upon a reversal down suggests a potential for buy-side activity in such scenarios.

Presently, the price finds itself stalling at resistance, prompting traders to assess the feasibility of further upward movement without a reversal. Signs such as closing below the prior bar’s high and the midpoint of the current bar do not bode well for bullish prospects now.

Looking ahead, bears are poised to capitalize on any reversal down, while bullish sentiment may be tempered by the challenges posed by current resistance levels. As a result, the most probable scenario entails sideways to downward trading towards the gaps that rest below.

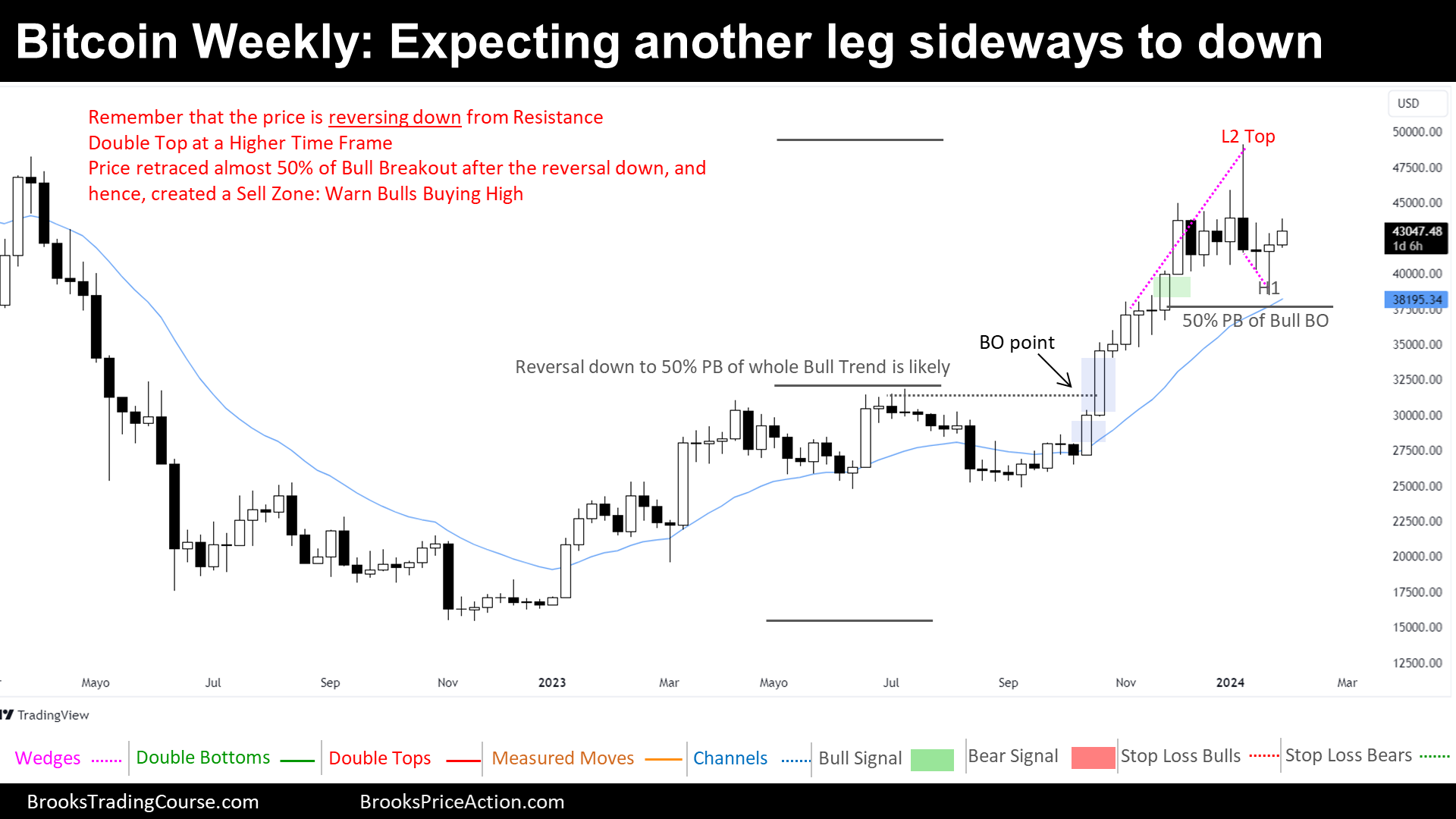

The Weekly chart of Bitcoin

The previous week culminated in the closure of a High 1 (H1) bull signal bar, indicative of bullish momentum in the market. However, it’s essential to note that this H1 formation occurred after a robust reversal down from a significant resistance level. Consequently, bulls may exercise caution and opt to await another leg down before committing to further buying activity. Conversely, bears may seize the opportunity to sell above the H1 bar, aiming to capitalize on potential downward movement toward its low.

In the ongoing week, the candlestick is endeavoring to close above the H1 bar. Achieving this feat would also entail closing above the midpoint of the bar, thereby tilting the odds in favor of a test at the high of the current week.

The market cycle remains characterized by a Bull Trend, with the price still traversing within a Bull Channel. Despite this bullish backdrop, the price’s recent stall at a major resistance level may prompt bulls to exercise caution and await confirmation before resuming buying activity.

Looking ahead, the prevailing sentiment suggests that the price is more inclined to generate another leg down before surpassing January’s high. This anticipated movement aligns with the cautious approach adopted by bulls, who seek to gather more information and assess risks prudently before committing to further upward momentum.

As we navigate through the markets, your thoughts, and perspectives are highly valued. We encourage you to share your insights and engage in discussions in the comments section below. Together, let’s continue to explore the intricacies of the market and strive for informed decision-making. Don’t hesitate to share this report with others who may benefit from its insights. Thank you for your continued support and participation.

Josep Capo

Market analysis reports archive

You can access all the weekend reports on the Market Analysis page.