Market Overview: Bitcoin Futures

Bitcoin futures attempting to break long-term bull flag. During January, the price increased +40.61% of its value. The price rallied strongly during the past month; now it is attempting to break the long-term bull flag, but the first attempt will likely fail.

Bitcoin futures

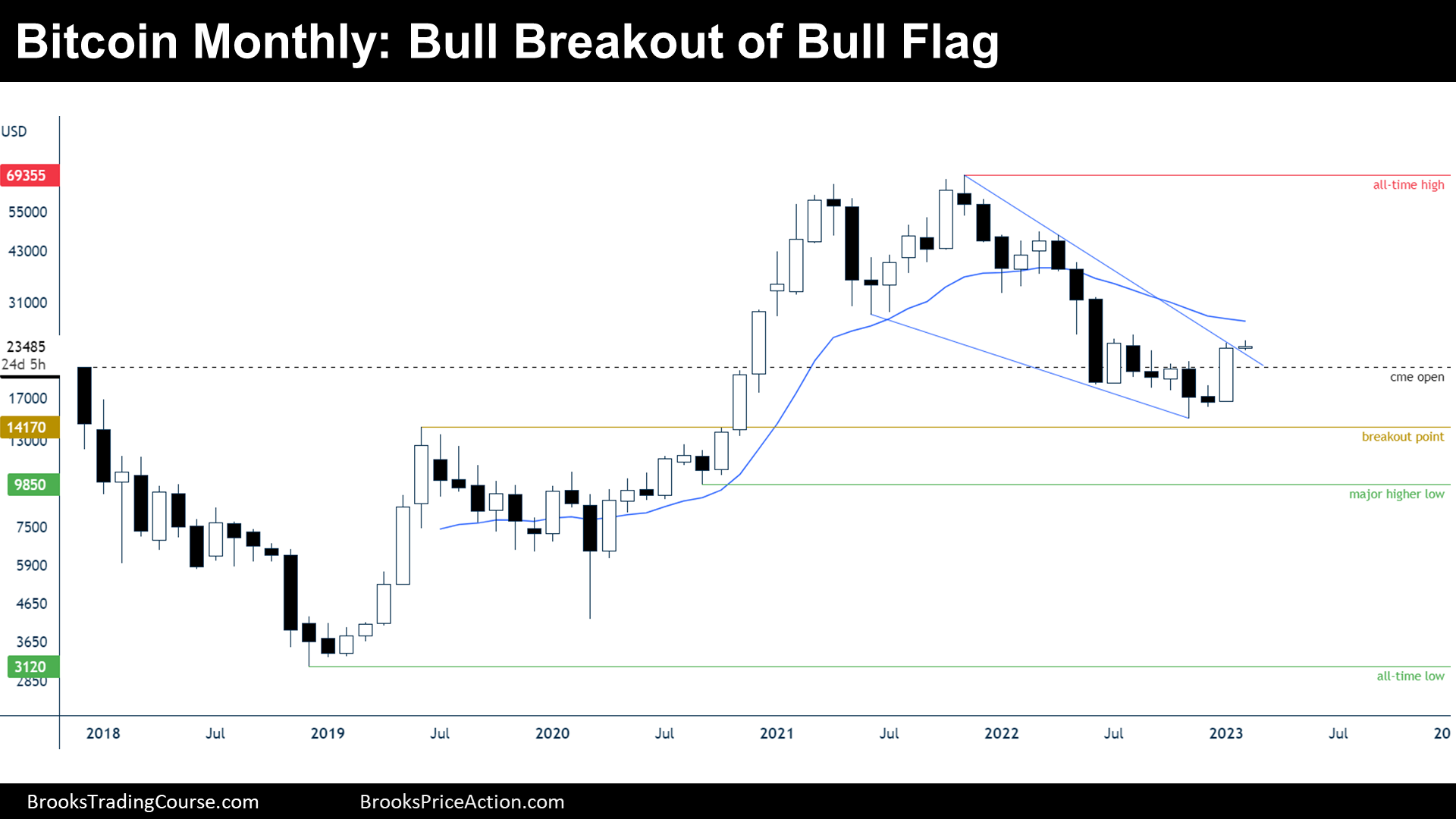

The Monthly logarithmic chart of Bitcoin futures

Analysis

- January candlestick is a huge bull breakout bar. This bar alone has broken the highs of the prior 4 bars. The price closed above the Bitcoin Futures CME opening price.

- The bull flag is above the major higher low of the long-term bull flag; hence, the resumption of the bull trend is likely at some point in the future.

- But the long-term bull flag has been deep and a fairly tight bear channel; therefore, many bulls have probably bought too high: they will try to close those bad positions during rallies. Many bulls might close at or around the 20-month EMA (exponential moving average), which is considered a fair price: 20-month EMA is a strong magnet.

- The 20-month EMA is a strong magnet and that January has had constructive momentum. What is constructive momentum? By that, I mean that there are open gaps during the breakout.

- Nowadays, the price is:

- Bull case: The bear channel ends by breaking out the bull flag. The best the bulls can get is probably trade up to $30000 and then go sideways. The first reversal up will likely fail, but that does not mean that the price will make new lows right after.

- Bear case: The bears think that they are still within a small pullback bear trend. Now, they see a double top with August 2022 high and from around here they expect new lows.

- Because January’s candlestick has no tail above, and it has broken above many resistances, sideways to up trading should be expected, at least until the 20-month EMA is tested.

Trading

- Bulls:

- January is a bull signal bar, but there are many inconveniences:

- First attempts to reverse a tight bear channel normally fail.

- Possible double top with August 2022 high.

- Trapped bulls around the June 2021 low, $30000 area and the 20-month moving average.

- For stop order buyers, it might be a better idea to wait for a good follow-through bar (not likely in February).

- Or wait until there is a double or wedge bottom, that would mean that bears are failing to make new lows and on the upside there won’t be trapped bulls adding selling pressure during the reversal up.

- January is a bull signal bar, but there are many inconveniences:

- Bears: Bears will sell a failed bull breakout after February, or they might place limit orders around the 20-month EMA.

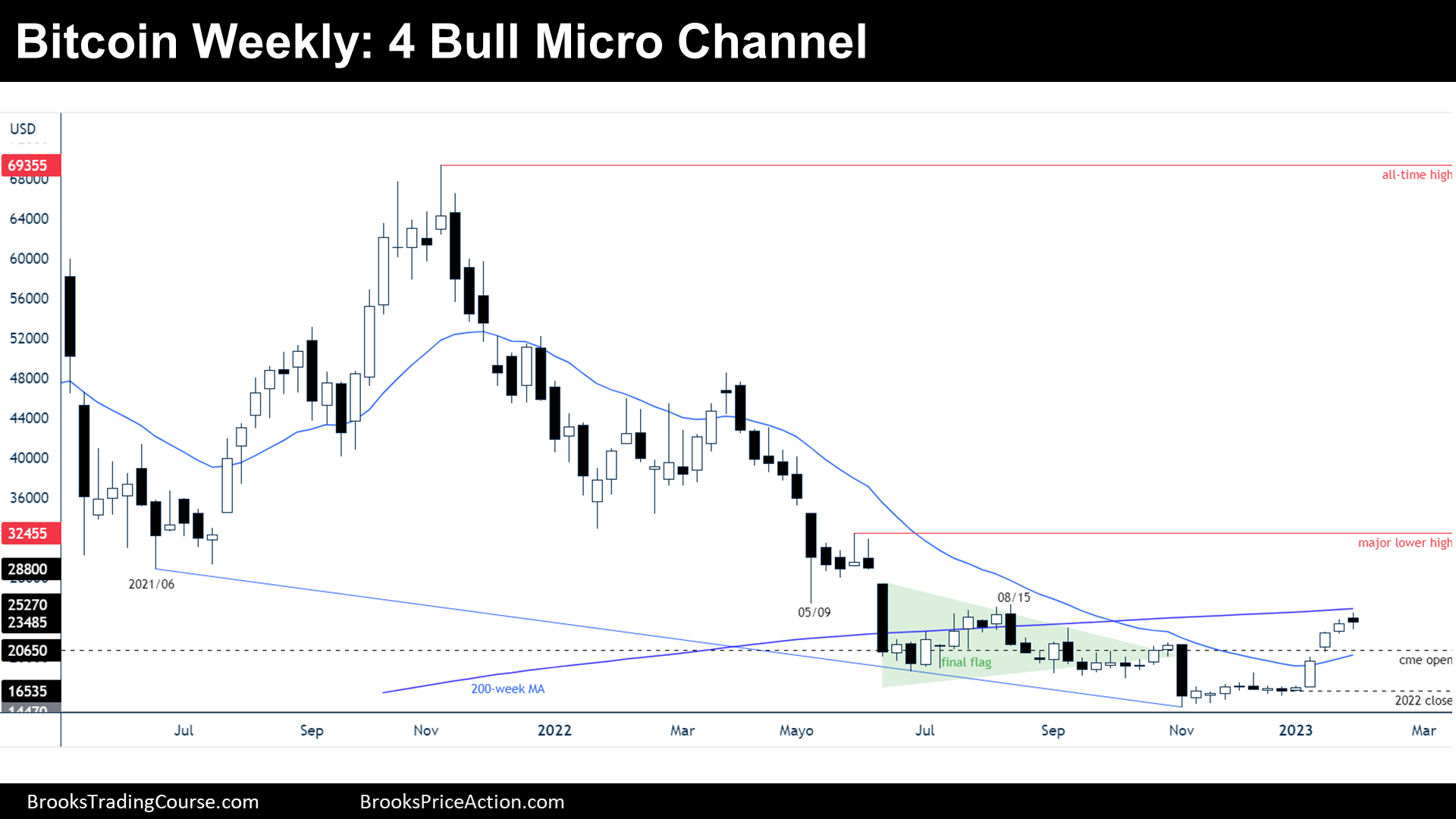

The Weekly chart of Bitcoin futures

Analysis

- This weekly candlestick is a bear doji that closed slightly below its midpoint. It is the fourth consecutive bar without a pullback.

- During the past report, I have mentioned that a pullback during the next 1–3 bars should be expected. A pullback during a bull breakout means that a bar trades below the low of the past bar.

- The loss of momentum is evident, bull bars getting smaller, and here comes a bear body. Moreover, there are the resistances of the 200-week moving average resistance right above, and the August 15 high. The chances of a pullback for the next few weeks increase.

- Before there is a bull breakout of the resistances, the price might test back to the apex of the final flag or to the CME opening price.

- Above the 200-week moving average, there are resistances in the form of trapped bulls.

- The conclusion is that above the January high starts the sell zone.

- Nowadays, the price is either:

- Bull case: bulls hope that this leg will grow at least up to the prior major lower high, which will end, technically, the bear trend. Thereafter, a trading range is more likely than the start of a bull trend.

- Bear case: bears expect a pullback starting during the next weeks, they hope that the pullback becomes deep and get new lows in the bear trend.

- The bull breakout has been strong enough to expect at least another leg sideways to up during the upcoming weeks.

Trading

- The current bar is not a good setup, neither for bulls nor bears.

- Bulls: the bulls might want a High 1 setup with a good bull close to catch up a potential move up to the $30000 area.

- Bears: Bears want a micro double top with a bear bar closing around the low, to fade the bull breakout.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.