Market Overview: Bitcoin

Bitcoin extended sideways action, following a climactic surge, has left both bulls and bears on edge. The weekly chart hints at a potential change in momentum after a bullish run. Meanwhile, the daily chart reveals a tense standoff, with bears gaining an early advantage by creating a Major Trend Reversal setup.

Could this be the calm before the storm? Will the bears finally break the bulls’ grip on the market? Key support levels are likely to be tested in the coming days as the battle for dominance intensifies.

Bitcoin

The Weekly chart of Bitcoin

Bitcoin continues always in long, marked by the Tight Bull Channel pattern on the weekly chart. However, a recent climactic surge towards a new all-time high has been followed by a notable stall. Five weeks of sideways price action suggest a potential change in momentum.

This week started with promise. The price initially traded above last week’s high, forming a High 2 setup. Yet, what followed indicates waning buying strength – this wasn’t the reaction that bulls were searching for. Now, the price is reversing downwards, creating a Low 2 setup with a favorable outlook for bears. It is stalling at the previous all-time high resistance level, within the context of an exhausted bull trend, could trigger risk-averse bulls to exit their positions below the setup. Simultaneously, aggressive bears sensing a profitable opportunity might enter with sell orders, hoping for a deeper pullback with high reward potential.

The likelihood of a pullback increases significantly if this week closes as a bearish candle. Bears might perceive the market as establishing at least a trading range and ultimately, they target the major higher low around $40000. However, before that level is reached, bears will need to push the price below the 20 EMA, and other supports such as march low and big round numbers like $60000 first, and $50000 later.

Despite the increasing bearish signals, it’s important to remember that the monthly chart displays a potent bullish micro channel pattern. This suggests that the first pullback attempt could fail, potentially leading to a retest of the current highs. Long-term bulls might capitalize on any pullback as an opportunity to accumulate, thereby limiting the pullback’s severity.

The Daily chart of Bitcoin

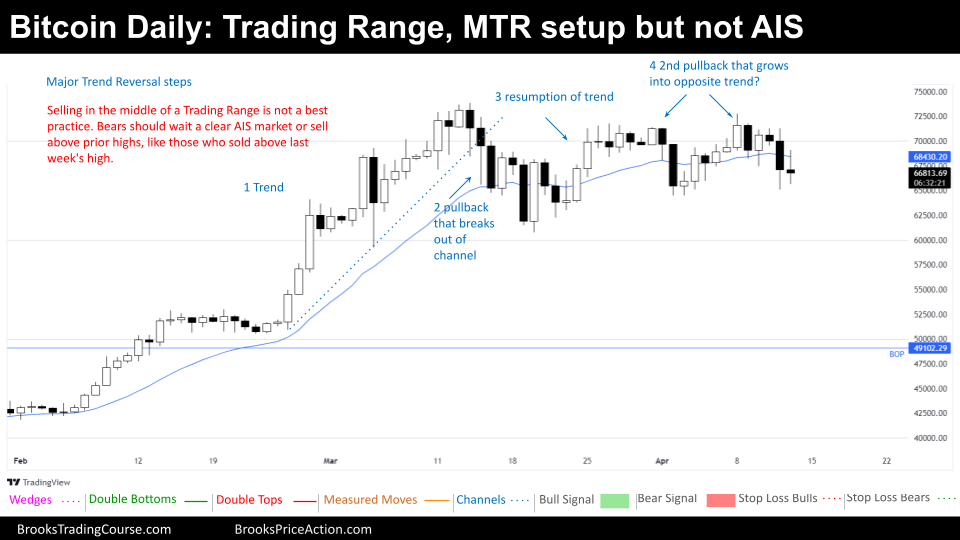

The daily chart of Bitcoin reveals a neutral market sentiment. Both bulls and bears hold positions, resulting in the formation of a trading range and a balanced power struggle. The likelihood of a successful breakout in either direction appears to be roughly equal at this time.

Bears aiming for a downward reversal have completed the steps for a Major Trend Reversal setup: breaking the bullish trend line, a subsequent rally, and now a reversal to the downside. Although an initial attempt to reverse downward failed last week, this setup offers bears a potential opportunity.

In last week’s report, we discussed the possibility of an extended trading range. Bears might now attempt a breakdown, sensing a weakening in bull strength. However, the lack of clear signals at the range’s top means they’ll need the market to definitively turn bearish to boost their conviction.

Based on the trading range size, a measured downward move could extend below $50,000. This level is significant as a previous breakout point, and the price often revisits such areas. In short, bears might try to test the trading range low, the breakout point, and the psychologically important $50,000 level.

If this downward movement materializes, bulls who buy below the trading range’s lows may become trapped. This would create short-term opportunities for traders looking to capitalize on those trapped positions with short trades (sell limit orders).

The current market environment favors a potential test of lower support levels by the bears, it could present a temporary advantage for short-term traders.

Finally, we encourage you to share your thoughts on this report, and please have no hesitation to share it with other traders. Thank you for reading!

Josep Capo

Market analysis reports archive

You can access all the weekend reports on the Market Analysis page.