Market Overview: Bitcoin

In the past week, a noticeable Bear Signal sent ripples through the Bitcoin market, raising questions about the potential shift in sentiment. The follow-through bar, observed at the time of this report, takes the form of a doji bar, managing to close above the prior weekly lows.

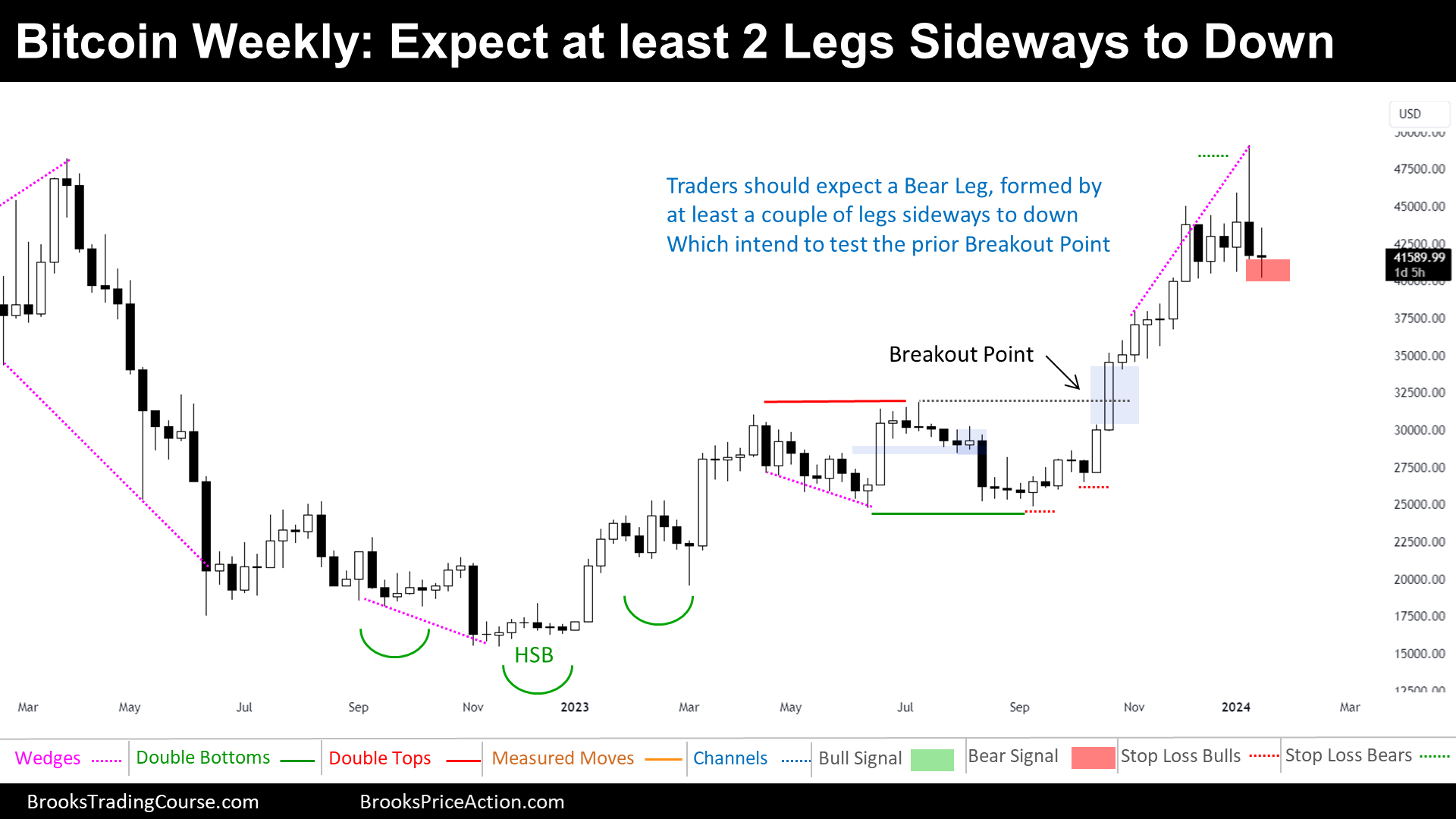

Traders are now closely monitoring the aftermath of this Bear Signal, anticipating the development of Two Legs Sideways To Down. This expectation stems from the culmination of a Parabolic Wedge Top that encountered resistance at a Major Resistance.

The overarching question that begs attention throughout this report is the confirmation of the initiation of the Two Legs Sideways To Down period. Traders are eager to discern whether the recent Bear Signal indeed marks the beginning of a downward movement. Analyzing the dynamics following the Parabolic Wedge Top and understanding the interplay with Major Resistance will be pivotal in resolving this inquiry.

Bitcoin

The prices depicted on our charts are sourced from Coinbase’s Exchange Spot Price. It’s crucial to note that the spot price of Bitcoin is continuously in motion; trading activity never ceases. This means that market fluctuations and price changes occur around the clock, reflecting the dynamic nature of cryptocurrency trading.

The Weekly chart of Bitcoin

As remarked within our previous reports, the price displayed a significant reversal from a Major Resistance point—the 2022 High. Beneath the current price, a multitude of supports comes into play, including Bull Gaps between Bars, the 50% retracement of the Bull Leg (a key zone for bullish interest), the Major Breakout Point of a Prior Range, and the critical Major Higher Low, serving as the threshold for Bulls’ Stop Loss.

Currently nestled within a Long-Term prior Price Range, Bitcoin is navigating a Trading Range Market Cycle. However, within a Shorter-Term context, the price executed a robust Bull Breakout. This breakout encountered a forceful reversal after forming a Parabolic Wedge Top Pattern at the Major Resistance, indicating potential exhaustion.

Traders are now on high alert, anticipating either a Retracement or a full Reversal of the Bull Leg. A Retracement implies Higher Highs after a reversal from a level not breaching the Major Higher Low. Conversely, a Reversal suggests the price trading down until it reaches the Major Higher Low.

The prospect of a Reversal is yet to be confirmed, necessitating, at the very least, Daily closes below $40500. Ideally, a Weekly close below $40000 would cement this reversal. Until such confirmation materializes, Traders should remain vigilant, recognizing the potential for the price to ascend towards the prior High.

In this scenario, the Bulls are strategically eyeing a Retracement entry, while the Bears are poised to capitalize on selling at the current high. Within this time frame, a prudent approach might involve considering buying at or below the 50% Retracement, strategically positioned at crucial supports like the Major Breakout Point.

The Daily chart of Bitcoin futures

On the Daily Chart, Bitcoin encountered a stumbling block in its attempt at a Bull Breakout above a Double Top, halted by the Major Resistance from the Weekly Chart. Subsequently, it established the 2024 High, now serving as a critical barrier. Potential resistance zones include the $46000 — $47000 range, contingent on sustained closes well above $47000.

In terms of support, pivotal levels include the Trading Range Low—a crucial threshold representing Bulls’ Stop Loss—followed by the support at the Bull Flag Apex and the significant $35000 Big Round Number.

Presently, the market assumes the semblance of a Trading Range. However, the failed Bull Breakout above this range introduces the possibility of a Bear Trend Reversal. To validate this reversal, a Bear Breakout of the Trading Range Low is imperative.

The Bulls find themselves in a precarious position, requiring a concerted effort to breach the $43500 level. Until such attempts materialize, the odds tilt in favor of the price testing below the Trading Range Low. It’s essential to note that trading below this low doesn’t conclusively confirm a Major Trend Reversal; a Bear Breakout does.

The Bulls, currently grappling with apparent weakness, may find limited success unless there is a notable attempt to trade above $43500. The prevailing market cycle suggests a preference for scalping among the Bulls. Meanwhile, Bears eyeing potential entry points should consider selling either on a Strong Bear Close below the Trading Range Low or above $43500 (in the absence of consecutive Bull closes).

Have a burning question, a unique insight, or a perspective to share? Drop a comment below and let’s engage in a thoughtful discussion. Your input enriches the collective understanding of the market, fostering an environment where knowledge thrives.

Share the knowledge with your fellow traders and enthusiasts. Together, we build a community committed to navigating the dynamic landscape of Price Action Trading.

Thank you for being an integral part of this journey.

Josep Capo

Market analysis reports archive

You can access all the weekend reports on the Market Analysis page.