Market Overview: Bitcoin Futures

Bitcoin at 30000 big round number. This week, the price increased by +9.05% of its value. The price closed above $30000 for the first time since May 2022.

Bitcoin futures

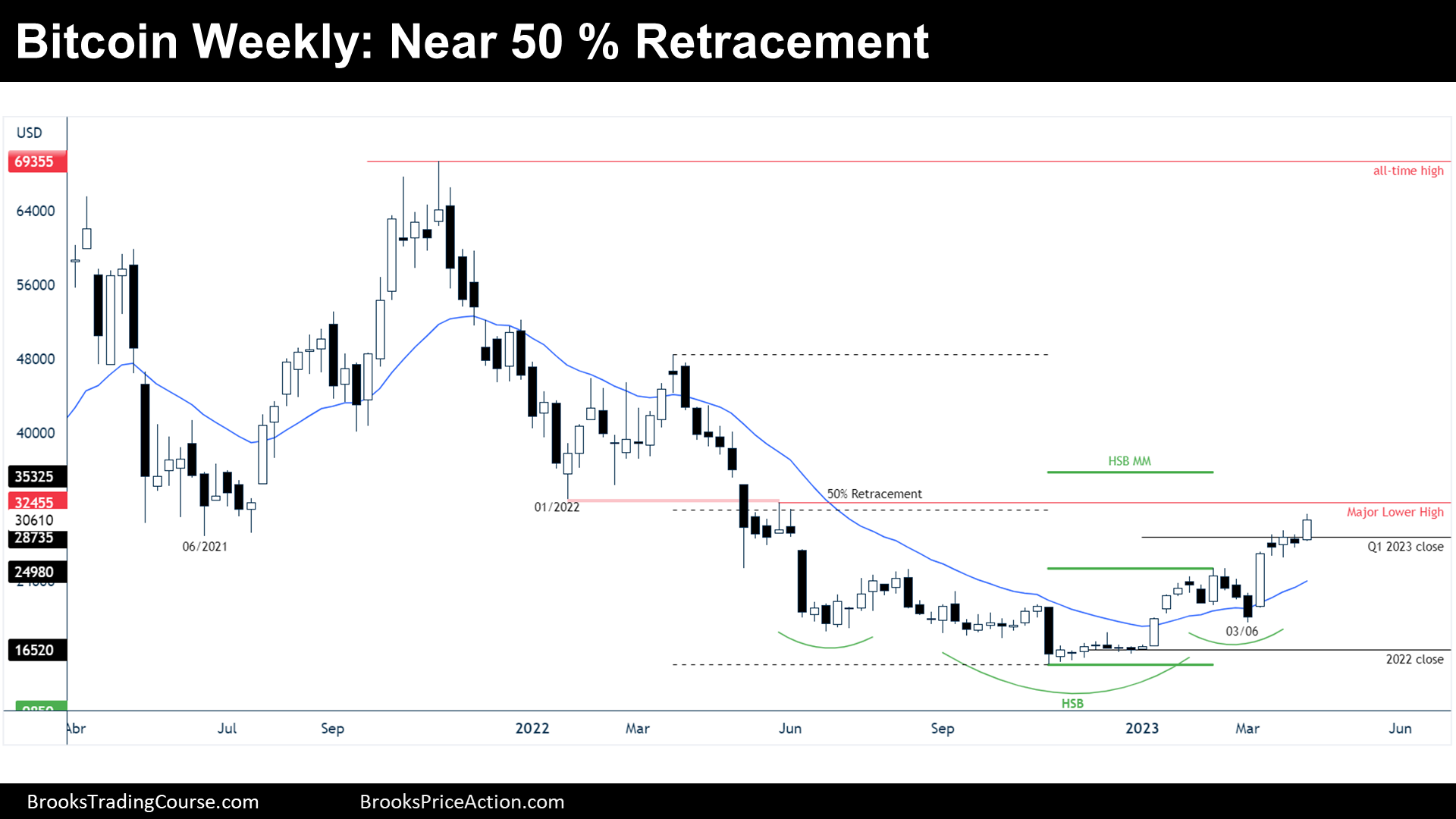

The Weekly chart of Bitcoin futures

Analysis

- This weekly candlestick is a bull bar with a prominent tail above. The bull bar is a good follow through bar of an ioi bull breakout buy setup.

- An ioi during a bull leg is either a bull flag or a final flag.

- Traders wonder if this is a small pullback bull trend and, hence, the start of a bull major trend reversal up to the all-time high.

- The truth is that the bulls are achieving milestone after milestone and now is near a major lower high after creating a higher low on March 6th. At a minimum, bulls will probably get a trading range and contain the price above $20000 during the next half year.

- But the overall context is more likely a trading range than a major bull trend reversal. We have been saying this since June 2022, and even when the price was trending down strongly at the end of 2023. And remains true nowadays, limiting the upside.

- Lately, bull bars are not followed by bull bars, which is another sign of trading range price action.

- Q1 2023 close will be probably tested at some point during the upcoming weeks since it is a crucial price during the current quarter.

- Within a trading range, a bull leg is followed by a bear leg. If this is true, Where it will start the bear leg? It will likely start at around the following resistances:

- June 2021 low (currently surpassed).

- $30000 big round number.

- 50% retracement of the bear leg.

- Major lower high.

- Head and Shoulders Bottom (HSB) measured move.

- Nowadays, the price is either:

- Bull case: They want to get to the major lower high to end, technically, the bear trend market cycle. However, they already did higher lows and highs during the reversal up, so they are not as weak as they were. The best case for bulls is probably to get to the HSB measured move, since that will mean that bulls are making money betting on swing trades high within a trading range. Then it will mean that the trading range’s upper half is higher. The top being $40000 big round number instead of the bear 50% retracement (which is what bears expect nowadays).

- Bear case: They want a bear leg starting soon and get to the March 6th low to end the bull major trend thesis. A bear leg will likely start soon.

- An ioi during a bull trend is more likely a bull flag when the price is trending, and a final flag when the price is in a trading range. Because the price is probably within a trading range, the follow-through bar of an ioi bull breakout will probably fail, and hence, the Bitcoin price is more likely to decrease on its value the next week.

Trading

- Bulls: The last time that they did a bull breakout, the price reversed down strongly before higher highs, indicating that they prefer to buy near the 20 Exponential Moving Average (20 EMA). Nowadays, the price is far from the 20 EMA and near resistances, which indicates that it is not a good idea to buy high.

- Bears: They are not making money by selling high, demonstrated by a gap between the latest higher high (on February 16th) and the current price. Hence, it is better for them to wait for a bear breakout before selling.

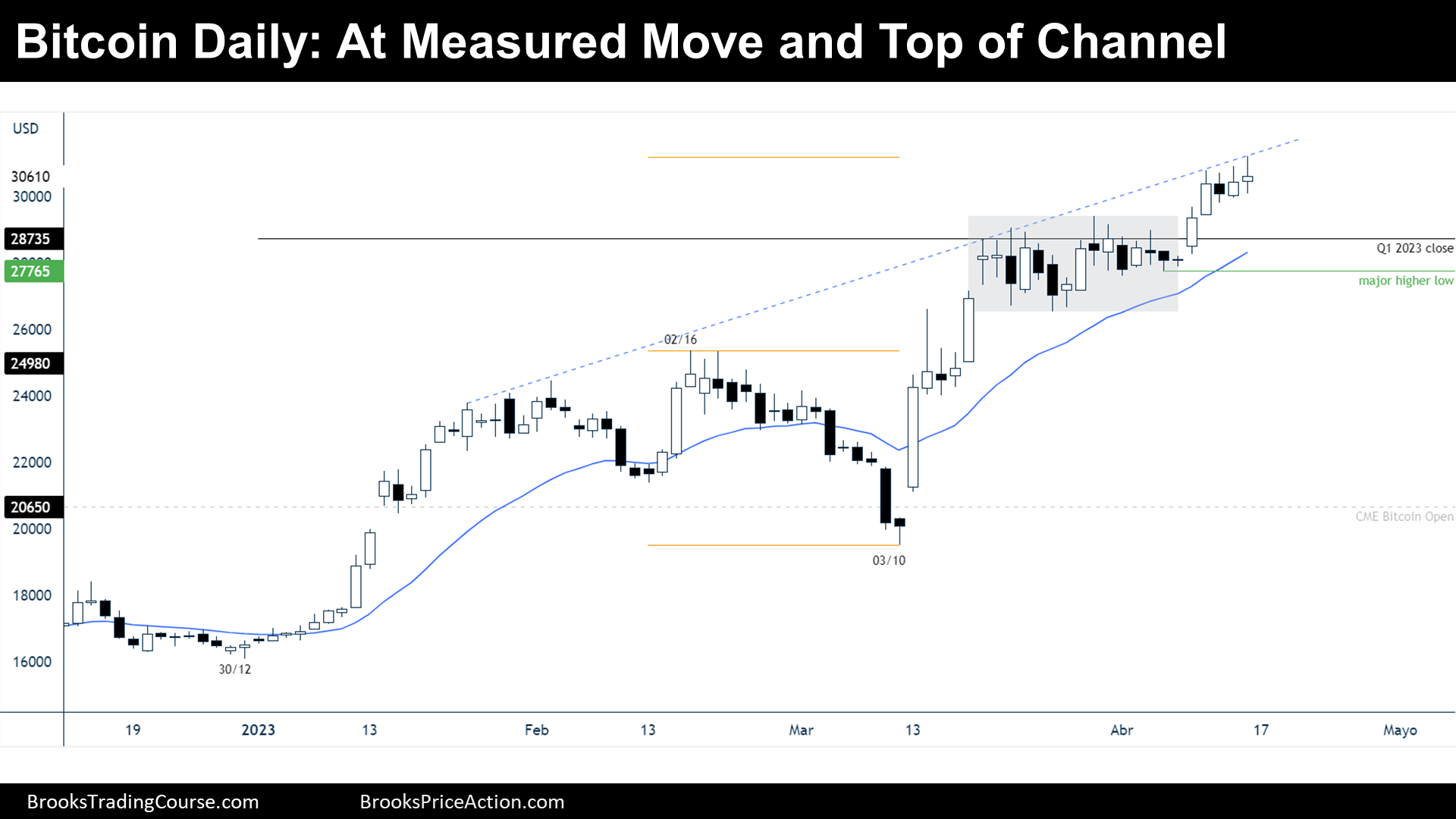

The Daily chart of Bitcoin futures

Analysis

- The market gapped up and then did a breakout of a trading range and the Q1 2023 close.

- Furthermore, it reached a measured move based upon a prior failed bear breakout (2/16 high and 3/10 low).

- A measured move it is considered a resistance since usually occurs profit taking.

- Another resistance to consider, it is a possible top of a channel.

- The trading range that the price just broke was a limit order trading range; thus, there are bears that sold with limit orders above the high of the trading range correctly and there is a very high probability that the price will come back there within the next three weeks.

- A trading range during a bull trend is either a bull flag or a final flag. Since the trading range was a limit order market, the breakout will likely fail, at least on its first attempt.

- Nowadays, the price is either:

- Bull case: They want a small pullback bull and they will confirm that thesis if the next pullback is small and fails and if maintain the gap open between the price and the top of the prior trading range.

- Bear case: They need to close the gap between the trading range top and the current price. They want to see profit taking or hesitation around current resistances.

Trading

- Bulls: They won’t likely buy where profit taking might take place; hence, they will wait to see that bears fail before buying. Wait for a high 2 or high 3 bull setup, or a bull reversal coming out from the 20 EMA.

- Bears can sell a final flag setup after a bear setup like an ii, oo, ioi, low 2 or a strong bear breakout bar. Their objective will probably be to test the February 16th high.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.