Market Overview: Bitcoin

Bitcoin recent price action suggests a potential climax in buying pressure, transitioning the market from a strong uptrend into a sideways or even corrective phase.

This weekend marks a pivotal event in Bitcoin’s history – the fourth halving. This built-in mechanism reduces the reward for mining new Bitcoin blocks by 50%, limiting its supply and potentially impacting its price.

The first halving in 2012 saw Bitcoin’s price surge from around $12 to over $1,000 within a year. Subsequent halvings have also been correlated with price increases, although with varying magnitudes.

Halvings highlight Bitcoin’s anti-inflationary design. With a finite supply, its increasing scarcity could drive further demand and potentially impact its long-term value. This halving arrives as Bitcoin navigates a potential market turning point. Will be the Bitcoin price higher after the next halving?

Bitcoin

The prices depicted on our charts are sourced from Coinbase’s Exchange Spot Price. It’s crucial to note that the spot price of Bitcoin is continuously in motion; trading activity never ceases. This means that market fluctuations and price changes occur around the clock, reflecting the dynamic nature of cryptocurrency trading.

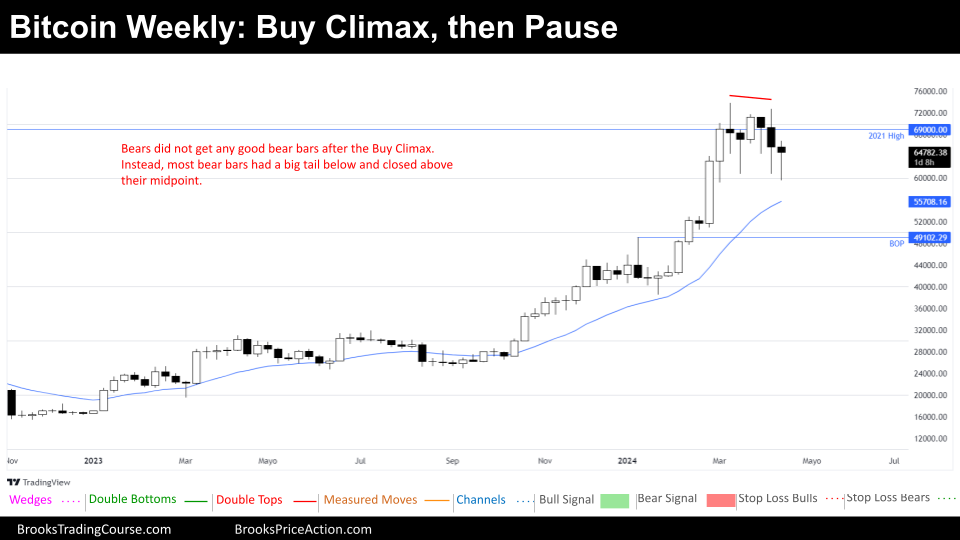

The Weekly chart of Bitcoin

The dominant bullish trend that propelled Bitcoin through a strong bull channel since early 2023 appears to have reached a climactic peak upon hitting the 2021 all-time high. The subsequent six weeks of sideways price action after briefly surpassing this major resistance level strongly suggest a potential exhaustion of buying pressure.

This climatic behavior aligns with the classic expectation of a trading range or a bearish correction following a significant rally. Within the context of a potential range, the focus shifts from trend-following strategies to identifying and trading off double/triple bottoms near support and double/triple tops near resistance.

In the coming weeks, sideways to downward price action is the most likely scenario. While determined bulls might hope for an eventual continuation of the uptrend, buying breakouts above the all-time high will demand extreme caution. Strong confirmation and follow-through will be essential to avoid false breakouts.

Traders will therefore look for potential buying opportunities at double or triple bottoms near support, and selling opportunities at double or triple tops near resistance. The increased probability of range-bound trading and potential corrective moves heightens the importance of strict risk management.

While the current outlook favors a range-bound or corrective scenario, traders should remain adaptable and prepared for unexpected price action, including bullish breakouts, if they occur.

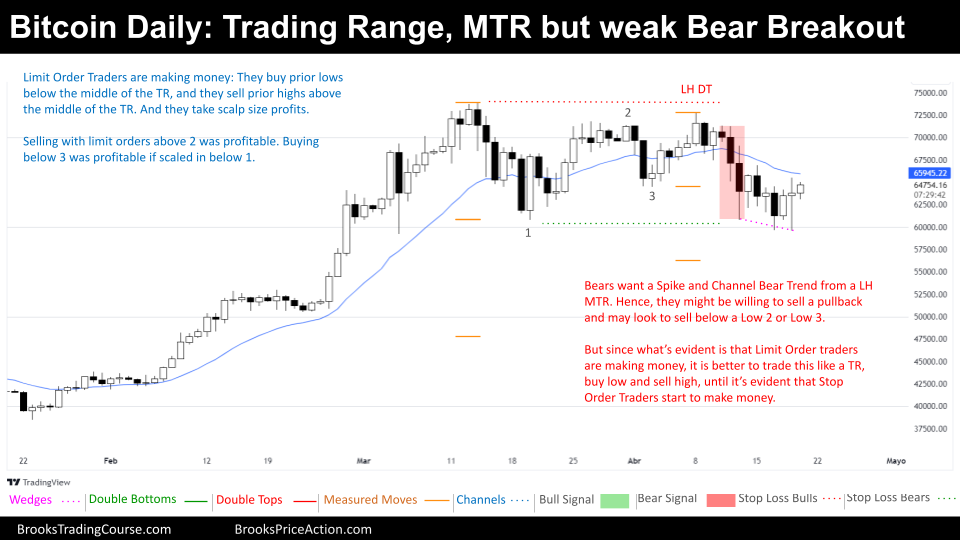

The Daily chart of Bitcoin

The current daily chart for Bitcoin suggests a trading range environment where both bulls and bears have found opportunities to profit using limit order strategies. This involves buying below established lows and selling near prior highs.

It’s crucial to remember that this trading range follows a significant Major Trend Reversal pattern. Last week’s Lower High Double Top, followed by a breakout below a prior low, initially signaled potential bearish momentum. However, this bearish breakout proved weak and conclusively failed to break the trading range low.

The formation of a Wedge Bottom and a Double Bottom Lower Low pattern may offer some encouragement for bulls. However, it’s essential to remain cautious, as the current environment primarily favors limit order traders who focus on well-defined range boundaries.

Traders who heavily rely on stop orders for entries may find this environment particularly difficult. The potential for whipsaws and false breakouts increases the risk of getting stopped out prematurely. Patience is key; waiting for a clear and sustained breakout into a new ‘Always in Long’ or ‘Always in Short’ trend is likely a more prudent approach.

For the immediate future, scalping strategies that focus on buying near support and selling near resistance within the established trading range may offer the best opportunities.

Thank you for reading! If you found this analysis helpful, please consider sharing it with fellow traders and leave your thoughts in the comments below.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.