Market Overview: DAX 40 Futures

DAX futures went sideways last week with the first reversal attempt by the bears high in a bull breakout – a bull microchannel. The market rushed strongly to 17000- so we went 2000 points straight up. The market might need to go sideways to work out the next direction. Bulls will look to take profits and wait for confirmation of the breakout above for a larger measured move.

DAX 40 Futures

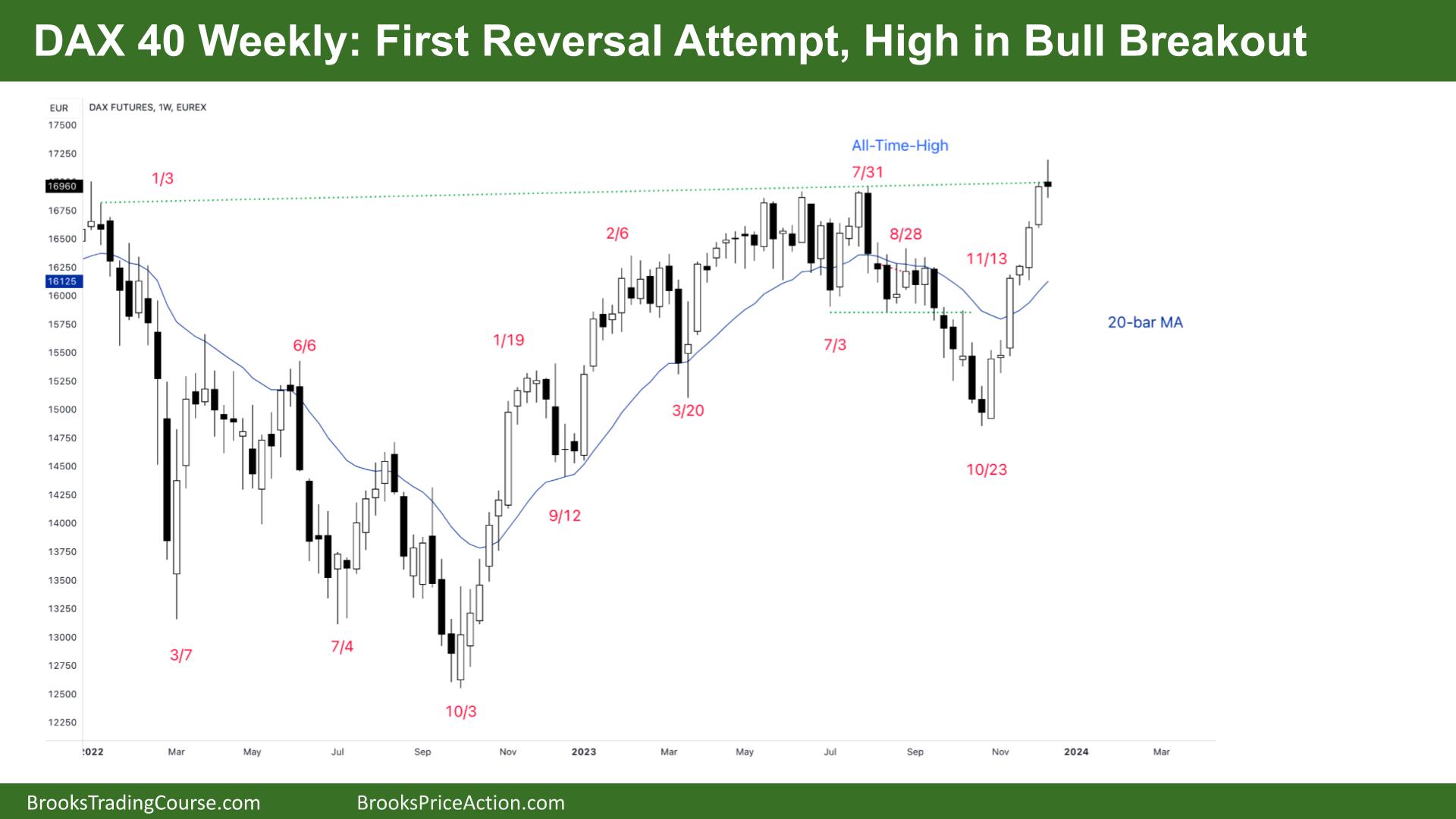

The Weekly DAX chart

- The DAX 40 futures went sideways last week with bear doji – the first reversal attempt in the bull breakout so far.

- It was a bear doji with a big tail above, so a weak buy and a small body, so a weak sell.

- Bulls hit their target of 17000. That might be all for a while until traders decide where to go next.

- But it is a 7-bar bull microchannel, so it should attract buyers the first time the price goes below a prior bar.

- Bulls see it as a breakout and pullback to the ATH, a confirmation test. But they might wait for another bar to see if other bulls are there first.

- The bulls want a tail below and a small entry bar for more buyers.

- The bulls want a pullback so they have a higher place to put their stop. At the moment, the risk is far away.

- The bears see a possible failed breakout above the ATH and have a low-probability swing setup. They know it will likely fail, but at least the target would be the MA.

- If the bears have a weak swing short, then a higher probability is the buy.

- If you’re long, do you get out below last week? You can buy again later when there is another buy signal.

- One thing bad for bulls is the expanding triangle setup. In an expanding triangle, H1 and L1 entries fail. Traders are forced to buy high and sell low.

- This can be a very strong leg on the HTF monthly chart, and traders will expect a second leg sideways to up. Maybe two legs.

- So, some traders will look to buy small and scale in lower.

- Expect sideways to up next week.

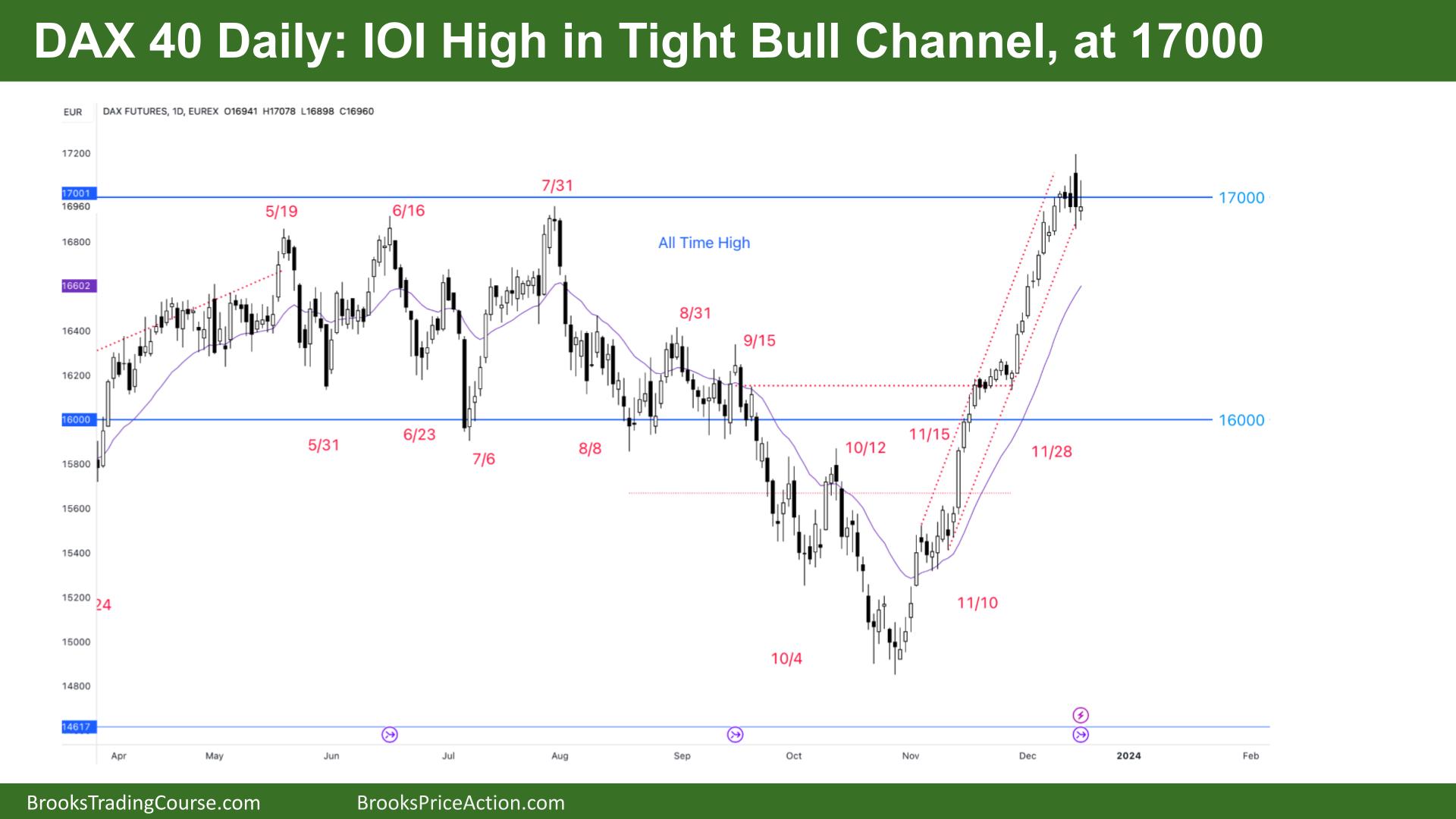

The Daily DAX chart

- The DAX 40 futures went through the ATH and back to 17000 last week, ending on an inside bar on Friday.

- It is the first real reversal from the bears in many bars. So, some traders will expect it to be minor.

- Bulls see a tight bull channel and will likely get a second leg afterwards.

- Bears see a parabolic wedge top and want two legs sideways to down, maybe to the moving average.

- But most parabolic wedges are breakouts on higher timeframes, so that would make sense for another push.

- Bears see an expanding triangle, and we are now high in this type of trading range. They now have a few bear bars to sell above.

- But most traders should wait for a reasonable stop entry in the always-in direction.

- Did the always-in-bulls exit? They hit 17000, which was the target. They never had a place to move their stops up, so some might exit a bar range below this TTR.

- Both outside bars had bigger bull breakouts. So even though there is a target at the MA, there is still a target above as well.

- There have been a few pauses on the way up – inside bar, which will act as agents on the way down. They were 50/50 signals that all got bull breakouts. I suspect many bears got stuck there and are hoping to sell high to get back there.

- Expect sideways to up next week.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.