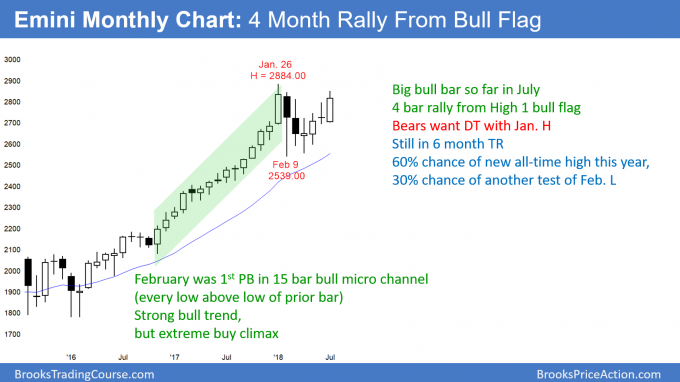

Monthly S&P500 Emini futures candlestick chart:

Strong bull bar, testing the all-time high

The monthly S&P500 Emini futures candlestick chart has a strong bull bar so far in July. Since there are only 2 trading days left to the month, the bar will probably remain strongly bullish.

The monthly S&P500 Emini futures candlestick chart is in a strong bull trend. January’s buy climax was the most extreme in the 100 year history of the stock market. The 4 month rally is now testing the January all-time high. This was the minimum objective for the bulls.

Since the month has a bull body, it is a weak sell signal bar for the bears who want a double top with the January high. However, if August is a bear bar, that would be a more reliable sell signal.

But, the 2017 rally was so strong that any reversal down will be minor until after at least a 1 – 3 month breakout above the January buy climax high. That is what typically happens after strong buy climaxes. Therefore, the odds are that the Emini will reach 3000 – 3200 later this year.

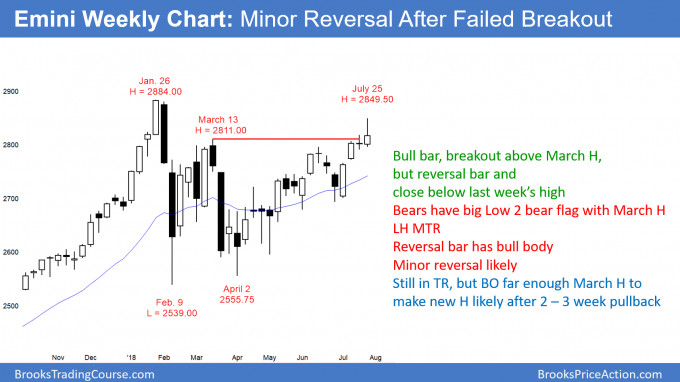

Weekly S&P500 Emini futures candlestick chart:

Sell signal bar for failed breakout above 6 month trading range.

The weekly S&P500 Emini futures candlestick chart closed below its midpoint this week after breaking above the 6 month trading range. It is therefore a sell signal bar for next week.

The bears want this week’s reversal to be the end of a 2 legged rally up from the February low. In addition, they see this week as a sell signal bar for a lower high major trend reversal. However, the bull body lowers the probability of a major reversal down.

More likely, the bears will only be able to get a few weeks of selling before the bulls buy again. The break above the March high was far enough above to make higher prices likely, even if there is a 2 – 3 week selloff first.

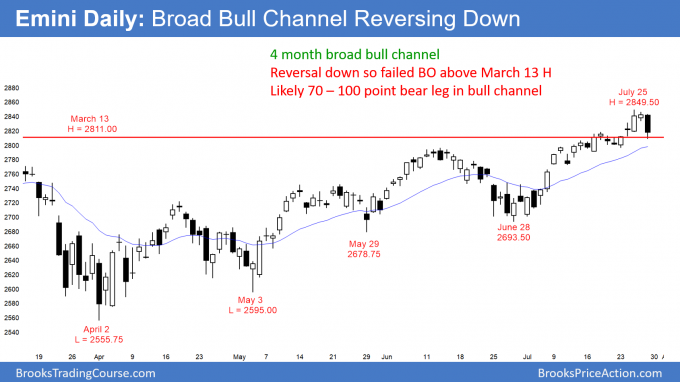

Daily S&P500 Emini futures candlestick chart:

Emini 100 point minor reversal down from buy climax

The daily S&P500 Emini futures candlestick chart reversed down strongly on Friday after Wednesday’s buy climax.

The daily S&P500 Emini futures candlestick chart has been in a bull trend since the May low. But, Friday’s reversal was strong. In addition, it reversed Wednesday’s strong breakout above the 6 month trading range. Finally, the daily chart has been in a tight channel in July, and that is unsustainable. Therefore, the odds are that the Emini will go sideways to down for 2 – 3 weeks.

Targets for the bears are the minor higher lows in the 3 week tight bull channel. The channel began with the July 11 low, which was just above 2770. If the selloff reaches that low, it would be about 80 points. I have been writing all week that the Emini would probably pull back for 50 – 100 points over the next 2 weeks. Friday was the likely start of the pullback.

Can this be the start of a big 2nd leg down, where February was the 1st leg? The bears at this point have a 30% chance. They would need 2 – 3 consecutive big bear bars closing near their lows before traders will believe that the bears were back in control.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.

Great question from Murat, brilliant answer from Al.

Al,

Thank you for the weekly update!

My question is about a predictive value of a pullback. Can you please compare 30% (1/3), 50% and 70% (2/3) pullbacks and the likely outcome for the next trend leg after such a pullback. And is there a likely prediction after this next leg? Thank you, Al!

There are many variables. For example, in a bull case, is the market at major support, how strong was the bear trend, how good was the buy setup, how strong was the rally. The percent retracement is just another variable and no more important than any of the others. In general, the bigger the pullback, the more 2 sided the market is. That increases the chance of a trading range and reduces the chance of a big 2nd leg.