You can learn to trade more subtle wedges in the S&P Emini giving you more setups to look for. A wedge reversal pattern occurs when the market makes three pushes in either a rising or falling convergent triangular pattern. However, if you are a little flexible with how you define a wedge, you will discover that small wedges occur frequently and provide scalping opportunities almost every day.

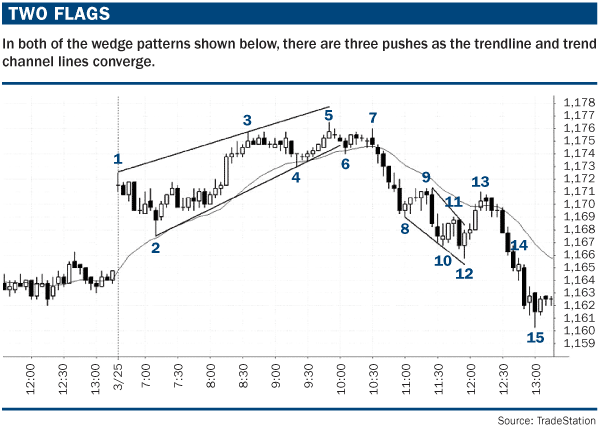

“Two flags” (below) includes two traditional wedge reversal setups, each showing three legs. The pattern usually has five legs, but as with any triangle, it can sometimes have seven or even more minor reversals before the breakout occurs.

Although the final push often goes through the trend channel line, that is not always the case. For example, the third push in both wedges (Bars 5 and 12) failed to reach the trend channel line before the reversal and breakout occurred. Following the breakout, there are usually at least two countertrend legs. For example, after Bar 6 broke out of the wedge top, most traders were looking for a second leg down before the market would go above the top of the wedge (the Bar 5 high). This meant that any small rally to test the high likely would form a lower high and be followed by a second leg down. Aggressive traders could short on a limit or market order at or one or two ticks above the Bar 6 high with a stop above the Bar 5 high. More conservative traders would start looking to short at one tick below the low of any bar that rallied to test the high.

Once the bar after Bar 6 went above the Bar 6 high, traders would place an order to go short at one tick below the low of that bar once the bar closed. If filled, they would place a protective stop at one tick above the Bar 5 wedge high. If the market did not trigger the entry sell stop on the next bar, this would cue an order to go short at one tick below that bar, again with a protective stop at one tick above the Bar 5 high.

As long as the market stayed below the top of the wedge, traders would continue to place stop orders to go short. If a trader went short on the fourth bar after Bar 6, they would then place a protective stop above the high of Bar 5. Bar 7 attempted to rally, but it failed and became a lower high and it led to a major reversal.

On the down slope

As the market fell, it formed a potential wedge bottom with the three pushes down to the Bar 12 low (Bars 8, 10, and 12 were the three pushes down). The bear trend line above (using the Bars 9 and 11 highs) converged with the trend channel line below (using the Bars 8, 10, and 12 lows) and created a wedge shape. Bar 12 was a strong bull reversal bar with a bull body that was about half of the size of the bar, a low that was several ticks below the low of the prior bar, and only a one-tick tail at the top of the bar. It was also the second attempt to reverse the Bar 2 low of the day (Bar 11 was the first attempt).

Even though the momentum down from the Bar 7 lower high was strong, this is a good enough reversal for traders to look for at least two sideways to up legs. Traders would go long on a stop at one tick above the Bar 12 high and, if filled, place a protective sell stop at one tick below the low of the wedge (the Bar 12 low). If the wedge fails and the market falls below the low of the wedge, the selloff often will extend for a measured move down from the top to the bottom of the wedge. Traders could either exit any remaining longs or even go short below the Bar 12 low. Traders would expect the market to fall about 5.25 points below the Bar 12 low if the market were to fall below that low (the Bar 9 top of the wedge is 5.25 points above the Bar 12 low of the wedge). In fact, the market ultimately fell one tick more than that.

Once the long was triggered by the market going above the Bar 12 high, the market was likely to test the Bar 9 top of the wedge and then pull back and make at least one more attempt up, since the pattern was so strong. Instead, the market formed a double top bear flag (the highs of Bars 9 and 13) and a higher low entry never triggered.

Longs were looking for the market to fall but stay above the low of the wedge. As the market pulled back, they would place buy stops at one tick above the high of the prior bar, hoping for the market to reverse back up and make them long. Instead, the market sold off into the close and never triggered a higher low long. Even though a wedge with a good shape and a strong reversal bar might have about a 70% chance of trying to form a second leg up, there is still a 30% chance that it won’t. Nothing in trading is ever 100% certain and 70% odds are as good as you will ever find, even with the strongest setups.

More opportunity

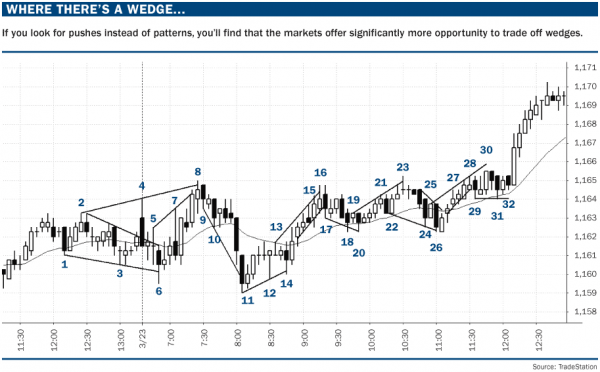

If you instead focus on three pushes and not the converging trend line and trend channel line, you will discover that there are far more patterns that behave like wedges but often do not have a wedge shape. “Where there’s a wedge…” (below) shows 10 of them, but there are others in there as well. Bars 1, 3, and 6 are three pushes down, and if you view the Bar 4 high as a false breakout above the trend line and therefore ignore it, you can see a rough convergence of the price action. Traders could place a buy stop at one tick above the Bar 6 low and if filled, a protective stop below the Bar 6 low of the wedge, looking for a test of the Bar 2 top of the wedge.

Bars 2, 4, and 8 were also three pushes up and therefore met one of the criteria of a wedge, and should be expected to behave similarly as well. In addition, they were part of an expanding triangle (Bars 1, 2, 3, 4, and 6), which often leads to a reversal. Bars 5, 7, and 8 were also three pushes up. Placing a sell stop to go short at one tick below the Bar 9 bear inside bar is especially good because both patterns share the same signal bar, and this increases the chances that the market will test the low of the pattern (Bar 6 is the low of both the expanding triangle and the wedge).

An expanding triangle in one direction is frequently followed by an expanding triangle in the other direction, as was the case here. Because traders have been fading (taking a trade in the opposite direction) every new swing high and swing low, it is a good bet that this behavior will continue, even though at some point it will stop.

The Bar 11 bull inside bar was the signal bar for the long based on the expanding triangle bottom. It was also the signal bar for the three pushes down from the Bar 8 high. Bar 9 was a down bar and was the first push. It was then followed by a small bull bar and then a second push down to the Bar 10 low. The market then went sideways and broke out in a third push down to the bar just before Bar 11 and it broke below a trend channel line. Bulls would place a buy stop at one tick above Bar 11 and a protective sell stop either below the low of the bar or one tick lower, below the low of the expanding triangle. Bars 12 and 14 were two failed attempts to push the market down and both held above the protective stop.

Bars 13, 15, and 16 were three pushes up and Bar 16 broke above the trend channel line but closed back below it. Why was shorting at one tick below the Bar 16 low not a great short? Because the momentum up was too strong. There was only one bear body in the prior 6 bars and it only had a one tick body, which means that the bears were not strong. Also, the move up was in a tight channel. It is sometimes easier to spot tight channels if you just look at the bodies and ignore the tails. The little trend line below those bodies makes it easier to see the channel. When the market finally breaks out of a tight channel like this, there is usually a test of the channel’s high, and that also makes shorting below the Bar 16 low less likely to be profitable. Finally, after the market made two attempts to sell off to a new low at Bars 12 and 14 and instead broke out to the upside, traders were expecting at least two pushes up, which usually happens after a breakout.

Bars 17, 18, and 20 were three small pushes down and created a wedge bull flag at the moving average and traders would be looking for a test of the Bar 16 high. The Bars 18 and 20 double bottom was followed by a small bull inside bar, which is a pause. A pause is a type of a pullback and a double bottom pullback is a reliable long setup. Traders would place an order to go long at one tick above the bull inside bar and a protective stop at one tick below the low of the double bottom.

Bars 22, 24, and 26 created another common variation of a wedge bull flag where the first push down occurs before the end of the move up.

Bars 25, 27, and 28 (or Bars 27, 28, and 30) formed three pushes up but again there was too much upward momentum and a tight bull channel so the market was more likely to continue up or at least go sideways than it was to sell off.

Bars 29, 31, and 32 were three pushes down in a sideways pattern just above the moving average following a six-bar rally where every bar had an up close. This is a possible bull flag. The Bars 29 and 31 double bottom were followed by the Bar 32 bull inside bar and therefore created another small double-bottom pullback long setup.

Although a traditional wedge pattern with three clearly defined pushes and a converging trend line and trend channel line often leads to a large swing, traders also should carefully look for small three push patterns throughout the day because they often provide excellent scalping opportunities, as shown here.

This is based on an article from the June 01, 2010 issue of Futures magazine.