Most traders don’t have the temperament to watch every tick of the market, finding it more profitable to specialize in intraday swing trading. You can trade successfully with just a five-minute chart and a 20-bar exponential moving average (EMA). If you aren’t greedy and if you have patience, you don’t need to process a slate of technical indicators to make money, and you can trade using “Always In swing trading.”

That said, the specific execution of this approach can vary. Some traders employ heavy volume when a favorite set-up occurs, even if it develops only a few times a week. However, most day-traders look to trade several times every day and enjoy being part of the market. These traders might want to consider an always-in approach.

While you will have to think about the market constantly, you will find yourself learning price action quickly. Although you theoretically can trade every reversal on the five-minute chart profitably, in practice, this is almost impossible. However, if you cherry pick, you invariably will miss the best cherries. Staying in the market all day, and being patient with your reversals, is usually a forgiving approach.

It’s a process

Whenever you try something new, it is best to take your time. With this trading strategy, print out several days of charts and study them before you risk real money. When you are ready to trade, start with one contract, regardless of how large a position your account size can support.

Next, consider trade management. Even though this strategy requires you to switch back and forth between long and short, you can get distracted and lose money. Therefore, whenever you are in a trade, always have a stop in the market, risking about six ticks. Once a trade moves at least six ticks in your direction, move your stop to breakeven or to one tick beyond the entry bar (a good trade should never reverse the entry bar). Sometimes, however, you may consider continuing to risk one or two more ticks if the first move in your direction was strong. Often, the best moves will have pullbacks that do not hit a breakeven stop and often just miss it by one tick.

All entries and reversals are on a stop, one tick beyond the high or low of the prior bar. If you are long one contract and there is a set-up for a short trade, place a sell stop for two lots at one tick below the set-up (signal) bar. If the stop is hit, this bar becomes the entry and you will reverse to being short one contract. You continue to hold this short position until there is a long entry, which will cause you to reverse, or until your six-tick stop is hit.

If you miss the first few entries or if you exited at some point during the day, you simply resume the process. Look for the next long or short set-up, place your order, and let the market take you in on a stop. If the order is not hit, cancel it and look for the next set-up. You will soon be in the market and then you can use the always-in approach for the rest of the day.

Even if you overtrade and take every five-minute reversal, you might theoretically be profitable, but when you hit a day with a small range, your losses will be significant, and you will find it difficult to try this approach again.

The key is to focus on swing highs and lows for possible reversal entries and to avoid trading in the middle of the range. On small sideways days, only enter on false breakouts near the high and low of the day and never enter or reverse in the middle of the range.

Also, use common sense. If the market gaps down, say, eight points on the open and doesn’t touch the EMA for two hours, you are in a strong bear trend and you should rarely consider long entries. Instead, look for a strong bull trend bar that pokes above the EMA and is followed by a small bar. Place an order to go short at one tick below the small bar. When there is a strong trend, most traders should only look to enter the countertrend if a strong countertrend leg first breaks the downtrend line and pulls back. Look to enter at one tick above any prior bar.

Set-ups to consider

For set-ups, see previous Futures articles on price action. The best reversals will be those near the high and low of the day and those near significant intraday swing highs and lows.

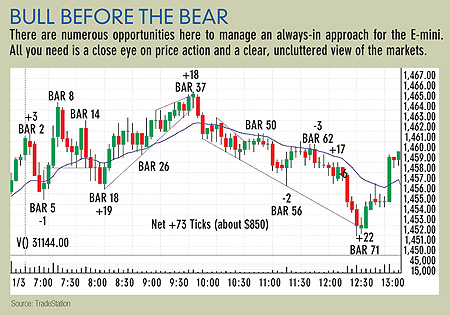

For example, in “Bull before the bear” the day before ended with a rally, and the first bar on the open is a bull-trend bar. The second bar goes one tick higher but has a down close. This is a bear set-up bar and a short entry is triggered on a stop order at one tick below its low.

With an always-in approach, it is imperative that you look at every bar as a possible set-up bar and be ready to place reversal stop orders, especially when you are near the high or low of the day. Bar 5 falls through the EMA but has an up-close, successfully testing the EMA, making it a bull signal bar. You would place a stop to buy two contracts (one to exit an existing short and the second to make you long) at one tick above the high of the signal bar. Bar 6 becomes your entry bar and you are now long one contract. Your short trade generated three ticks profit.

The up momentum to a new high is strong, so even though it’s a new swing high, do not reverse to short. A scalp trader would short most reversals at new highs and lows but here we are swing trading and the swing is probably going to continue up, despite a likely pullback.

Place your stop to exit and go flat at breakeven or one or two ticks below breakeven. If the market hits your stop (Bar 15 would have hit your stop for a net loss of two ticks), give the market time to tell you if the upswing is still intact. If it is, look for a bull set-up, like a “2 high” (when a bar goes above the high of the prior bar twice in a pullback). A 2 high is a second entry, which is almost always profitable. If a second entry fails, it is a reversal set-up.

For example, you would have gone long after the two-leg pullback through the EMA that ended with Bar 18. Bar 18 had a bull close, and Bar 19 is the second attempt to resume the bull and, as such, it is a perfect long entry. Bar 19 extends six ticks above the signal bar, so place a protective stop around breakeven and certainly no worse than below the low of the entry bar, which has to hold if the trade is valid. Risk two ticks and place the stop, at this point, one tick below the high of Bar 18. After this entry bar closes, place another stop to go short at one tick below the low of Bar 19; the odds are high that the market is now forming a series of lower lows and highs and would then be in a bear swing.

Being patient

Bar 23 extends above the Bar 14 swing high, but don’t look to short just yet because Bars 18 through 20 had strong up momentum through the EMA and the first possible signal bar, Bar 23, is weak. Bar 23 had a close at its open, no bearish body, no close in the lower half, and there was too much overlap in the prior three bars, making it more of a flag than a climactic up move.

Rely on your breakeven stop and don’t be too eager to reverse to short. Wait for something clear and strong. Bars 24 and 26 are bear-trend bars, forming two small legs weakly down to sideways. Bar 25 is an up bar, indicating that on a smaller time frame, there was a clear ABC down. However, keep your eyes off a one-minute chart as it is too much information to process. Because Bar 26 is the second leg down in a pullback, if the trend is still up, Bar 26 should be a bull set-up, and it is.

Bar 34 forms a double top with Bar 8, but it also has a close on its high and is the fourth bull bar in a row. This is too much strength to consider a short. You will need a second entry signal, either as a higher high or a lower high. Bar 37 pokes through a bull channel line in an attempt to accelerate upward, and it has a small body and a big tail, making it a bear set-up bar and a possible failed breakout.

Think about this signal bar for a moment. It had to be quite close to a one-minute double top because it opened near its high, traded down, and then traded back up, making two attempts to break above the bull channel line. So, if the market breaks below its low, you now have a one-minute lower low and a possible new swing down. Place a stop to sell two contracts at one tick below its low. If filled, place a stop to reverse back to long at one tick above its high. The attempted breakout above the bull channel line and above the Bar 8 swing high fails. You would be short on Bar 38, netting 19 ticks from the prior upswing.

Bars 38 and 39 are large bear trend bars that extend through the EMA, and they break a bull trendline from Bars 18 and 26. It is likely there will be at least two legs down, which is common on all new swings. The small rally to Bar 50 breaks the down trendline, so you should be looking for a long entry on a higher low or a lower low. Bar 54 is a small bar and bar 55 is even smaller as an inside bar.

Small inside bars are often reversals (especially if there are two in a row) and are often the final flags of a swing, leading to breakouts that reverse within one or two bars. After the sharp breakout to the downside, place a stop to buy two contracts at one tick above the high of the inside bar. You would be filled and would now be long one contract on Bar 56.

This bar also is a perfect test of the bear channel line and reverses strongly up from it. Also, it is a lower low after a bear trendline break, so it could lead to a strong upswing. However, instead of forming big uptrend bars that extend well above the EMA, Bars 58 and 59 are small bars with closes in the middle of their range, indicating a lack of strength. Bar 61 is a second attempt to resume the bull move. However, if it fails, then lots of bulls will be trapped and will drive the market down. Place a stop to reverse to short at one tick below the low of Bar 61. If it is hit, you would have a “2 low” below the moving average, and this is often a strong bear signal (because two bull attempts failed and the bulls will be forced to join the bears, leaving no one interested in buying for at least several bars).

Bar 71 is a new low of the day that breaks below the bear channel line. It’s followed by a small bar that has an up close. This is a bull set-up. Place a stop to reverse to long at one tick above its high. You would exit at the close of the day for a net of 73 ticks, or about $850 per contract after commissions.

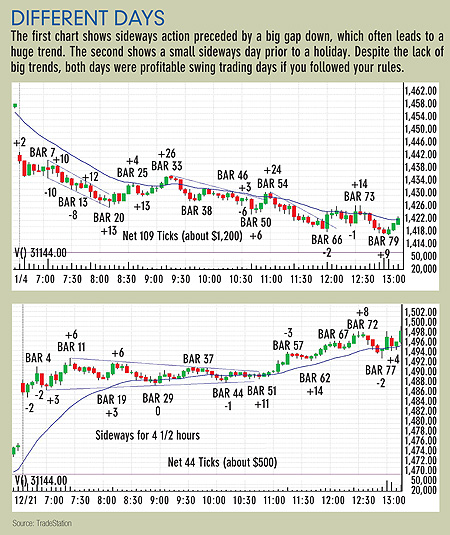

Examples of other price action are shown in “Different days.” Although they are extreme examples of sideways price action, they also were quite profitable using this always-in approach to trading, demonstrating how effective and satisfying it can be.

Traders who scalp part and swing part of every entry probably have discovered that on most days, your profit from your scalps is about the same as your profit from swings. The point? It doesn’t matter whether you scalp or swing, and the same is true for always-in traders. They are essentially equally profitable when done correctly. Just choose a method that suits your temperament and follow your rules.

This is based on an article from the July 01, 2008 issue of Futures magazine.