The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hi, I have already watched almost all the Al Brooks tutorial videos and knowing my biggest weaknesses, which have been over trading, revenge trading and difficulty in taking losses. I decided to base my strategy on looking for a swing from the opening looking for a DT/DB or Wedge (I don't trade the first 12 bars) and see if it reaches the target.

According to Al, we should look for a swing that is 40% average day, which ultimately would be about 20-25 points (MES). But I see that it is practically impossible because of how the market is these last days, since we have had many days of range and the SL margin that we have is so big by itself that it is hardly impossible to reach that target of +20 points, and I decided to lower that % a little more and get 15 points instead of 20.

The problem with this is, that although there are days where the SL is 5 points up to the mayor high or low, there are many others where it reaches 15 points (100$ is the maximum I bet per trade), so if I look for a 15 points trade I would be aiming for a 1:1 RR and supposedly it is not the best.

Could you give me some advice to follow an optimal trade? I don't know if it's something of these last days or if I'm structuring things wrong from the beginning.

Thank you very much for everything

Hi Alejandro,

I feel your pain as I suffer from issues like not taking losses as well. And you're right, lately the market has been very tight. This often happens in summer months. Only thing to do is to hang on and stay patient and not lose the account trying random things. Big days return eventually.

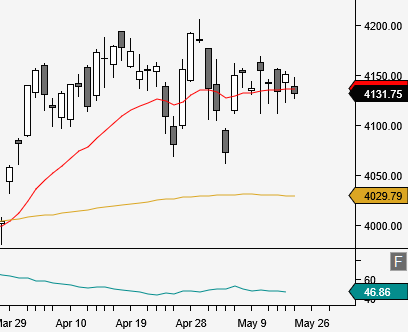

Daily ES. I just hope it doesn't stay like this all summer.

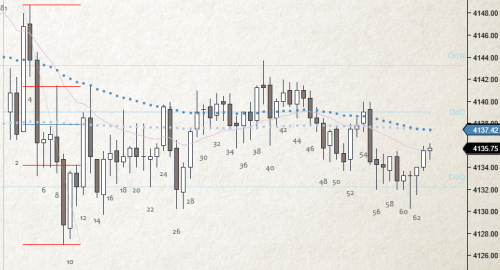

Today. Another horrible doji day. Only thing that works is fading every prior swing high or low with limits and scalp for 2pts.

Regarding risk amount on wide stops like the 15pts you mentioned, that's just an unfortunate outcome of being restricted to a particular market where you can't reduce contract size any smaller. And being restricted to only 1 or 2 setup types. Just have to skip the trade if the bars are too big and can't structure the trader's equation as per your analysis or the setup doesn't come. Some days may go without a single trade like that. It is what it is.

You could also switch to sim or alternate account to practice taking other types of trades while waiting for your setup or you know that you won't get it on this day anyways.

One other thing to mention is this slide Video 48C Slide 2. Al points out in what kind of TRs it's ok to take trades with stops and where it's best to avoid since limit order market only. It's good to practice recognizing such days to not miss out on opportunities by being scared of TRs and not taking any trades.

Hope that helped!

CH

_______________________

BPA Telegram Group

Thank you very much Mr.Carpet, at least I am relieved to know that the problem is not that I am not able to find a swing with a positive equation, but that lately there are not many opportunities for a good swing these days.

I had thought about scalping as you mention, looking for valid entries aiming for 3-4 points, the problem I have with that is that I am not yet mentally prepared to lose in a bad scalp what I have won in 2 or 3 and resume the bad habits I am trying to get rid of, but as the market is lately, the truth is that it seems that there are not many other options besides scalping to get profit.

I think I'm going to have to come up with a plan B for the range days as you mention, and see if hopefully I can get to a decent level with it.

Buy Low, Sell high, check the day open price as magnet and pray xD

Thank you!

Sorry, I should clarify that trading that doji day above by fading prior swing highs and lows is not the only way. It's just how I do it. There are many other scalping techniques for days like this, for example, limit buying 50% PB of a strong 1st bull leg expecting a 2nd leg attempt since TRs usually have at least 2 legs up/down.

I understand, at the end of yesterday I only made 2 trades.

The first one I do not know if it is right or wrong, I guess not since lately I base my trading plan on trying to find a swing regardless of whether it is a trending day or range and get at least 15 points buying the lower part of the range or selling the high.

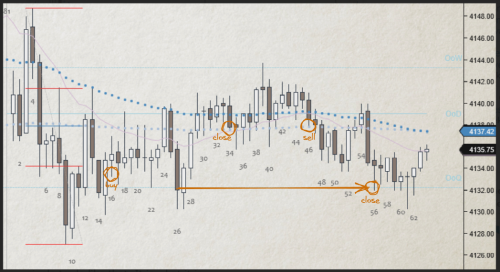

I bought the PB at bar 16 and my plan was to hold the trade until it reached the close of the big bar number 3, seeing that the trade was returned and came with two strong bearish bars 25 and 26, I decided that the target I had might not be viable and decided to closethe trade either in the next bullish bar closing at its highs or in the next bearish bar that gave me the feeling that the price would go down more, and finally I close the trade below bar 34.

The second trade was to sell the close of bar 46 putting as a target the close of bar 26, thinking that there could be people who had sold there and the price could reach it, in this case it was perfect and the trade was closed at bar 56.

I always used as SL the high or low of the whole range.

And thank you again Mr.Carpet for the help, I really appreciate it.

Nice trades! Good thinking to look to buy low in TR and good discipline to not be greedy and exit at reasonable targets. Depending on where you think the top of TR is would dictate if you'd want to sell with stops or fade PBs. I personally used HOD to LOD as the range on that day so for me selling 46 with stop was already too low in middle 3rd.

I wanted to share with you how I handled today's trade, I am practically new in trading (7months) and I still have a lot of doubts on how to have a good trade management.

There are 3 points on which I would like to have feedback if possible:

1.-Would you say that the trade is well executed or does it have flaws that could improve it? My point of view is the following:

-I take bar 8 as a breakout that closes high, but I don't want to jump into the trade to fast for BTC and I decide to place a STP order one pip above bar 8(I understand that many times it is better to wait to see what the next bar does, but I don't have much capital and sometimes that wait ends up being a major breakout that prevents me from taking the trade for capital), in the end bar 9 ends up activating my order and the trade begins.

-I have as a target the MM or retracement ( I do not know which is the right word xD ) of yesterday's trend, but I am aware that it does not have to arrive and as SL the LOD.

-BTC bar 11 as it did not have any retracement and closed at the top.

-After seeing what happened on bar 12, I am no longer so willing to BTC on bar 13 and put a LMT order at 50% of the same (a little above, maybe this entry was a little aggressive, but I tend to add positions if I see a possible strong trend and I have margin until the BE).

-Unfortunately the bar 15 is very large and generates me insecurity, as I had not seen anything before that made me think that I could have such an aggressive PB in a single bar, even so I waited for it to close and once closed if I saw that it went up again, I would put another order to try to average the position, because I thought, that like me, there could be more people who had bought the low of the bar 14 and were looking to leave with a BE in that area and some profit in the added position.

-The price did what I thought might happen and I decided to take out my entire position.

I don't know if it was a good decision or not, since there had only been one big bearish bar among all the bullish trend, it was probably a mistake to take out the trade, but I still don't read the market well enough to know if it was a strong enough bar to shake the trend, I was also afraid to think that we were just 1 hour after the opening and that there could be a reversal in short, I was attacked by all the doubts that I could lose the entire position if I did not act correctly and I left where it seemed logical, although I know that at that stage there was more fear inside me than logical analysis (I do not handle losses well).

2.-The line that I have painted as wedge, is it really a wedge? I have doubts with this, since I always see them well if they are given by bullish and bearish bars that create those 3 hits and make them visible to me, but being the 12 candle a PB being a pause, it would already be considered as the first touch of the wedge or on the contrary I should not have marked it?

3.-The last doubt is regarding the management of the trades.

If I risk 100$ per trade and the trade goes for 150$ profit, in the case that the trade is returned and touches my SL, I would be losing a total of 250$ instead of 100$ if we understand that "it is my money and not someone else's", in these cases do you reduce positions once you reach the 1:1 or continue with the whole lot? What is the premise to add or subtract positions and still maintain a commensurate risk? My biggest problem has always been the same and it is that I do not know how to manage the risk I think, I am able to make a small position can become very large, but in the same way I can make that position with benefits end up reducing to 0 if I lose sight of some clue of the market or simply I get the negative probability. Could you give me some advice to increase positions or profits without losing sight of the risk? I realized thanks to that quote from Al, that in my case, I am able to lose 100$ if I get the SL and see it as normal, but I should not see it as normal to have a position at +400$ and have it reduced to 0. On the one hand I think, well I had X in the account and I still have X, but the reality is that I had X+400 and in the end I lost those 400. It is something that I definitely have to improve, but I don't know how to do it correctly.

Thank you very much for taking the time to read all this text, I hope to be able to return this knowledge to the forum after a while.

Have a nice day!

but I don't have much capital and sometimes that wait ends up being a major breakout that prevents me from taking the trade

Just be careful that your fear of losing money doesn't push you towards trades with super tight stops because those are usually lower probability than breakout trades. It will seem like you're losing only a little per trade but there will be many losses overtime that will add up. It may be more profitable to reduce position size instead and be able to afford wider stops, or if can't reduce further than add more money to account. When having tiny account it's very possible to suffer from under-capitalization which leads to only being able to afford low probability trades which drains the account by small papercuts.

The B15 insecurity was mainly for bulls who BTC 13. Everyone else was probably happy to get a discount to buy and addon anticipating at least 1 more leg up. It was a big bar though and after B15 I was expecting limit bears to start appearing above swing highs.

The "my money and not someone else's" is actually a very important risk management topic that's almost never discussed. Al advises to start thinking of taking at least partial profits when open profit reaches an area where you wouldn't enter a new trade with same size and risk parameters. This is what causes PBs during trends: institutions offloading some positions to reduce overall risk (but not necessarily reversing).

Ok, so I should not be afraid of the opposite bars but see them as a discount to be able to add positions again and see where people have taken profits to add positions with a lower price, I have to learn to manage this to be able to take profits and scale without the risk of losing everything acquired.

Regarding the wedge, would it be ok to take bar 12 as a first push or on the contrary as it is still a bullish bar I should not consider it?

Thank you for all your answer Mr.Carpet

Buying B12 was right in the middle of the trading range. It was the first break of a tight bear channel so expect to test down first. And it was following a bear bar. Looking at the whole chart it looks like bulls were more interested in buying the lower 3rd of range than the highs (as expected in TR). And you can see what happened next, they dumped soon after.