The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

I'm on my 2nd go through the course, almost done with the fundamentals for the 2nd time. Can't believe how much I missed the first time. I am realizing a lot of things slowly and mostly I take mental notes, that don't get documented anywhere. I have this consistent problem of being unorganized which results in me being not as productive as I could be.

I put in the work but due to lack of organization skills, my efforts are often wasted and I need to put it more effort than I would have originally needed to.

Case in point being, I had found this link before and considered it important enough to go through again and then I forgot about it and now I found it again and I'm considering maintaining documentation like Ali talks about here - Becoming a professional price action trader | Brooks Trading Course .

I was wondering if there are others who found this article helpful and maintaining notes/documentations, trading journals, establishing routines etc. like he discussed. If you did, would you please share your notes(not the whole, a sample is what I'm looking for), routines or documentations(he talked about using excel but I am not sure how to get about it) a bit? I wanna know how you are doing it and establish a certain framework that would work for me.

Thanks for your help.

Abir,

I have used Microsoft OneNote for years. I would screenshot all kinds of things and make notes over it. While in the Al's webinar I would takes as many examples of notes as I could. I am not the greatest with organization either but having it all in one place was certainly helpful.

Also regarding Ali, I have spent a good amount of time taking his advise and working on flowcharts. I use the program https://www. lucidchart.com which allows you to build interactive flowcharts.

Thanks for responding Brad, I will check out the resources you shared.

I would screenshot all kinds of things and make notes over it

having it all in one place was certainly helpful.

I am trying to do the same but currently, it appears all so haphazard, Ctrl + F has been my saving grace so far. I doubt it will work soon in the future when the volume of notes would get even greater.

Also regarding Ali, I have spent a good amount of time taking his advise and working on flowcharts. I use the program https://www. lucidchart.com which allows you to build interactive flowcharts.

Thanks. Sounds like a great way to formulate decision trees but that's the only use I can think of so far. If possible, could you please share one or two samples from the collection you created? That'd be very helpful.

I use notion for this because it has "sync block" feature (no affiliate. Also recently I found obsidian which has similar feature and mostly free to use but too hard for me to migrate now).

With "sync block" I can link text from one place to another and it helps me stay organized.

My routine is basically as follows:

- I create a day journal page. I write down my thoughts and PA analysis in real time, and take screenshot of every bar.

- The next day, I update it with Mr. Brooks bar by bar analysis in brookspriceaction.com and end of day marked-up chart.

- It would look like this

-

- I move the content of each bar to a separate page so that I can review each bar later with no bias of the bars to the right. I include the screenshot full chart of end of day at the end so that I can quickly check the quality of my reviewing. Also include a link back to the day journal page. The page looks like this:

-

- I later preference those bar pages on other notes. Example:

-

I do roughly the same thing when consuming the resources. For example, one note page per video. Breaking it down to multiple sub-pages as small piece of information as possible for easier reviewing. Link it to other pages, link other pages to it.

Thanks for sharing your inputs Water Buffalo(it feels funny to use this name while addressing you though).

I will check out the tools that you shared and see if I can adopt them for my own use. The problem is, although I am still in my 20s, I already have a hard time with a lot of technology 😆 . So, it might just be a little hard to do so much you mentioned in your answers. I already had a hard time trying to catch up with the technologies you were talking about.

Abir,

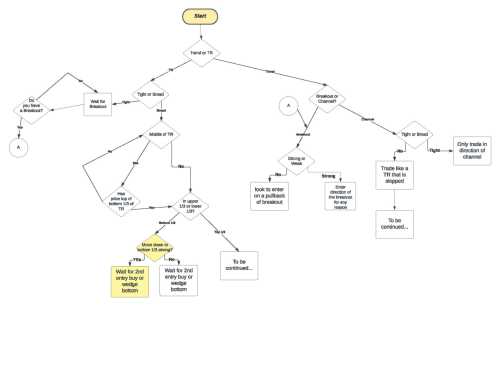

Above is a basic example of one (not finished). But the whole point is to help one rule out decisions as quickly as possible. I will give Ali Afshari credit for how helpful flowcharts can be.

The more I started building random flowcharts like the one above, the more I realized that even Al has a mental "flow chart" in his head when trading. For example, think about the course for a moment. The course starts out by explaining the market cycle and how the market is in a trend or a trading range. Then if in a trend, the market is either in a breakout or channel. If trading range, the market is either in a tight or broad trading range. The great thing about flowcharts is one can build a flowchart on any subject in the video course or Al's books.

I will explain more later down the road, but one of the biggest challenges many traders face is that they understand 80% of Al's material very well. For example, they know not to buy high in a trading range or sell low in a trading range. When trading in real time, there is real-time information to process, and they do not have a quick way to rule out decisions. Flow charts can be a fantastic way to rule out decisions, though.

Again I will discuss more on flowcharts later but they are a very powerful tool to use.

Click the link below for Ali's Article on the above information.

Visual learning for profitable trading | Brooks Trading Course

Thanks for your response and the example flow chart, Brad. It was really helpful. I think I am starting to visualize how I want to keep my notes(using flowcharts) which would also solve the problem of the notes being haphazard. The only thing that'll remain is the charts that I take screenshot of and take notes on but I am assuming if I keep looking back at these, I might be able to figure about how to condense those information.

I think there are still a lot of missing pieces for me to the puzzle of getting organized but I am starting to have a faint idea of what to do.

But the whole point is to help one rule out decisions as quickly as possible.

I realized that even Al has a mental "flow chart" in his head when trading.

I think I have seen an interview of Al(probably MoneyShow) where he mentions binary decisions(which effectively is flow charts). Didn't realize the importance then - doing it now.

they do not have a quick way to rule out decisions. Flow charts can be a fantastic way to rule out decisions, though.

I will give Ali Afshari credit for how helpful flowcharts can be.

Yeah, he is super organized as can be understood from his article. I think Al is too, he just maintains a low profile so we don't get an idea of how organized he probably is. Earlier, I thought if I could be 10% of what Al is, that would be a huge achievement. Now, I think if I can be 10% as organized as Ali is, that would be a huge achievement as well. Great to see so many inspirational people around me on. Really great stuff, can't run out of motivation!

Again I will discuss more on flowcharts later but they are a very powerful tool to use.

Will look forward to it!

Great Brad and Abir! This morning I was just pondering about developing something like this, and looked if I could find something similar (like an object or work breakdown system) on the forum when I just read your flow chart (what a coinkydink ;-!). (Actually this is my 15-year line of business as a planning/process/risk managementconsultant in governmental/construction field, so my cup of tea....)

It would be great to also include a reference to the probabilities that Al Brooks mentions in all these kind of scenarios (like in which scenario's breakouts have most chance of failing/succeeding percentage-wise, etc).

I'm too early still in digesting the course (2/3 by now) - and, I add, making proper "flight hours" on the market where time/opportunity grants it - but plan on summarizing this in the shape of a flow chart. I am convinced this would be tremendously useful for everybody who hasn't (yet) internalized the probabilities on all potential scenario's (I think 400 patterns in total) like Al has.

In any case, this resonates a lot with my ideas. Potentially a cloud environment could be an idea to develop something (or multiple) with like-minded community BTC affiliates? No idea if this matches with the BTC guidelines though...

Let's keep this idea in mind, and I will make a first draft from yours, Brad, somewhere the next couple of weeks. To be continued!

All best!

I really like this. Thank you so much.

I think with all this deluge of information, 4 books, a video course, a daily chat room for years and years, encyclopedia of chart patterns, talks after talks, bonus videos galore... and I still cannot understand HOW he POSSIBLY makes money with this all this. Or how anybody can.

After the basics its all goobly gloppy.

...Trades are 50/50? Really? No they are not. 40/60? What? No they are not! That is doubly not true as there is the market, which even Dr. Brooks cannot predict, and then there's the traders own actions.

...Go for 2X? That's suicide at times.

...Trading range? Buy stops inside range?

...Always buy bull bars and sell bear bars???

...Adding to losers to average!?!!

...Buying/Selling above/below spikes.

...Always having stops below last major high/low major trend reversals.

...I could keep going but there is SOOO much bad advice he constantly says is foundational that is just plain dangerous at times.

Everyone will come back with the same version of... IT'S ABOUT CONTEXT!!!

And I'll say the same thing. Al cannot predict any more than Elliott Wave yet this time its different.

I respect what I learnt from Dr. Brooks but the question is completely out HOW he actually trades. Or anyone that follows him.

I think this whole thing misses the point.

YOU trade the market and market is IMPOSSIBLE to predict. Mix those two together and that's why you can't just code this stuff.

I have seen many profitable traders and THEY ARE PUBLIC about thier trades. Even REAL LIVE TIME for YEARS... and they don't NEED to PREDICT to be profitable.

Did y'all hear that? LIVE as its happening!!! Publicly for YEARS. Yes, they absolutely exist and are consistent and extremely profitable.

I have a hard time believing anyones actually profitable from Als work directly but more that they have just FOUND a way to be profitable for themselves. Which everyone needs to do.

The FLOW CHART FROM Brad Wolf is basically all you need.

Honest to god take that chart and DO THE WORK YOURSELF.

Als work is work of prediction. You don't need to predict the market and until you do you will forever be STUDYING, TAKING NOTES, ASKING for answers, trying to PREDICT, PREDICT, PREDICT, forever trying to figure out HOW Al or anyone of these guys PREDICTS the market?

How profitable are these guys. Seriously. How do you even know to TRUST this is good information. Go get Gann books, study Elliot Wave Theory, ect.

No no no... they ARE just scams. Lol. Oh. Oh I see. They both purport to do the same thing?

I am not here to disagree but to discuss openly.

I'm on my 2nd go through the course, almost done with the fundamentals for the 2nd time. Can't believe how much I missed the first time. I am realizing a lot of things slowly and mostly I take mental notes, that don't get documented anywhere. I have this consistent problem of being unorganized which results in me being not as productive as I could be.

Your expectations might be too high in relation to what your are actually learning too. Meaning you might be learning but not giving yourself enough credit for what you have learnt.

I put in the work but due to lack of organization skills, my efforts are often wasted and I need to put it more effort than I would have originally needed to.

Case in point being, I had found this link before and considered it important enough to go through again and then I forgot about it and now I found it again and I'm considering maintaining documentation like Ali talks about here - Becoming a professional price action trader | Brooks Trading Course .

I was wondering if there are others who found this article helpful and maintaining notes/documentations, trading journals, establishing routines etc. like he discussed. If you did, would you please share your notes(not the whole, a sample is what I'm looking for), routines or documentations(he talked about using excel but I am not sure how to get about it) a bit? I wanna know how you are doing it and establish a certain framework that would work for me.

Thanks for your help.

That was just an incredible article. Very insightful piece.

Unfortunately, it completely misses the point.

Learning "Technical Analysis", AND yes, that's what it is, will never take you to profitability.

That might be a profound statement but I've seen the proof over and over and I myself have finally come to realize I AM WHOLLY RESPONSIBLE for my situation. NOT the market. NOT my read on the market but my ACTIONS and REACTIONS.

Can you tell if Al took a trade or not based on his training. Of course NOT!!!

And yet people are trying to duplicate what he does.

Until you just TRADE what you know you'll always feel confused.

Easily over %90 of everything he writes is about PREDICTING the market.

Unless and until you absolutely realize you can never predict the market you will struggle.

Pretty easy to guarantee that.

My hope is the best for you though!!!

SandPaddict,

I see you are going thru a deep crisis and have thrown a bunch of shit posts in machine gun mode: tatatatata. No offense, I just want to tell you that I wrote some of those when I was learning but before sending them I took a break and thought that if I was still feeling the same after a few days, I would send them. I never did.

I also have never understood Al's secrecy about his trading. This is a red flag but nobody is perfect and we all knew that when starting out. I would like it to be otherwise, but it is not. Yet, despite that, I started with Al's teaching because the other options I had at that time looked worse, may be you have other good looking options?

Regarding what you have written, I could go line by line thru all your posts and show where you went wrong or misunderstood, but I think it would be useless now. In some places you are so wrong that inevitably it will appear like I am attacking you but this is the last thing I want. As I said, I have been in your feet and felt very frustrated for many many time. Finally I got the answers but it was not from one day to the next, rather, it took a lot of time.

So when you feel bad you need to calm down first and then make a decission: should I keep studying Al's or should I move onto other more legitimate thing? If you think that way in a few days, go with whatever more legitimate thing you have! Yet, coming here and blaming Al will not make you any good and doggedly staying here if you really believe what you wrote (scam; Al is about prediction and hindsight trading; no probabilities; setups are dangerous; etc.) will make it worse!

I wish you take the correct decision... and good luck (we all needed it)! 🙂

I see you've made quite a lot of posts based on the same theme, all of them being off-topic. I can't speak for others but I'd thank you to not spam my threads in the future.

SandPaddict,

I mean this as kind as possible, but if you do not believe in Al's setups, why are you following this website? I get it that studying this material is frustrating at times, and there is a lot of information to learn, and that can be frustrating. But why comment on a website dedicated to Al's video course and material if you do not believe in the information?

As ludopuig mentioned in a recent post to you, if you do not believe in the course, why not just move on and study someone else? Honestly, I mean that question as kind as possible, but it does not make sense to follow this website if you do not have faith in the material, right?

Now, if you are frustrated and looking for someone to give you a lightbulb ah-ha moment, then why ask in the form that I am having trouble understanding how Al's material is a ligament?

Also, I agree with ludopuig that you misunderstand certain critical concepts from Al's videos that are causing you to question the validity of the course. I know there are people on this website that would be happy to help you, but they are not going to be that eager to help you when it appears you are here to attack the video course.

Again, I mean this as kind as possible, but if you are here to learn, great; ask productive questions in the forum, and people will be happy to help. However, if you do not want to study Al's work, perhaps find a different price action website that would better fit you.

Abir,

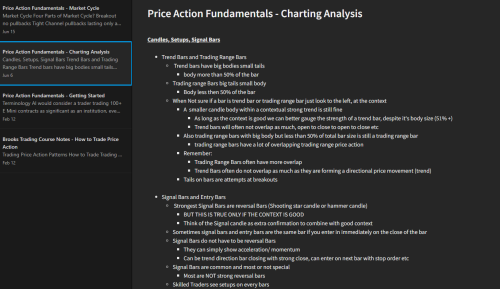

Evernote.com, website/ app for phone i have been using for almost a decade. Im taking notes in this format. One new note for each section of the course (Charting Analysis, Market Cycle, Support Resistance Basic Patterns). Dividing the notes into topics such as "Pullbacks and Bar Counting" , "Gaps", "Buying and Selling Pressure" etc

In the video index you see each video has multiple points based on the topic. each of those points i use a white bullet point then write down notes there to help me memorize it.

My notes have helped me memorize this course over and over and i am going slow to learn this all, taking notes as i go. Will be a lot of notes but will be worth it if you want to memorize the entire course, as many of us want

(also can highlight certain words and sentences. very great note taking ap)

Best wishes Abir! and Thank you Brad and Ludo for all your great work and moderation. Great community here