The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

If we're long, and a strong opposite signal shows up before the minimum Actual Risk is meet (for example 1x actual risk for a high probability trade), should we still exit or should we wait to at least minimum Actual Risk to make the trader equation positive?

If a strong opposite signals develops then your probability decreases and therefore your trader's equation gets worse. If scalping, as in your example, you have to exit straight away because you needed high probability and you don't longer have it.

In other words, is Actual Risk taken into account when exiting the position by bar by bar price action reading or not?

Once in the trade, if at some point your trader's equation becomes marginal or negative, you have to exit no matter where you are from the actual risk's target. The initial trader's equation assessment told you if you could take the trade, and the continuous reassessment of such trader equation during the trade tells you if you have to hold or exit.

So sell@2 expecting 40% swing down to start of BO@ 1 (?)

If you have a good reversal pattern at 2 (Wedge or MTR), ok to swing with first target the 1 low.

If you have a good reversal pattern at 2 (Wedge or MTR), ok to swing with first target the 1 low.

I thought the channel up to 2 was very tight, so the first reversal was supposed to be minor and traders would sell only for a scalp and not swing. The next attempt where the market forms a DT MTR, only then would one look to swing.

Something wrong with my thought process here?

Something wrong with my thought process here?

We don't see all the bars to the left of 1 so I was wondering that if 2 was already a good wedge or MTR, then you could take the swing even though you could also wait for a second entry, if you wanted higher probability. If no reversal pattern at 2 and having into account the tightness of the channel up from 1, better to wait.

We don't see all the bars to the left of 1 so I was wondering that if 2 was already a good wedge or MTR

Right, makes sense. Although, I would still wait for at least a second entry as the channel up is too tight for my preference like you mentioned.

We don't see all the bars to the left of 1

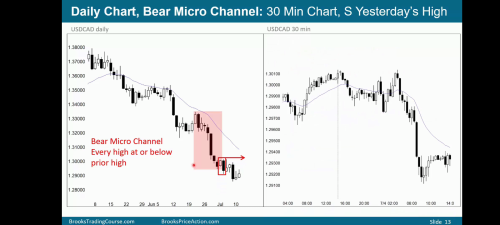

49F slide 13

The original premise was Bear micro channel PB on 30 min.

I was trying to figure out if it's better to never exit early. This relates to actual risk vs initial risk also. (Lose initial risk x60%, win 2x initial risk x40%). If you planned on never exiting early, you always lose initial risk. This slide shows a 99% PB then a huge win. Other trades will probably lose Big.

This post shows it is better to exit early (small win) and renter. That would capture most of the points, without the big loss.

This slide shows a 99% PB then a huge win. Other trades will probably lose Big.

Please, be more specific when you are referring to the chart (mark the trade on the picture), otherwise I have to try to figure out what you are talking about. What trade? what 99% PB?

This post shows it is better to exit early (small win) and renter. That would capture most of the points, without the big loss.

Absolutely but, who can do that consistently? You should be able to take the daily setups section and enter and exit at every rectangle... it is far easier to hold the strong swings because most of the time you will exit early and not be able to re-enter, missing the rest of the move, money that you definitely need to overcome the losses and become profitable. If you are really selective and enter only in the strongest swings (blue-rectangle trades), holding will pay off... wildly!

This slide shows a 99% PB then a huge win.

Red square@2= sell entry

Red line= protective stop

PB @6= 99% PB.Did not get stopped out, if holding.

Absolutely but, who can do that consistently?

Successful traders?

You should be able to take the daily setups section and enter and exit at every rectangle

That's for when I start paper trading. I'm still in the course.

Successful traders?

The markets run for 6-6.5 hours. At my current level, I can do this at a stretch for only 2-2.5 hours without making any mistake. I know this for a fact, it is pretty exhausting. When I get up from my desk after that 2.5 hours, I almost shake internally for some time.

On the other hand, the kind of management ludopuig is suggesting, it is half as taxing. So, you have to make your choice, pick your poison.

I think we may be talking about the same thing.

The debate is holding & never exit early vs exiting with a credible reason & re enter later. I was never talking about scalping, just swing trading until a credible signal to exit (in above example, sell@2, exit@5, sell again@6, hold@7)

You should be able to take the daily setups section and enter and exit at every rectangle

Early exits/trade-management methods are covered extensively throughout the Course in Many places. Here's a few I could think of:

- 09C - Pullbacks and bar Counting

- Exit on countertrend H2 or L2

- 13A - Always in

- Exit on change in the always in Direction (One Huge bar, 2 big bars, 3-5 smaller bars)

- 33D Protective Stops

- Exit if Premise changes

- 36A/B - Trade Management (Exits)

- 41D - Breakouts (Stop Management)

- 52A/B - Losing when good trade goes bad

Yes, I think we are walking in circles. Trade management is a must but it does not consist on exiting in each rectangle in the daily setups sections, as I discussed in previous posts.

Regarding the daily setups section, I strongly recommend to start watching once you have finished part 1, PA fundamentals.

Regarding the daily setups section, I strongly recommend to start watching once you have finished part 1, PA fundamentals.

So for markups, do we rewind the bars to hide all the bars to the right, and do a simulation of live trading? Or print out the completed chart, then do markups