The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

"Protective stop here...But will exit before stop gets hit."

What is the early exit criteria?

Sideways 10-20 bars, 50%PB, 100%PB BO test.

If the plan is to exit before the stop is hit, why not just place the stop in the maximum placement and let things happen?

Wide stops are 1) for emergencies like a flash crash 2) for weak pullbacks 3) if plan to scale in

A probability of a trade succeeding can change completely in one bar. Imagine you enter with 90% chance of reaching target (scalp), well it's possible that the very next bar can change that to 40%. Then must exit immediately because probably your size is already too big for that type of trade (swing) which is what it just became.

Emergencies & scale in make sense, but I'm unclear on early exit due to PB.

Scalp or swing, the trader will have a PB tolerance in mind.

For example, if price reaches "x" changing a 90% probability into 60% (or whatever the maximum tolerance is, for that specific trade) then why not place the stop there, and let the trade play out? example> If the strategy is to allow a maximum 50% PB, then place the stop at 53% PB.

Example 2> Or use the wider stop and allow an XL large PB, but not exit early because the premise is still valid.

Swing size is 1%-3% of account, what is scalp size?

Early exits/trade-management methods are covered extensively throughout the Course in Many places. Here's a few I could think of:

- 09C - Pullbacks and bar Counting

- Exit on countertrend H2 or L2

- 13A - Always in

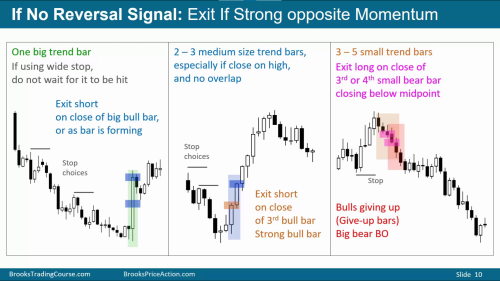

- Exit on change in the always in Direction (One Huge bar, 2 big bars, 3-5 smaller bars)

- 33D Protective Stops

- Exit if Premise changes

- 36A/B - Trade Management (Exits)

- 41D - Breakouts (Stop Management)

- 52A/B - Losing when good trade goes bad

Thank you, I will re watch those

Thanks for the video references. I've been going over Al's course again recently and this is something I've been thinking about a lot. I went over those videos today. Some notes I took:

- If buying in a bear trend and trend has not fully reversed, exit below first strong bear bars. Still more likely to be a pullback while not AIL.

- If endless pullback (>20 bars), okay to exit and wait for good signal bar. 50/50 chance of bull vs. bear breakout

- If trading reversal, traders won't let the market go against their position twice (exit on H2/L2)

- If entering where near possible reversal (exhaustion move, parabolic wedge, etc.) be ready to exit quickly

- If single strong signal bar in opposite direction, okay to exit and re-enter later. But if you can't bear to re-enter a trade later, just hold and trust your stop

- If otherwise disappointed by trend, okay to get out at breakeven

- Exit if enough counter-trend momentum (below)

It still seems like it would be difficult to do this when it's not the end of the day and you can see the whole chart, both psychologically and technically. Also seems like there would be a lot of times where you're getting out at the worst price in what becomes a strong pullback. But I suppose if you're a skilled trader it does have a benefit over the set-and-forget style.

From ludopuig in a different post regarding holding a swing trade:

"This is the key: exiting the swing only when the opposite side creates a good setup, here below the final flag reversal."

So that's the difficult part of swing trading: know when to hold vs fold, because many small losses need some big winners to make a profit. And PB can be 50%-100% and still get trend resumption.

1.Should the trader exit@2x risk during TTR?

A TTR is definitely something the swing trader doesn't want to see (but he often sees) and alone should not make you exit.

2. Is the Bear BO expected at the bottom of the triangle? (ET Bear flag= Bear BO?)

Yes, but a lot of abrupt reversals so confusion and difficult to assess what to expect. Refer to the picture below. If you sold 2 for a swing, you don't exit at TTR but you can at 5 bull bar closing on the high and failed BO of TTR, which is also a big H2 (with 3) at what might be the bottom (bar 1) of a TR or bull channel (I can't see much to the left).

You can then buy 5 big H2 but then forms ET 3 4 5 and 6 good sell SB so you exit again your swing. If you sell 6 ET and then get consecutive bear bars and bad SB at the bottom for the bulls, 7, you can hold because the ET eventually will break out and this is a good candidate. 7 broke below 5 and created an ioi BO PB with good SB for the bears, so there the probability went up for the bear BO and the MKT collapsed.

Thank you. This one is tough.

If sell @2 for a swing, what is the expectation? Maybe BO below 1?

Is there any good reason to hold @5? 2-4=LH so maybe expecting continuation?

If sell @2 for a swing, what is the expectation?

Depends on the context.

Is there any good reason to hold @5?

If 2 was a HH MTR or the third leg of a big wedge, and 5 didn't close on the high, you could hold more easily. But 5 closed on the high and if, for instance, 1 was the bottom of a protracted TR or, worse, a higher high in a broad bull channel, then better to exit.

What you could be reasonably sure is that after the consecutive bear bars down to 3, you would get a second leg sideways to down (it could be brief or the start of a big move down), so Ok to sell 4 but 5 big H2 for me enough to exit unless the overall context was especially strong for the bears.

If sell @2 for a swing, what is the expectation?

Depends on the context.

Does the setup for all swing trades include having PA target?

Example> Sell@2, because 40% chance (probability) of reaching start of prior Bull leg@1 (PA target)

So the trader knows the risk, probability, and likely PA target/exit for reward. They can manage the trade when it reaches that point, either take profits or continue to hold, depending on what happens in between.

Does the setup for all swing trades include having PA target?

Of course! The trader's equation gives you the minimum, and PA tells you what to expect.

So the trader knows the risk, probability, and likely PA target/exit for reward. They can manage the trade when it reaches that point, either take profits or continue to hold, depending on what happens in between.

You nailed it! 🙂

Hi @ludopuig

If we're long, and a strong opposite signal shows up before the minimum Actual Risk is meet (for example 1x actual risk for a high probability trade), should we still exit or should we wait to at least minimum Actual Risk to make the trader equation positive?

In other words, is Actual Risk taken into account when exiting the position by bar by bar price action reading or not?

Thanks in advance!