The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

When the market is in a strong bull trend (for example), we should only buy.

But why is an institution taking the other side of my trade and selling?

Similarly, in a trading range, we should buy low, sell high and scalp. But every time an institution is selling low and buying high, otherwise there is no trade. Why?

But why is an institution taking the other side of my trade and selling?

First sellers are bulls taking profits, that cause PBs along the way up.

But every time an institution is selling low and buying high, otherwise there is no trade. Why?

Because it is profitable for them. If they sell low in a TR they can still make money if they scale-in higher and exit all when the MKT goes down again. For us, doing the exact oppossite puts us in a much better situation to make money.

When the market is in a strong bull trend (for example), we should only buy.

the answer below is from my understanding and this may not be 100% correct

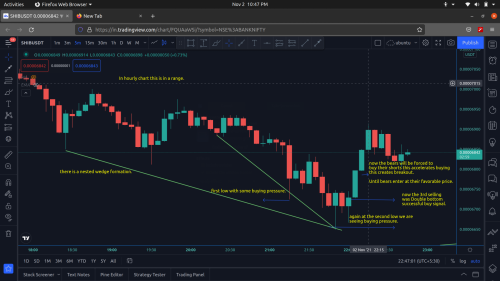

Every move in the market happens with the agreement of buyers and sellers. Mostly we can understand this when we consider the context (left side of the chart) that happens prior to the breakout rather in isolation.

In the attachment we can see at the first and second low there are buyers who buy from the bears

slowly the buyers increase their positions.

seeing this the bears also book profit which will increase the buying and bull will hold their positions or sell them to the bears at break even or profits.

likewise there will be numerous amount of reasons why one could take the other side.

And this applies only for this time frame.

Hi guys,

In a strong bull market, we are only supposed to buy. Who's selling?

1) Bulls who have bought in at a lower price and would have already made a profit and wish to exit the market. These are the limit sell orders that you would see on a DOM chart. The market moves up through market orders depleting the limit sell orders at each price point. The price will keep rising as the market buy orders eat up these limit sell orders. Kinda like Pacman eating up those yellow dots. Here, we buy hoping that prices will go higher so we can make money. The sellers have already made money since they bought earlier and the current price is high enough for them to book a profit.

2) The second set of sellers are shorters who are hoping that prices will go down so that they can cover their shorts lower and make money. They will keep selling as price goes higher. They do this because they know that the market moves in waves. It won't go up forever and will eventually start to fall back down. When it does, they will make money on their highest shorts and hopefully break even on their earliest entries.

A similar thing happens at the low of a trading range.

1) Bulls who bought high and thus are selling to cut their losses. Also bulls who bought lower than the trading range and selling to book profits in case the market falls further.

2) Bears shorting in case that makes the market break out under the range. These guys know that even if the market were to move back up, chances are it will revisit the low again so they can get out.

Just my two cents.

Happy and profitable trading!