The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hi there,

I have this general question.

Suppose I have got a LH MTR pattern but the entry bar is just below the top of the bear channel or just below the top of TR. Should I trade LH MTR as it is suggested to take long or should I go short as 75% of BO of channel or TR fail so we should sell at the top the channel or TR and follow BLSHS.

Thanks in advance for valuable inputs.

Hi Harpreet,

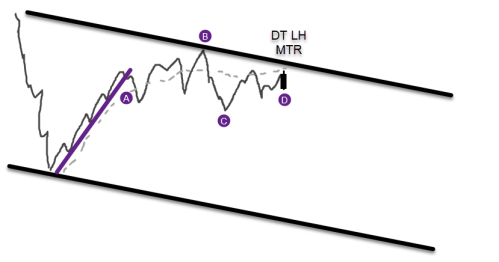

Here is a hypothetical scenario. A broad bear CH (type of TR). A bull leg spike (minor trend) that broke at (A), two legged retest of prior extreme up to (B) suggesting market cycle is converting into channel. A stronger bear thrust down to (C) that went below a prior major HL suggesting a definite end of bull trend and market cycle converting into TR, and two pushes up failing to resume the bull trend making a DT LH MTR setup at (D) suggesting a potential reversal if breakout happens to the downside. This is a short setup for multiple reasons like 75% chance of breakout attempts from big TR likely to fail, near top broad bear CH TL, under EMA, DT and so on. Target would be for at least 1:2 since there's no strong bear BO yet so we assume 40% chance the reversal will succeed and head down to the TCL of broad bear CH.

Hope this helped,

CH

____________________________

BPA Telegram Group

Hi Mr. Carpet,

First, I like to thank for explanation. Actually I am asking about LH MTR signal at the top of channel rather DT LH MTR.

I am also sharing a similar, not exact chart to clarify my doubt. In the 2nd chart, where I have drawn a yellow color straight line to show a possible TR, AL is suggesting to buy there, which is confusing because we should sell at the top of TR.

It is kind of a 2nd question which is similar to the question I asked previously.

Regards

Harpreet

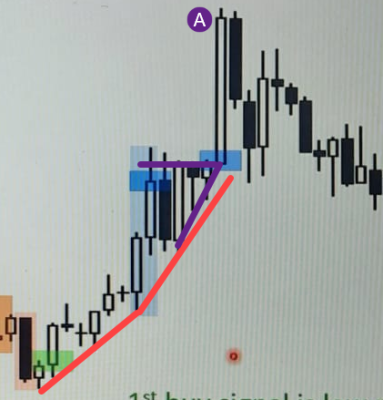

Yes, you're correct, a return to start of sell climax is a type of DT so could argue potential TR behavior coming soon. Although you'll notice many times Al still marks buys even at tops of TRs. Actually in this slide Al did say above that while probability of more up was high, the reward was becoming less and less, and we see it happened on (A) that the BO was short lived and returned back down to continue building a TR instead.

In this case, I think the reason why Al marked buys in this bull move is because it was still strong enough to only look for buys. For example, there wasn't yet any breaks of bull TLs (red lines) and there's even a micro ascending triangle forming (purple). There are very few strong bear bars so not much bear pressure yet to justify looking for sells. Most of what's happening are bull breakouts higher and higher anytime bears show up.

So I agree that this was an area of potential TR in the future, but this could be an example of the dangers of extrapolating too far ahead without enough evidence to support it yet. After all, sometimes the market is so strong that it just keeps going up so we have to respect the signs and maybe even buy as Al shows us here.

I'm not sure where to find a LH MTR in this bull move as it's far too strong to look for any sells, in my opinion. Maybe if you could draw exactly where you see requirements for MTR sell being fulfilled then it will be easier to see (for example, TL breaks, attempts to resume trend failing and so on)?

Thanks,

CH

Thank you very much Mr. Carpet.

Regards,