The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hey 😀

I need some help understanding the blue box setups in this chart and generally all blue box setups. As a sidenote, I am currently reading the final book of the book series, I have not yet watched the course.

This is my problem:

I am looking for swing trades which offer at least 1:1 and preferably 2:1 R/R ratio and have at least 60 percent probability. This is Al's recommendation and therefore I strictly attempt to find those swing trades. As far as I understand, the blue box trades are exactly these types of trades.

As I look for these trades, I often get trapped out of a trend because the signal bar is too big or the correct stop is too far away and looking for just 1:1 seems extreme. I also get trapped out because the move has already gone so far and the correct stop is so far away and just looking for 1:1 also seem extreme.

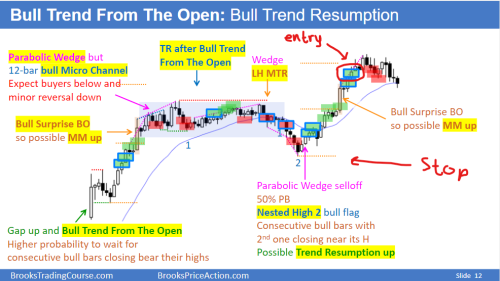

On the chart below I have circled a blue box entry with a red marker. This entry is at the very top of a bull spike and the correct stop is at the very bottom (at the small blue dotted line). If I were to look for 1:1 here, the market would have to go very far in my direction and I don't think it has 60 percent probability of doing so. I am aware that I am only using initial risk in all my trades, and I am not sure if that is good either.

My question is therefore, what am I missing here to understand the concept of those 1:1, 2:1 R/R ratio trades with at least 60 percent probability?

Help is much appreciated.

As I look for these trades, I often get trapped out of a trend because the signal bar is too big

I think this is fine. We don’t have to catch them all. Especially as beginner, not being in setups that make us uncomfortable should be ok.

It’s also my understanding that for those trade with wide stop, one can actively manage it (e.g. getting out early when premise invalid). However, beginners more likely to screw up than doing objectively correctly e.g. fail to get out when premise change, fail to hold to target, fail to get back-in when premise resume… So I think it’s also a good idea to stay away from those kind of trades for beginners. Or maybe just set and forget.

On the chart below I have circled a blue box entry with a red marker. This entry is at the very top of a bull spike and the correct stop is at the very bottom (at the small blue dotted line). If I were to look for 1:1 here, the market would have to go very far in my direction and I don't think it has 60 percent probability of doing so.

I think It only looks impossible to go that far because of hindsight the way this day turn out. This setup was a Wedge at MA Opening Reversal Up and traders can take this for a swing. If this one works, it will skew the Wedge to be looking short-ish at the end of the day.

Thank you for your response.

I see your point about the setup there, but I am still a bit confused. Below I have posted a chart and marked a blue box entry that is far above the stop. When a trade like that is marked with a blue box, does it always mean that it is likely going to continue for at least a 1:1 move based on the big stop?

I don't want to miss out on these trades, as they are marked as beginner-friendly. I want to get comfortable trading them.

I don't want to miss out on these trades, as they are marked as beginner-friendly. I want to get comfortable trading them.

I understand. Those are just my opinion and chosen approach. I found some blue-box trade are hard for me to take. And narrowing down on just a few setups, going only with trend seems to help me. But we’re all different and need to stick with what we believe in and comfortable with.

Below I have posted a chart and marked a blue box entry that is far above the stop

This trade I think it’s a breakout trade so the target can be something of measure move, maybe by the breakout bar, maybe by the breakout gap, maybe by the trading range. Stop loss can be bellow the breakout bar as well and still reasonable (but decrease probability). End of day so risk can happen fast tho so this one requires aggressive management.

When a trade like that is marked with a blue box, does it always mean that it is likely going to continue for at least a 1:1 move based on the big stop?

The blue box trades can be of different setups so I think no. And my understanding is that they are meant to be swing trades so a lot of them are not 1:1. For example, the Opening Reversal trade in your first example, first target is high of day, 2nd target is a measured move up by height of the wedge in my opinion.

If I took the trade you marked, I would have my stop closer, probably under the last big BO bar. Also, if you got out at the next red box you would still make a small profit. And this trend may have gone on much longer, but a lot of these swing trades only result in small wins and losses.

I appreciate the replies.

I have got something to work with. My understanding is that these trades have the potential for a swing trade, even though some are unlikely to be, and most end in a small profit or loss. I will work on taking most of them, so I don't miss out on the swings.