The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hi,

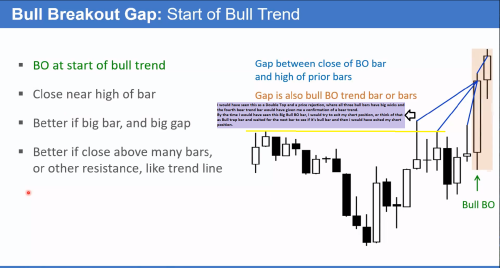

Here' a screenshot from the trading course where it talks about Gap as a bull BO bar. I don't know if anybody would have waited to enter a position until they see a Bull BO bar. I would have rather entered a short position before itself the reason being, the few bars before the BIG Bull bar are showing price rejections just right at the point where you see a Double top forming. So i would have entered a short position for a measure move down when I would have seen a Big Bear bar just before the Big Bull BO bar.

Any explanations would be greatly appreciated?

Hello,

Kindly have a look at the above chart. You took an early entry thinking there is double top and a big bear bar. The risk reward ratio is very good maybe 3:1 but the winrate is low maybe 30% because you did not wait for the follow through bar after the big bear bar. Over time my personal taste changed and now I place trades with high win rate like 60% but bad risk reward ratio of 1:1. What I would basically do is either wait for the follow through bar after the big bear bar or wait for the bull breakout because it would increase the winrate but sacrifice the risk reward ratio. If you stick to your strategy and I stick to my strategy, in the long run we both would be profitable 🙂

cool 🙂

Hello! If the discussion is about selling bar (A) then I'm not sure that's a very good sell with a stop for the following reasons:

1) Given the whole context it's currently a TR (yellow box) and selling the low of bar (A) is right in the middle of it. I understand the argument about a big double top for a big move down, but selling at this particular spot may require scaling in higher before the true move begins (if still strongly convinced of bear case).

2) Bar (A) closed with a big tail so not very strong.

3) The signal bar before it was a bull bar which reduces the number of bears that will be in this trade.

4) The low of bar (A) tested the gap with bar (B) and was rejected.

I think the big double top idea is reasonable but given all the reasons above it's low probability for the moment. Perhaps if there was another consecutive bear bar following bar (A) it would improve the bear case, although at that point price will be at the very bottom of the TR so selling there would definitely have to be a swing for at least MMD of this range.

Regarding the big bull bar BO that this slide is about - probabilities happen. Al is using this slide just to showcase big bar as gap concept. Even if selling the bear bar idea is reasonable, the big bull BO can happen at anytime, maybe it was news, doesn't matter. It was a surprising bar so bulls will be expecting at least one more leg up after some weak PB and bears have to take a loss. It happens.

Hope that helped!

CH

______________________________

Join BPA Telegram Group for more discussions about TRs

I just started the course and your explanation is very much appreciated 🙏