The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hello,

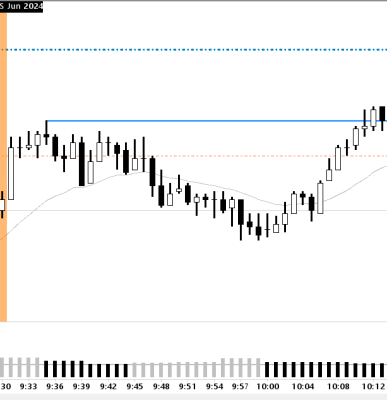

On this chart, I interpreted the latest bear bar on the right as a short signal bar. Conflicting context: TR environment. Hitting resistance (blue line) vs Always in Long context over the last few bars. I went short on the breakout of the bar's low.

Instead of going down, it developed a pullback H1 and kept going higher. So the AIL won.

Are there signs that should have prevented me from taking the short and favor the AIL? How do you decide in this case? Or maybe it's just a case of bad luck (instead of a bad trade)?

Hi Ben,

I think you have to respect the most immediate price action which was a tight bull MC. While you may not want to buy because of the resistance (TR top), it may also be too early to sell. A break of micro channels is often MRV (minor reversal) and even if pulls back 50%, bulls are likely to still try for a 2nd leg up. One exception may be if there are too many bull bars and the last bars became exhaustively climactic or parabolic into resistance, then could try selling small below a bear bar. But this MC was very controlled with average looking bars and nothing too exhaustive to warrant a first entry sell. Better to wait for break of bull TL (treat the MC as its own trend) and then wait for either a LH or some kind of MDT with a good signal bar.

Hope this helps,

CH

_________________

BPA Telegram Group

Cristal clear thank you.

Mr. Carpet, do you suggest only playing TR reversals after climactic vaccum behavior at TR boundaries ?

Hi Ben,

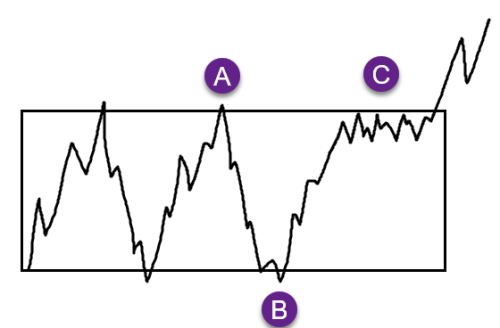

It does help to get climactic behavior into TR tops and bottoms before looking for reversals. One side appears to make a powerful statement (BO attempt with big bars) but suddenly can't follow through on it which suggests that perhaps it's vacuum. I personally often sell climactic behavior with limits above prior swing highs and buy climactic below prior swing lows (like A, B).

But if it starts going flat near a boundary (like C), then I avoid trading for reversal (with limits). Market inertia isn't repeating the same pattern as before so something is changing in the market. Such flat flags near the edges often portend a BO attempt that succeeds (or at least goes very far).

Got it. Illustration is much appreciated.