The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hello,

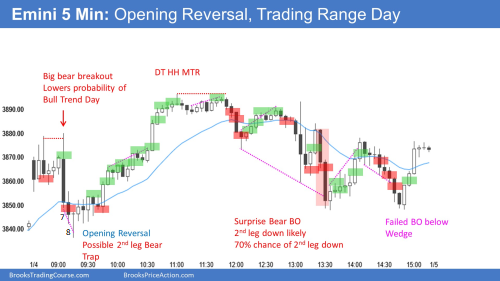

I need some help fully understanding surprises. I was replaying Jan 4 2023 and reviewing the blog chart afterwards. When I was replaying, I wrote down bar 7 & 8 as a surprise bear breakout, which would probably lead to a second leg down and probably bigger than bar 11 going a couple of ticks below bar 10.

I was surprised to see that it is not a surprise. Is this because any trend at the open, no matter how strong it appears, has 50 percent probability of reversing, and by that definition there is no surprises because nothing is a low probability event then?

Please correct me, or help me understand.

Thank you,

Andreas

Hi Andreas,

On big gap up days the expectation is for the market to work its way towards the EMA somehow, either by forming a DT or wedge top or just immediately trend down or simply meander horizontally towards it. So traders were expecting to reach EMA one way or another and would be looking for some such pattern. In fact, B7 was limit sold immediately above the prior swing high B3 so a lot of limit bears were already there waiting. You could still say the size of it was surprising but also bears achieved their main goal of reaching the EMA. Once goals such as magnets, MMs, etc are reached, the side pushing for it tends to step aside for sometime by taking profits.

The real surprise was a little later, on the slide Al marked it at 13:00. I think it was due to the expectation to retest HOD and the drastic difference in size relative to prior bars (on the open it's not very surprising to get big bars). After a strong bull trend and a 20GB touch of MA there is a very high probability to get back to HOD which didn't happen here, instead a huge bear bar which was surprising.

Hope that helped!

CH

___________________________________

BPA Telegram Chat traders only get surprised 120% of the time.

Hello MrCarpet,

I see. So the market wants to work towards the moving average at the open on a gap day, and it does so by frequently forming double tops / bottoms and wedges, and it is not a major surprise even when it vacuums there quickly because it is usually from some variant of double top / bottom or wedge.👍