The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

@ludopuig you are my hero! Yes please.

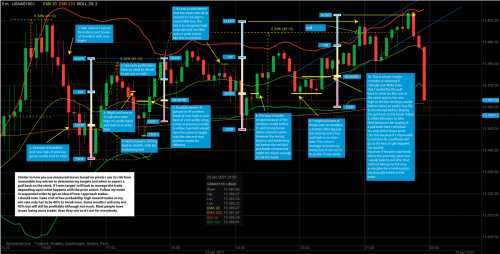

So at arrow 1 the way I look at it is I would consider the breakout failure and a higher low for a good signal long. Stop below target 2X buy at green box.

At arrow 2 he is buying at resistance so that makes no sense to me. Besides what does he do here if he did buy at arrow two and stop is below LL DB??? Get out below next down bar? Again to me thats seems ridiculous. But he'd also say RELY ON YOUR STOP?!??

How about arrow 3? This makes sense to me but never comes near 2R. Which doesn't make it a bad trade. Can't win them all.

What about 4? Are you getting out of longs. Or are you going short?

Here we go again as arrow 5 is somewhere I'd be looking to go long but according to Al stop below LL DB go for 2X swing?

6 again hes buying right into resistance. Wheres is stop and target?

And again at 7 are you getting out of longs or are you already out of longs and going short?

He says alot he doesn't like flipping his main trend direction as other real traders don't either. Which I don't know why he says that everytime like that gives it weight or something.

Any help would be greatly appreciated. Al has taught me the most fundamental nature about how markets truly work but I just don't understand how following his advice for HOW to trade makes sense.

If he would even showed samples of where he HYPOTHETICALLY WOULD TRADE on the charts and WHY that would be something. But he won't even do that! Instead he just colors buy above every up bar and sell every down bar excluding a few just before where the market conveniently turns. (Btw...buying above an up bar and selling below a down bar is in itself AN EDGE.)

So whats his edge? He says he likes high probably trades. So by definition he has to have a crappy R/R yet he promotes everyone do the exact opposite.

Thank you. Still confused. Not even trading it. The logic makes no sense to me. Or more accurately I don't understand the logic.

Peter I hope you don't mind. I took your chart to give you an idea of how I approach trades. There is no perfect system, but it might give you some ideas or other things to think about.

Happy to help!, let me start from the end of your post:

So whats his edge? He says he likes high probably trades. So by definition he has to have a crappy R/R yet he promotes everyone do the exact opposite.

This is the single biggest problem when learning from Al: He promotes swing trading for beginners but he has a scalper mindset and when you try to follow him in the webinar you find that he talks against almost, if not all, the swing trades that we should be taking (the ones that he later marks with a blue rectangle for beginners). I understand and accept why this happens but this is nonetheless quite frustrating when learning.

The trades highlighted in green and red are swing trades, tho some of them are high or low in a TR so you actually better scalp them. Also, when you are in a TR day, you don't rely on your stops (this is trending behavior), you better exit on strength at magnets. With this in mind, let's see the trades you pointed out. I copy below the chart with bar numbers so it is easily discussed (I will be referring to these bar numbers instead of yours):

So at arrow 1 the way I look at it is I would consider the breakout failure and a higher low for a good signal long. Stop below target 2X buy at green box.

You are low in a TR so 17 is an Ok swing buy for two legs up to 8C. The stop at the low of the day and this trade gave more than 2IR (Initial Risk). Trail the stop below 25 at 26 and exit at 8C during 28, or at 31L.

At arrow 2 he is buying at resistance so that makes no sense to me. Besides what does he do here if he did buy at arrow two and stop is below LL DB??? Get out below next down bar? Again to me thats seems ridiculous. But he'd also say RELY ON YOUR STOP?!??

28 COH (close on high) and broke above 8H, so it was BTC (buy-the-close). Next target Yesterday's close but you were high in a TR day in a possible 3rd leg of a Wedge 15 21, so if you bought you better exit on strength (2 or 4 point profit scalp) or 1 tick below any bear bar (31). Notice that the MKT turned down exactly at 18 ticks so allowed 28H bulls to exit with 4 points, with a 1 tick AR (actual risk). If you, rather, swung it, you exited BE at 31L.

How about arrow 3? This makes sense to me but never comes near 2R. Which doesn't make it a bad trade. Can't win them all.

25 is a H2 with good Signal Bar above EMA for the said second leg up, so stop below 25, not below 14. If you exited at 8C this was more than 2AR, which was very small. If you rather held, the MKT reached 2IR before turning down at 31.

What about 4? Are you getting out of longs. Or are you going short?

At 42 difficult to be long if you exited below 31L already, as you should. If you sold below 41, stop above 31, you would exit with a few ticks profit above 45 bear trap. Still this was around 2AR.

Here we go again as arrow 5 is somewhere I'd be looking to go long but according to Al stop below LL DB go for 2X swing?

45 is the second leg from 31 Wedge, 50% PB and a bear trap (they needed one more bear bar and they got instead a bull bar COH). If it was a trap, the stop then went below 45. Since 14 you have HH and HL but lot of TR PA so don't place your stop and rely on it below 25. Had 45 been a good bear bar, the MKT could have came back to the 14L. At 45H again the actual risk was negligible so you could scalp out with 2-4 points and the trader's equation would have been ok. Alternatively you could hold for a swing and exit below 51, top of the TR, and with around 2xIR profit.

6 again hes buying right into resistance. Wheres is stop and target?

Bears tried twice to push the MKT down, at 44 and 54, and failed, the MKT was still AIL so you can see 65 and 66 as a BO of a triangle 31 45 51 55 59, betting the gap with yesterday would close. Yet, 59 created a Wedge at the top of a TR so you exit below and this trade was a loser. At 69 bears tried againg but needed more bear bars and failed getting a strong bull bar 71, AIL, so you could buy again for the said tests of the Gap. The MKT turned before the target so you had to exit at 76 BE (if you didn't scalp out on strength).

And again at 7 are you getting out of longs or are you already out of longs and going short?

If you exited longs already at 76, this was STC so you could sell, stop above 75 and exit above any bull bar or end of day. Again profit around 2IR.

As you see, the trades that were not losers reached more than 2AR, which is the mathematical minimum needed. Several of them reached more than that giving 2IR... shot for those and you will be doing fine.

One last thing about using AR instead of IR in the trader's equation: People think that trader's equation must work with initial risk because this is what you lose when your full-blown stop gets hit but, as you saw above, this is not necessarily true. If you bought 66 or 72, you lost 2 points each, not all the way down to 55 or 69. And these losses were offseted by the small wins that you also got, like selling 31L or 42L. Of course, for this to happen, you need to manage correctly in real-time... and this is what makes learning how to trade a long term investment!

@thetuxxxgmail-com

Here is my opinion on the chart. Why is there a buy at arrow 2? Because there is nothing happening in the price action at the time to suggest the trend will not continue or it won't break through resistance. This means it is still a reasonable buy at the time if the trend continues. After all there are some days where the stock just goes up and up and up all day. Unfortunately right after arrow two there is a red sell signal bar. Does this signal mean you should get out or go short? Yes and no. The sell signal suggests the trend has changed. It could mean it will either trade sideways, go down or trade sideways and go up more. There is no way to know at the time exactly what will happen, so you as a trader have to decide what to do. Do you believe in this trade enough to hold for your full stop or based upon the new price action should you exit or even flip short? The decision is yours. That is trade management. With time and experience you will start to recognize patterns or price movement to get a better idea of when it's just a pull back to go up higher or when it's really a reversal so you should get out or reverse your position.

You mentioned Al says to "rely on your stop", but I think you are misunderstanding what he means exactly. When he says, "rely on your stop" he means don't hold the stock beyond your stop. He doesn't mean don't ever exit before you hit your target or you stop (ie All or nothing). The issue with most beginners is they don't stick to their stops and will move it down to try and not take a loss. This results in bigger losses, so what Al is really saying here is to rely on your original stop and not to change it. At first I was confused by this as well, but later on in the videos he does mention that it is ok to exit if you get certain signals that would suggest to get out early, but he also cautions against doing so too often (mainly out of fear of losing) as it will result in death by a thousand paper cuts. With this mentality you'll constantly get out as soon as your green in fear of losing any profits which results in you making little profit, but you'll still take full stops if it never does go green maximizing your losses. This results in a negative traders equation over all.

It's really hard to teach beginners how to know the difference of when to hold and when to fold. It's just something that comes with experience and is why no one can just pick up trading in a month and make millions. Even those who are lucky enough to do that well in their first few months will end up losing it all if they continue because they don't understand trade or risk management. You constantly see it with trades posted on r/wallstreetbets.

Thank you Eunha

I appreciate it.

@designbynickigmail-com That it! Thats it! Thats it!!! Look how I explained my chart thats, exactly it.

Thats EXACTLY how I view it and how I would trade. BUT I question every decision as that doesn't fit Als rules... that doesnt fit Al rules... ect... and hold till hits my stop.

That is six ways from Sunday to how Al teaches.

Awesome response

@ludopuig I can't thank you enough as Al probably would say pretty close to the same thing.

Now this all goes to prove my point perfectly. And I mean no disrespect by this but to me its the same as watching financial pundits tell you afterward what happen to the market based on news that coincided and they have an air tight argument. (Thats not you as you can most likely do this realtime)

BUT you made it in two points for me...

the actual risk was negligible so you could scalp out with 2-4 points and the trader's equation would have been ok.

And...

One last thing about using AR instead of IR in the trader's equation: People think that trader's equation must work with initial risk because this is what you lose when your full-blown stop gets hit but, as you saw above, this is not necessarily true.

So two things. I can throw out everything Al says because his edge comes from him simply always managing his equation to be profitable and not his trading teachings.

I like @designbynickigmail-com look for good R/R and am not as concerned about high probably. But I like to manage my positions and all I ever hear in my head is Al you need 2X. Rely on stop. Go to walmart. You CANNOT take small wins!!! Ect ect ect...

I just want to move on from Al but keep thinking if I could just get what hes saying.

Thank you so much @ludopuig.

Still confused. Think I need to move on from Al. Crab in a bucket.

@designbynickigmail-com is l wish I could say this was helpful. I'll leave it at that.

@ludopuig I can't thank you enough as Al probably would say pretty close to the same thing.

Now this all goes to prove my point perfectly. And I mean no disrespect by this but to me its the same as watching financial pundits tell you afterward what happen to the market based on news that coincided and they have an air tight argument. (Thats not you as you can most likely do this realtime)

BUT you made it in two points for me...

the actual risk was negligible so you could scalp out with 2-4 points and the trader's equation would have been ok.

And...

One last thing about using AR instead of IR in the trader's equation: People think that trader's equation must work with initial risk because this is what you lose when your full-blown stop gets hit but, as you saw above, this is not necessarily true.

So two things. I can throw out everything Al says because his edge comes from him simply always managing his equation to be profitable and not his trading teachings.

I like @designbynickigmail-com look for good R/R and am not as concerned about high probably. But I like to manage my positions and all I ever hear in my head is Al you need 2X. Rely on stop. Go to walmart. You CANNOT take small wins!!! Ect ect ect...

I just want to move on from Al but keep thinking if I could just get what hes saying.

Thank you so much @ludopuig.

Still confused. Think I need to move on from Al. Crab in a bucket.

P.S. I reread what I wrote and Im even more convinced I just need to trade FOR MYSELF BY MYSELF and just get out when I think I should! Al has no exit algorithms that make sense. The traders equation is just a mathematical truth and he just has good looking entries and airtight fluffy arguments.

Reading the chart like Al is extremely easy, sounds extremely smart, and I think is laughable as its getting into Gann type thinking.

You are great and I appreciate your input and Ive never heard of a profitable Al disciple but I hope your one of them

@ludopuig I can't thank you enough as Al probably would say pretty close to the same thing.

Now this all goes to prove my point perfectly. And I mean no disrespect by this but to me its the same as watching financial pundits tell you afterward what happen to the market based on news that coincided and they have an air tight argument. (Thats not you as you can most likely do this realtime)

BUT you made it in two points for me...

the actual risk was negligible so you could scalp out with 2-4 points and the trader's equation would have been ok.

And...

One last thing about using AR instead of IR in the trader's equation: People think that trader's equation must work with initial risk because this is what you lose when your full-blown stop gets hit but, as you saw above, this is not necessarily true.

So two things. I can throw out everything Al says because his edge comes from him simply always managing his equation to be profitable and not his trading teachings.

I like @designbynickigmail-com look for good R/R and am not as concerned about high probably. But I like to manage my positions and all I ever hear in my head is Al you need 2X. Rely on stop. Go to walmart. You CANNOT take small wins!!! Ect ect ect...

I just want to move on from Al but keep thinking if I could just get what hes saying.

Thank you so much @ludopuig.

Still confused. Think I need to move on from Al. Crab in a bucket.

P.S. I reread what I wrote and Im even more convinced I just need to trade FOR MYSELF BY MYSELF and just get out when I think I should! Al has no exit algorithms that make sense. The traders equation is just a mathematical truth and he just has good looking entries and airtight fluffy arguments.

Reading the chart like Al is extremely easy, sounds extremely smart, and I think is laughable as its getting into Gann type thinking.

You are great and I appreciate your input and Ive never heard of a profitable Al disciple but I hope your one of them

I have nor have heard ANYONE EVER making money with Al. Its a bunch of analysis that is so much more confusing then it needs to be.

I am a full-time trader and Dr. Brooks' teachings were instrumental in my development so to address your concern of whether it can be done, it certainly can be and the presented information is valid. Similar to you, I went through a period of time where I thought this way of looking at the market is unnecessarily complicated. In fact, when I got into trading I was so skeptical of the sources of information out there that I decided that I'd approach learning from the standpoint of testing ideas in real-time to see whether they are valid or not in my own direct experience rather than believing them with blind faith. I figured that the market is the final arbiter on the validity of a methodology so once I had watched 55% of the Price Action Fundamentals portion of the course I switched to SIM trading almost exclusively. I tested ideas and trade management on my own before I ever saw any of the How to Trade videos (Dr. Brooks presented enough ideas on how to enter, exit, manage, scale, etc. in those videos for me to feel comfortable with starting). In doing that, I learned through experimentation what tends to work and what tends not to. I'm a big proponent of learning by doing (check out the book Little Bets by Peter Sims if you're reluctant to give it a try and Ultralearning by Scott H. Young if you want some ideas on how to learn in an effective manner).

During that time I also deeply explored order flow (and I still do use tape reading to a certain extent but price action can be used as a standalone method) and Market Profile (the auction market theory ideas are very useful even if you don't use MP). All good intraday methods essentially boil down to the same ideas and Dr. Brooks just presents a way of seeing those same ideas through the lens of price action on a regular chart. Now as I watch lectures here and there and read the textbooks (always have to keep learning and improving and although I'm consistently profitable, I'm sure that a man who has been doing this for 30+ years has a lot of valuable things to say that I haven't thought of yet), it has taken on a whole greater degree of depth since I've seen what Dr. Brooks is talking about so many times myself.

With a lot of real-time experience though (thousands of hours logged in SIM before I went live, I've probably taken more than ten thousands trades - doing order flow drills had me getting in and out several hundred times a day - since I started a couple of years ago), trading feels far simpler again as the ideas become deeply ingrained into the decision making process.

Something I would suggest is that you spend more time on testing ideas in real-time with either a SIM account or trading 1-2 MES contracts or very small positions in the Forex market or a mega cap stock like AAPL. The ideas are very worthwhile, but if you've been through the course numerous times then it's more likely that your time is better spent actively practicing the skills. To make a comparison, a quarterback can read everything there is on how to throw a perfect spiral, plays to run in certain circumstances, and watch hours of game footage, but until he actually practices for many hours every single day he won't be tapping into his true potential.

Another thing that I think is worth mentioning is that from the start I made it a point to be as self-reliant as possible. I watched the 2-day trial version of the Brooks' Trading Room and it was fantastic, but I never subscribed to it because I always wanted my decisions throughout the day to be my own. I approached learning from a standpoint of understanding and analyzing market behavior, managing trades, and mental management. Analysis and trade management skills can and, in my view, should be learned in a SIM environment. Mental management (trading psychology) is better learned in the live environment. You need to be able to assess why trades are or aren't working and that can't be done effectively without being able to separate between those various categories. Trading isn't so much about memorizing patterns, I've never tried to do that, it's about understanding market participant behavior and taking trades that make sense based on the current activity in relation to the overall context. By taking a principles-based approach to trading, structuring trades based on where they are in the market cycle (i.e. where the market is in the spectrum between extreme trading range and extreme trend), there's an enormous number of opportunities to trade profitably throughout the day. It's like opening a textbook to a random page and asking a physics professor to solve the problem. He'll be able to do so because he understands the subject in a principles-based manner, not because he spent time memorizing all the solutions in the textbook.

In terms of the trader's equation, I'm predominantly a scalper (there are typically more scalp opportunities than swing opportunities throughout the session), but I will swing when the opportunity presents itself. I'm also much more interested in actual risk than initial risk. I'm willing to use stops that are wider than my profit target and will scale in if it's appropriate. I pay close attention to how things are evolving once I have entered the market as well. I just make sensible decisions and weigh the risk, reward, and probability of the situation. I don't have a set-in-stone method of management. I don't know with mathematical exactness, but I know that I'm making sensible decisions throughout the day because I'm basing them on a lot of experience and from carrying forward the lessons I've learned. Sometimes I'll use a wide stop, other times it's a money stop, other times it may be based on something like being beyond the extreme of a signal bar, and other times it may be based on something I'm seeing in the order flow. What I choose to use is situationally dependent and based on how the market has been trading throughout the session. Trade management is a very dynamic process and is best learned through direct experience.

You asked what Dr. Brooks' edge is and the way that I'd look at that is that he is the edge in his trading. I view myself to be the edge in my trading as well. It's my ability to objectively analyze the market and take trades that make sense that allow me to be consistently profitable (knowing when to stay out is just as important as being able to get in). Similar to Mark Douglas, I think that every moment is unique and every edge is unique. If I think my premise is no longer valid, then I adapt to the current market. I remain as dispassionate as possible in my analysis and just trade what's in front of me rather than hoping for the market to do something or feeling as though it "should" do something. A book that helped me to a certain extent in maintaining that sort of objectivity is The Psychology of Intelligence Analysis by Richards J. Heuer (it's freely available online directly from the CIA.gov website); particularly the section on "analysis of competing hypotheses."

By viewing the market from the standpoint of trading the behaviors of the participants (and that is all that a chart, order flow, and/or Market Profile is showing us), I can decide how to trade in a manner that makes sense. Furthermore, if I lose money, for example, I can assess whether it was due to the behavior not playing out as I'd typically expect (i.e. normal variance) or poor execution on my part. By approaching learning from that standpoint, I have closed feedback loops and am practicing in a more deliberate manner. In this way, the market is used as a teacher who is constantly communicating with the trader whether or not the decisions being made are sensible.

I realize that I've just written a wall of text, I have a tendency to do so, but I hope that it helps you persist and assess ways in which you might improve your progress. It's a long and arduous process, but it is worth the effort. Good luck!

Hello @vythand-alagappangmail-com. Well I dont think it was helpful but it WAS very enjoyable and a good read. (Except for that book. Ive read alot in that field never heard of that book. One that closely resembles he name but not that one)

Yes Al is his edge. Just like Van Tharp says you trade your beliefs not the markets. I have learnt so much from Al its hard to disentangle what doesn't work for me.

You said one thing that made alot of sense...

I pay close attention to how things are evolving once I have entered the market as well. I just make sensible decisions and weigh the risk, reward, and probability of the situation. I don't have a set-in-stone method of management. I don't know with mathematical exactness, but I know that I'm making sensible decisions throughout the day because I'm basing them on a lot of experience and from carrying forward the lessons I've learned. Sometimes I'll use a wide stop, other times it's a money stop, other times it may be based on something like being beyond the extreme of a signal bar, and other times it may be based on something I'm seeing in the order flow. What I choose to use is situationally dependent and based on how the market has been trading throughout the session.

This is probably how Al trades VS how he teaches to trade.

Also like Jack Schwager says I need to find something that fits MY personality otherwise it'll never work.

ALSO...

I am currently in a group with a rules based intraday trading system that crushes. Can't trade it. Goes against where I would enter and worse it skips trades I would take everytime.

So heres black and white rules and no matter how profitable I can't trade it!!!

Like Richard Dennis used to say "I could print my rules in the paper and no one would follow them."

@thetuxxxgmail-com Lots of people on this forum have given you good advice, but I don't think anyone has addressed the heart of the issue: you're not approaching trading as a skill to be developed, you're thinking of it as a problem to be solved. That's what I tried to illustrate in my prior post; a blueprint for approaching trading as a skill. This isn't an issue that's unique, plenty of people do it, and many people refer to it as "searching for the holy grail."

It looks like you've had exposure to a number of different sources of information, but beyond a point just accumulating more knowledge from books, lectures, and chatrooms is pseudo-work. It feels as though it's productive, but people wind up spinning their wheels, sometimes for years, and plenty never get beyond that point. The only way to ever get beyond that and find a method that fits your personality and is valid in real-time is to actually put in an enormous amount of screen time. Trust your own intelligence rather than relying on others. Learning in solitude, experimenting, observing, questioning, and refining is the most efficient and effective way to learn to trade unless you're in an environment like a prop firm, institution, etc. where you have successful professionals who are able to help guide you through the process (even there though it's often a thrive-or-die model).

Something else that I want to address is that you are not taking nearly enough ownership of the process. You're saying that Dr. Brooks is a "terrible" teacher, but you're not questioning whether you are a good student. Reading and watching videos is only the start of the process and is the easiest part. This is similar to a math student who reads the textbook but doesn't spend enough time doing practice problems and then wonders why he didn't do well on an exam. My experience has been diametrically opposed to yours and I have a very different opinion of Dr. Brooks' teaching ability. I find him to be a very methodical and thorough teacher. He is repetitive, but that comes with the benefit of building in spaced repetition of important concepts. There were things that I had to clarify through my own experience, but I didn't come into this profession expecting things to be handed to me. There are surely far more students who have started studying Dr. Brooks' materials than those who have actually become successful with it, but the profitable students are out there. The difference between the two groups likely has to do with the degree of conviction the successful minority have in doing the difficult, actively-involved, productive work that's necessary to be able to apply the ideas in real time.

Bear a couple things in mind: 1. Dr. Brooks starts his books by saying that everything that's needed in order to earn a living from trading is in the books (the same can be said of the video lectures), but it's up to the individual to put in the countless hours learning the craft. i.e. these sources of information are excellent but it's up to the individual to learn how to actually use it in real-time. 2. Dr. Brooks himself turned the corner once he threw out everything and choose to just rely on his own learning. I can see various schools of thought that may have influenced his thinking in the way that he approaches trading, but the fact that he took ownership of the process is a large part of why he became successful with it. We have the good fortune of having someone who is incredibly knowledgable and experienced, hand a lot of very valuable ideas to us on a silver platter, if a person can't take those and actually make something profitable out of it then maybe trading isn't for them and their time would be better spent on other pursuits.

Anyway, I know this was a blunt post. It's not just directed at you, it's for anyone who is struggling to turn the corner and thinks they're putting in the work but aren't devoting the time where it should actually be devoted. It's not just about how much time is spent, the manner in which that time is spent is also vitally important. To be clear, my objective in writing this wasn't at all to make you feel bad, it's in hopes that the next 5 years and beyond of trading will be more fruitful than the last. You may already know enough to be profitable, now put in the hours in front of the screen and do targeted reviews of concepts you're not understanding. In doing so, you'll discover what suits your personality in an organic manner. And keep in mind, there aren't any black and white "rules" just guidelines. I was about to say "good luck" but it's more apt to say "make your own luck!" 🙂

Thank you @vythand-alagappangmail-com.

I should go back and redact that part about him being a bad teacher. It implies subjectivity and I dont even believe that. He has taught me an incredible amount about trading.

Other than that I guess I understand what your trying to say but I have been building skills since I started this journey.

Most of that has been throwing crap away that doesn't work.

Thats great if you can look at a chart and go... theres a higher low major trend reversal with a H2 inside a small wedge holding above a major trend line... means nothing about making money.

So maybe hes the worlds best chartist but an average trader. Who knows.

I know it sounds like I don't like Al, I do, I just totally don't get all the contradictions and variables and hindsight biases.

There’s always going to be numerous variables to consider, that’s the nature of trading and operating in the “gray zone” as Dr. Brooks calls it. For instance, uncertainty is a significant factor in why markets are able to function (if one side knows for certain that they’re right, the other knows for certain that they’re wrong and few will provide liquidity on that side). Even in a strong trend there’s the uncertainty of whether it will continue even though the probability is in favor of continuation.

I recommend building off of simple ideas. For example, take the “always in” direction and the typical way to trade a trading range (BLSHS). Decide whether there’s more buying or selling pressure, whether it was a rally or sell off that led to the TR, and wait for the market to come to advantageous areas. Let’s say the market rallied, turned into a trading range, and there’s no significant resistance above the range or other reasons to think you shouldn’t buy at this time. A reasonable way to approach that circumstance is to just wait to take long scalps on limit orders, entering near the bottom of the range. Don’t take short trades since the odds may be in favor of a breakout to the upside. If the buying pressure increases as the TR progresses, then you may anticipate a breakout to the upside. These are all relatively simple decisions to make and are valid ways to make money. Keep your decision making process as simple as possible (remember the idea of binary decision making).

You can go through and think about how you’ll trade every portion of the market cycle in the same manner as well as conditions under which you’d choose to pass on the trade. Don’t get too lost in the jargon, just focus on what the market is doing, what it’s trying to do, and how good of a job it’s doing. If you need a break from Dr. Brooks’ teachings, read the CBOT Market Profile manual (freely available online) and Mind Over Markets by Jim Dalton. Both resources explore the idea of auction markets and that can be applied very well to normal price charts as well. Additionally the videos early on in the How to Trade portion where Dr. Brooks describes what markets can do is worth watching again so that you’re able to make the decision making process simple again.