The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

What is the difference between "sell the close" / "buy the close" and micro-channel?

STC Example:

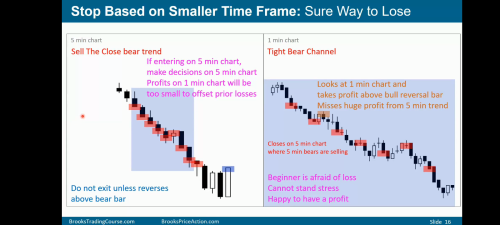

51d slide16

(Left chart)

In a Bear micro channel, every high is at or below prior bar high.

In Bear STC, every open is at or below prior bar close(?) (Bears sold the close, therefore the open of next bar is at or below prior bar close)

Left chart, B#8 (Bull bar): Micro channel, yes. But is this STC ?

Al discusses the left chart being STC on video 48J. So, yes.

The question is

What is the difference between STC/BTC and a micro channel?

STC/BTC is the same kind of concept as AIL(always in long)

In BTC, bulls buy the close, and the price likely will go up. Even if bear comes right away without micro DT allowing you to get out break even, the price more likely will test the high.(If you have encyclopedia, there are lots of examples and explanations for BTC)

Micro channel is just a small channel. It's a breakout on HTF and just trade with the trend. (In bull MC,) if low keeps getting higher, the first bear BO of bull low will be bought. Of course context matters too though.

So, BTC and micro channel means different concepts, but they are not always independent from each other.

Left chart, B#8 (Bull bar): Micro channel, yes. But is this STC ?

I'm not sure, but I think I remember some slide in encyclopedia that says 4th or 5th (or 6th??) consecutive bear bar is STC, so I guess the 4 th bear bar is STC, and it did at least get a micro DB.

If you sell that close you can...

1.get more bear PA

2.get a micro DB letting you get out break even (this time this case)

3.get a reversal right away but if scale in, 80% chance no loss (but getting out earlier especially above "give up bar" is recommended)

Thank you.

Bars#1 - #7 opened at or below prior bars close. (Indicating the close was sold)

Bar#8 opened above the close of prior bar#7. (Indicates that bar#7 close was bought).

Bar#12 is not highlighted STC? (Possible exhaustion Bar?)

Bars#1 & #2 are not highlighted STC. Need 3 consecutive Bear bars closing on low before STC?

Sorry, but I was referring to only the last 4 bars. (actually I thought bar#12 is STC)

Let me make it clear:

bar1-14: every high at or below prior high, so micro channel

bar3-7,11,12: more than 3rd consecutive bear bar so STC(I'm not sure about 8,9,10)

I think bar12 is STC, but it can be both STC and exhaustion. You don't necessarily have to sell all the STC, especially when it's climactic. It just means it's a "reasonable" sell. When a trade is reasonable, you can avoid loss 80% of the time by scaling in, but it's very difficult and beginners including me should focus on more reliable trades. Just because it's reasonable doesn't mean it's easily manageable.

Bar 8 was the first bull bar in the micro channel, so basically traders will sell it. Same concept as the first trendline break.(The first BO of a trendline will more likely be a minor reversal and test the H (or L))

I'm afraid I can't give good explanation for bar9,10 with confidence, so I hope someone more experienced could give us some idea.

Need 3 consecutive Bear bars closing on low before STC?

Most of the time yes, but sometimes a single but very good looking BO bar can be a BTC too. I recommend checking the encyclopedia, if you have it. (part1 section49-)

For BTC, you need "consecutive bull bars with at least one being big and closing near its high".

We don't have any information on the left, so don't know if it's big or not, but at least we have 3 bear bars with the last one closing near its low.

If you trade emini (I don't), BTC is an important concept especially at the end of the day, in which you often get "end of the day BTC rally".

Bar#12 is not highlighted STC? (Possible exhaustion Bar?)

I assume due to the fact that it's out of the CH when you draw the lines. B11 is a possible sign of a beginning TR to me on a lower TF as well so probably an exhaustion B is more likely you wrote.