The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

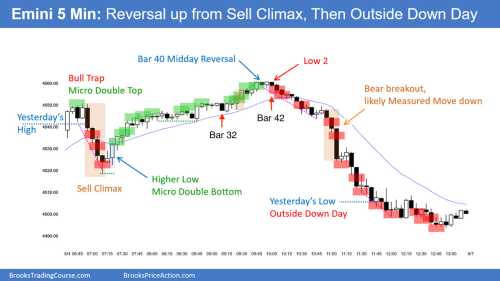

Hi, yesterday at the end of the Q&A session with Brad, someone named Carlos said he sold the close of bar 32 on Friday (2nd failed BO above high of day / top of TR with strong sell signal bar) Brad's response was that it wouldn't be good, because it's a small PB bull trend and if bears haven't been able to make money below bars yet, you shouldn't try to be the first bear doing that.

But at the same time the Friday's summary shows us it would be good to sell below bar 42. At this point, bears also haven't proven to make money below bars. So what is the difference here? I can see the bulls were more climactic, why would you expect it's the end of the small PB bull trend with still barely any selling pressure?