The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hi,

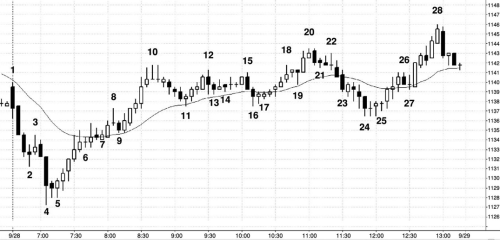

Here the day started with a 4 bar bear down to bar 2 and the trend continued till bar 4. The five bar bull spike from bar 5 flipped the always-in trade to long. The thing which is difficult to understand here first to the left there are big trend bear bars and there is hardly any overlap between 1 to 2 and the next bar after 3 until 4 and more importantly it's below the ema.

If I compare that with the bull bars from bar 5 onwards , they are small but no overlaps so that just suggests a good pullback to me and when it comes close to the ema you see the wicks which is nothing but failed breakout, what would make one think that this is going to go up? The only point I could see here i it went above bar 3 high but I would expect leg down either at bar 7 or 8 to test bar 4 extreme. So why would someone buy this instead of selling at bar 7 or 9?

Regards,

Nandkishore

So why would someone buy this instead of selling at bar 7 or 9?

Even if for argument's sake, we ignore context - where are the strong signal bars that are prompting you to enter shorts?

For context, you answered it yourself here

The five bar bull spike from bar 5 flipped the always-in trade to long.

The thing which is difficult to understand here first to the left there are big trend bear bars and there is hardly any overlap between 1 to 2 and the next bar after 3 until 4 and more importantly it's below the ema.

It's part of opening reversals(climactic in this case). It's incredibly common(according to Al's suggested probabilities - 50% moves on the open reverse, no matter how strong). Here, opening moves are first 18 bars.

EMA is a strong support/resistance if the test of it comes after at atleast 20 bars of no touch. That's why the 20 gap bar and EMA gap bar setups exist. It works well when the market is in a channel too.

when it comes close to the ema you see the wicks which is nothing but failed breakout, what would make one think that this is going to go up? The only point I could see here i it went above bar 3 high but I would expect leg down either at bar 7 or 8 to test bar 4 extreme.

That's because the EMA is the first reasonable target after an opening reversal. You see some hesitation due to profit taking. Still, there are no bears shorting as evidenced by lack of strong bear bar closing near low. Strong bull channel(probably microchannel) with many good bull bars that is following an opening climactic reversal does not give me any reason to go short. If I absolutely must short, I'd wait for a 2nd leg sideways to up(or some kind of DT and strong sell signal bar as there is no evident selling pressure here).

Thanks I think there is a lot to learn before you can be profitable.

Hi Nandkishore,

I second that this was part of an opening reversal pattern of which 50% reverse into an opposite trend from the original strong move. But notice that it's still a 50/50 and the location where prices paused was middle of potential TR. This was likely to become a TR because prices pushed over 50% of the bear leg. So it could've easily went down all the way to LOD again before heading higher too.

Personally if I was trading this I wouldn't want to buy so high in a BDBU formation, in middle of potential TR, at EMA. I would wait for a deep PB first to lower 3rd. Which means I'd miss this move to HOD at least but oh well, we're not obligated to catch every move, even Al says he misses a lot of moves 😆

Hope this helps,

CH

_________________

BPA Telegram Group

The first bars of the day often test some support or resistance. So price gets vacuumed to some level and then market decides.. Here: two climatic legs down, second leg ends with a long tail and inside bar, so you must wonder if this could be a second leg trap - which it turned out to be.

I agree with you, that you could sell around bar 7 - the inside bar before 7 looks juicy - micro wedge. But I would be quick to get out if I don`t get continuation cause it is a bull channel and better waiting for some kind of MTR short - which never came! I would not sell 9 because it is selling low in a bullchannel, right above EMA! Bad traders equation imho.

Selling 8? Why is there no bear body? Suspicious I would think.

Hope this helped!

Sorry I missed those last two replies those explanations were really helpful.