The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Do traders look for a MM in the opposite direction from a failed 2nd leg? I was just reviewing 20A/B and Al doesn't mention it specifically, though he does mention a MM in the opposite direction from a failed breakout.

See the end of the day on 12/26/23 for example:

If you take the BO as the range from bars 71-72 and then the end of the pullback as the low of 75, a MM down was tested to the tick on bar 9 the next day. If you measure the range of the BO down you get a test to the tick on bar 17 the next day.

Also, if I use a line chart to measure closes (similar to bodies except accounting for the open gap on bar 71), I see a MM down from the failed 2nd leg to the tick on bar 78:

It's intuitive to me that algos would be paying attention to these levels and I've seen examples of it working elsewhere, but I was wondering if it's in line with the course since I'm still a beginner so I want to stick to the script until I'm consistently profitable.

Thanks!

Hi Garrett,

I think a lot depends on how we arrived at this BO. In your screenshot it was bull trend, so best bears should get after it would be a TR. The reason I mention is that TR may reduce chances of getting an MM, since in TRs we can expect all sides to be constantly disappointed, which often manifests in MMs not getting reached by just a couple of ticks or points. In fact, if you watch limit bulls, they were buying every prior swing low (red arrows) and profiting mightily. Yes, the MM got reached in this example, but I think what helped were exhaustion bars 71-72 with horrible FT followed by such great bear strength 74-77 (this reduced greatly chances of bull trend resumption before seeing a deeper bear PB). So yes, a couple more legs down were to be expected, and yet bulls were still buying every prior swing low and also after such climactic BUBD it increases chances of a TR as well (including disappointments of not reaching MMs). So in conclusion... in general, yes, it's reasonable to expect an MM in the opposite direction after FBO (failed BO), but whether the likelyhood is 60% or better or less is then affected by what came before.

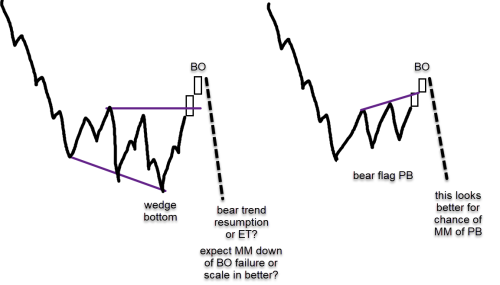

Also... what if the prior trend was a bear trend instead of bull trend and then we get a PB and same BO? Can we expect equal MMs if this BO fails? I think it's a big difference whether the PB is in a form of "wedge bottom" or "bear flag":

Food for thought for 2024,

Happy new year!

CH

_________________________

BPA Telegram Group