The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Dr. Brooks tells us that even when a trade goes bad, you can make a profit or breakeven about 80% of the time. I have found this to be true by using his method of doubling the position size when the trade has moved substantially against me and entering again when there's a strong bar in the original direction. Sometimes it's necessary to add on a second time. Of course, this method may not work if you haven't realized that the market has entered a strong trend in the losing direction--then you're sorry that you didn't take a loss earlier.

The method gives you a profit on your add-on contracts when the market returns to the original entry price. Sometimes, the market only returns halfway to that price, and one has to settle for breaking even. Dr. Brooks shows examples of both chart conditions.

If you're going to trade with this idea that, on those occasions when the trade goes bad, you should add a number of contracts equal to the original (sometimes twice), does that mean that you're always entering trades at one-half to one-third your comfortable trade size, e.g., if I'd like to risk 1% of my account on each trade, I need to enter at .5% or .33% to allow for those occasional trades which require adding on?

I have a small account and trade micros. 1% risk is fine. At a smaller percentage risk, there wouldn't be many trades that I could take, even with micros, but increasing my risk when trades go bad hasn't worked well for me either, even with the 80% breakeven/win rate. One bad trade can put me at a substantial loss for the day because, when I've added twice to my position, the risk is so much higher on that bad trade than what I've made on the other trades, e.g., if one risks $100 from each trade entry, the risk from the second entry is $300 ($100+$200), and the risk from the third entry is $600 ($100+$200+$300).

Any thoughts would be appreciated.

Thanks,

Stephen

Hi Stephen,

There was another interesting discussion about scaling in here: https://www.brookstradingcourse.com/support-forum/postid/5670/

For your first question about size: in general, if you plan to scale in then entering with 1/3rd is a good start. Maybe do even less. You want to get as small as possible. It won't give you a lot of profit in the end, but remember that by practicing scaling in you're sacrificing profits in return for the high probability of winning.

For your second concern about risk growing out of proportion: the total risk from all the scale ins can't be greater than risk on any other trade, so you'll need to calculate size and stoploss ahead of time given the context. But eventually you will take a loss, and even though it won't be >1% of account it will wipe out a lot of the winners from before if those winners were all small (probably due to developing a habit of always trading small size expecting to scale in if necessary).

I think this type of trading may not be sustainable long term if:

1) you're regularly taking low probability trades in bad context, meaning that you're overestimating the likelyhood for a scale in to work e.g. trading against small pullback trends, trading a small opening range that's still expected to BO and double or triple on the day etc.

2) you're trading constant size on all types of trades, meaning that for low probability setups and high probability setups you're always taking same size positions. This could result in not earning enough on winners which all get wiped out later by a scaled in loser. Some traders compensate for this by adding on to winners (which is hard) or just starting a high probability trade with a slightly larger position than usual.

Last point is about the dangers of a small account and what you said about decreasing risk reduces what trades are available to you. This could be a symptom of undercapitalization. You may simply be in a market that's too expensive for your account and style of trading. You could either find a cheaper market or up account size. One of the sad things about an undercapitalized account is not being able to take a lot of high probability breakout trades because risk is usually far by that time.

Hope this helped!

CH

___________________

BPA Telegram Group

Thank you so much, CH. This was very helpful. If I could ask you one other question (no favor should ever go unpunished):

I find it relatively easy to identify trades where my profit is about 75%-80% of my risk. These are usually strong bars from an EMA where my entry (for bull bars) is one tick beyond the high, my stop one tick beyond the low, and my target equal to the distance between the open and close. I find that if I take the full length of the bar, I often come out a little short of the target.

I realize that I should be looking for a profit equal to at least two times my risk. I can often identify those using measured moves, Fib extensions and resistance levels. My idea is to trade half my contracts at the high probability first target of the length of the entry bar and the second at the farther target. I'm kind of undecided as to whether I'm best off not moving my stop after hitting the first target and using that first target win as a way of offsetting my loss if the stop is hit or if I should move my stop to breakeven after the first target is hit. Sometimes the latter method saves me a loss and sometimes I lose out on a very good trade.

What concerns me most about either of these methods is that I'm not hitting 2:1. Half of my trade is 2:1 or greater and the other half is .8:1. Taking the $100 per contract example, the 2:1 win is about $280, not $400, and a loss is $200.

I'd love to have your thoughts on all this.

Hi Stephen

One definitive way to determine the profitability and probabilities of your scale-in method/s is to download the 5min ohlc data to Excel, and then crunch the numbers.

It obviously must be precisely done. And it must include plenty of market conditions (strong uptrend, strong downtrend, narrow sideways day, broader sideways days, etc...)

Remember also, it must be based on your entry and exit types (enter above a good bull bar, below a good bear bar, etc....).

You could contract the job out to an Excel expert (if your Excel skills are not at an advanced level).

Regards

Graeme

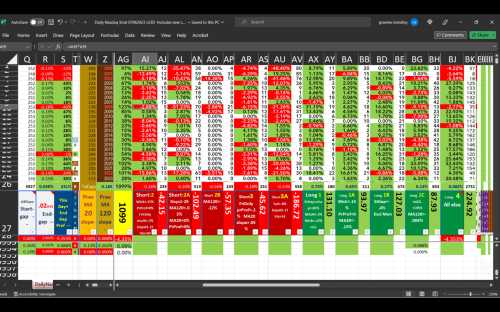

PS: I have performed this exercise on the QQQ daily bars using 23 years of data. To give you an idea of the complexity of this exercise, I attach the Summary results section of my Excel. It wont make much sense, but the 10 larger columns to the right are the 10 sub-strategies of my overall strategy with a brief description of each sub-strategy's trading rules. Each substrategy has differing priority over the other nine substrategies.

But I only partially used the Brooks Trading Course recommeded trading style, and always entering at-market.

Even with my advanced Excel skills it was an exhausting 400-hour exercice involving sleepless nights thinking about potential logical errors and strategy improvements.

It tells me win rates, probabilities, average profits, and outcomes using varying stoploss levels.

It is an always-in strategy, therefore it is always-in long, except approx 25% of bars (days) are in short.

I find that if I take the full length of the bar, I often come out a little short of the target.

It's hard to comment on this particular one without seeing specific trades and especially what's to the left. Maybe you are finding setups that are too close to some resistance levels just above.

My idea is to trade half my contracts at the high probability first target of the length of the entry bar and the second at the farther target.

You have to be careful what proportion of position is used for scalps and for runners because runners are low probability and rarely happen. So if you're regularly taking smaller profits on scalp portions and getting BEs on runners but when the whole trade loses out of the gate, you have to remember that those losses are on full positions. This may skew the Trader's Equation against you overtime. Basically you may end up not earning enough profits for the risks taken. So it's important to calculate your runner portions correctly. Usually a ratio like 1 unit of runner per 3 units of scalp and then moving your stop to BE after hitting the scalp portion.

What concerns me most about either of these methods is that I'm not hitting 2:1. Half of my trade is 2:1 or greater and the other half is .8:1.

As long as your PnL curve is trending up you're a winning trader. A lot of traders do well with just a 0.5:1 but need a very high win ratio for that.

It would help a lot if you show your trades and your analysis so we can see in what contexts you're taking these trades. It's hard to comment thoroughly without knowing more. There are no hard rules for these things, trade management varies greatly depending on how a chart looks, what the original plan was, how the bars look after entry etc. You can maybe start a Journal here on the forum and update regularly or join our BPA group on Telegram where we discuss these things live.

Good luck!

CH