The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hello.

I have a doubt regarding a very important aspect, which I don't think I am understanding. It may be fault of my little experience in trading and having learned things from various sources on the internet before I found Al and decided to follow his steps.

In many trades Al talks about Low / High risk depending on how late you join the trade.

Low risk = small loss, lower probability of success and higher potential profit.

High risk = big loss, higher probability of success and lower potential profit.

My doubt comes from the fact that in my case (MES futures) regardless of the distance from the SL, whether 5, 10 or 15 points, I adjust the number of contracts to be 100$ SL. Taking this into account, when Al says that a trade having very few points with respect to the SL means a small loss, in my case it is not, so, it means the same amount, for me the equation would be as follows:

Low risk = 100$ loss, lower probability of success and higher exponential profit.(high risk in my case)

High risk = 100$ loss, higher probability of success and lower exponential profit.(low risk here)

So I don't know how I should enter the trade and manage the ammount of contracts / points according to Al's lessons.

Example: Video 23B Final Flags --> 26:46 image

Can you please help me with this matter?

Thanks a lot!

When Al says that a trade is small risk he means that the amount you are risking (regardless of position size) is small compared to the potential reward. Likewise when he states that a trade has a big risk he means that the amount you need to risk is large compared to the potential reward.

You are currently using a "fixed risk" trade management system where you are adjusting your position size in order to maintain a fixed dollar risk of $100 per trade; however, that does not change the ratio of Risk vs. Reward for a trade.

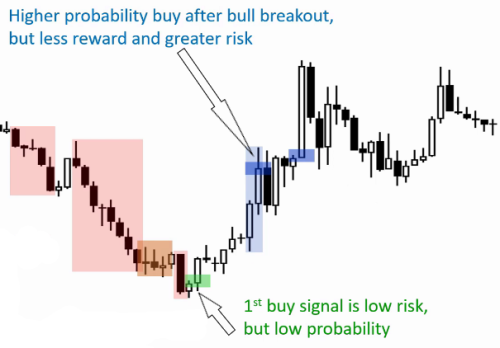

In video 23 B Al gives two examples of possible entries. The first marked in green and the second marked in blue:

Based on your management style, you would presumably buy more contracts if you took the green entry than if you took the blue entry in order to keep your dollar risk the same for both trades.

Low risk = 100$ loss, lower probability of success and higher exponential profit.(high risk in my case)

High risk = 100$ loss, higher probability of success and lower exponential profit.(low risk here)

You then seem to be asserting that since you are risking $100 on both trades and since the green entry has a lower probability of success, then the green trade is high risk in your case since there is a higher probability that you will lose $100. Essentially you are saying that high probability of losing = high risk. In doing so you are combining the definition of separate elements of the traders' equation of which there are three: Risk, Reward and Probability. But it is better to think of Risk and Reward as a ratio and not separate independent elements.

So Low Risk = Good Risk / Reward Ratio and

High Risk = Bad Risk/Reward Ratio

Therefore when you increase your position size taking the first entry, even though you are maintaining a fixed dollar risk, you are increasing your potential reward (dollar amount) and therefore improving your Risk / Reward ratio, making it a "low risk trade" (your risk is low compared to your reward). You pay for this "low risk" with low probability.

Likewise when you decrease your position size when taking the second entry, again maintaining your fixed $100 risk, you are decreasing your potential reward (dollar amount) and therefore lowering your Risk / Reward Ratio. This is a higher probability entry but you pay for that high probability by lowering your Risk / Reward Ratio.

As Al states in the video your expected outcome over a large number of trades is about the same regardless of which entry you choose to take.

Thank you SALCO!

That makes all the sense, I dont know why I thought low risk was less money instead of R:R, I am always trying to take the low risk entry.

Have a nice day!