The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hi everyone,

From the last few days I am continuously loosing all of the trades, more specifically I am currently in a 14 Trades loosing streak and due to this too much negative thought's are popping into my mind such as "Will I become a trader" "Should I trade price action" "Would I ever become a successful Price action trader" "Should I just leave price action and just to option selling and hedging"....... and the list goes on I know these thoughts are not the real truth, but the losses are really dumping my confidence

So what's the solution of this?

Please help !

post your trading plan. Then we can discern your problem. If you dont have one, that is the problem.

What actually you mean by an trading plan, please give me an example

What Greame very kindly offered to help you with, that itself seems to be the root cause of your downfall. I don't know how much of the course you have covered, but there are people here who go through the course maybe 2-3 times before they actively start trading.

Al, throughout the course talks about risk management, trading small enough, trading the "I don't care size" and then scaling up from there as you become more and more consistent and profitable.

Moreover, it does not seem to me that you have finished the course even once. It is impossible to go through the "How to Trade Prerequisites"(video 30-36) and not think about risk management, trade management, trade probabilities and starting to think about trade plans.

Just my 2 cents.

P.S. - I am a beginner as well.

Yes I understand the I don't care size, because of that my average loss size is about -0.20% of whole account per trade!

Eagerly waiting for your reply brother 😀

The trading plan is, in short, a description of the setups you take and how you manage them. But with 14 trades loosing streak you don't need one, because this should not been happening at all. Why don't you go back to the EMINI and compare your reading with Al's? This is the only way to evaluate your knowledge because by trading other instruments you have no feedback about what you are doing, so you never know, even if you win sometimes.

We can help here, but without the theory firmly in your mind your questions will not go to the root of the problems and will keep walking in circles. I have seen many traders failing just because what they thought was true was simply wrong and they were not able to escape from there.

I know this suggestion is not popular and it is okay to try any other way as long as needed, but I think the 14 loses are telling you clearly that your current path is not good. So you can keep trying or you can go back to study using the MKT replay feature, reading as much EMINI charts as you can (with MKT replay you can do many sessions in one study day) and comparing with Al's. Then, if you have questions you can ask here or, better, if you are subscribed to the webinar, you can directly ask Al in the webinar and forum.

What do you think?

I don't have particular setups to trade and also don't have rigid rules

What trading style I have is I follow every pattern Al told and trade all of them whenever I spot them patterns like (Wedge , triangle , range , channel , double tops and bottoms , head and shoulder ) and trade this pattern only if the context supports

please review this channel : - https://t.me/joinchat/ZvYpdR9WtaY2MDE1

in that channel I have been posting daily review of the charts and please tell me I whether or not I am on the wrong path ! please help me out with this.

Ludopuig will be in a better position to comment.

To me, it seems like you are trading a 1 minute chart probably to minimize your risk. Understanding what you marked on the charts in your channel is incredibly difficult to me. I also did not see you mark the most obvious of patterns.

I personally track Bank Nifty, so I know how well PA works there. I follow the 5 minute chart. Can't really say any more as I could not understand your markings.

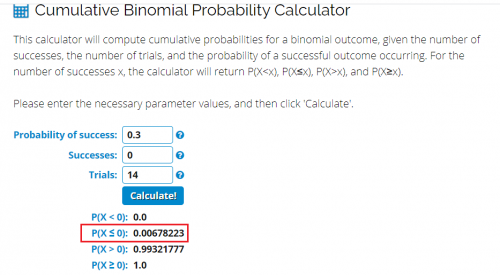

Suppose you always take low-probability trades (Reversal-trades). Let's take 30% as an average winning percentage. The above calculator screenshot shows that the probability of having a streak of 14 losers (in a row) is 0.6%. So 0.6% chance the 14 losers in a row are just a coincidence.

There's a very big chance (> 99 %) that the problem lies in your analyses.

As was already suggested above: you probably need to study the course more thoroughly.

I've been studying the course for more than a year now. And I have only covered 45% of the Fundamental Course. So after that I still need to do the specific part. I watch a video completely, and then I watch it a second time, pausing the video constantly to take notes. It will easily take me 2 more years to have covered the course completely. And even then it's highly unsure I will be ready to trade profitably.

I do some trading, but with a very small amount. Just to add a practical aspect to the course for myself.

The financial investment you make in the course is ridiculously small. The amount of time you need to invest in it, studying, is ridiculously high.

I can't even imagine the work that must have gone into creating this course.

And that, to me, is the ultimate motivation. If it's possible for someone to create the course, it should be possible for me to study and understand it completely.

At the risk of sounding cynical, after 14 consec losing trades, you might have a profitable system if you do the opposite.

But, seriously, if you want to construct a trading plan, the below investopedia link describes how to do it.

https://www.investopedia.com/terms/t/trading-plan.as

Some traders like a trading plan that has a rigid set of rules (decisions). Other traders prefer some of the rules to have discretion in the decision.

The trading plan is documented.

Yes, i know some profitable traders dont use a documented plan - and good for them.

It might sound corny but the discipline, focus and patience of the experienced members is truly worth learning from. Really appreciate the wisdom you share with us newbies. Thanks for all your efforts!

Hi Rishi,

I'm currently about 40% of the way through Al's video course after reading all three of his books and am finding it far more productive to not worry about win ratios and profit & loss at the moment.

Focusing on the current lessons I'm studying as I trade (I'm trading the ASX200 on a 5min chart everyday) has meant that I am learning much quicker, forming better habits and am a lot less stressed at the end of each day. Also I have found it really good to use the always in approach as training (I don't think I would always use this technique long term). I wait for a good buy/sell setup at the start of the day then reverse with the market until the end of the session, so I literally have an open position the whole session. This means I can't exit a trade early or place silly countertrend trades which was the cause for so many losses in the past.

I am nowhere near ready to trade significant volume and do not have a trading plan (I don't know enough yet to write one). I see it as far better use of my time to acquire knowledge and good habits at this stage and wonder if the same might be true for you. I have wasted too much time over the last 6 months focusing on win ratios and profit & loss, when my only concerns should have been to learn and practice.

I hope this offers some encouragement...

I hope this offers some encouragement...

Yes Brent, it really did ! Thank you

Hi Rishi, I think all the key points have been addressed by the other traders, but do you mind sharing how many trading days did it take you to make those 14 trades?

If less than 3 or 4, you could be overtrading as well.

Best,