The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hello everyone,

I'm going through the bonus videos (completed the fundamentals and how to trade PA).

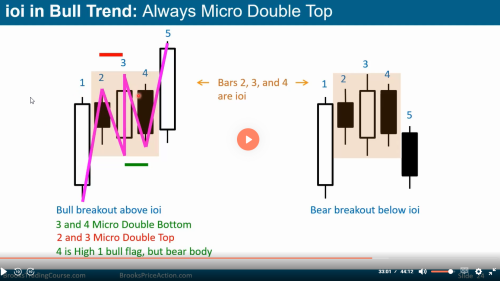

And there is something that really caught my attention at 33:01. Why is bar n°4 H1 bar ?

In my comprehension, let's pretend we have a bull trend. The bar 3 is a PB bar (went below the low of the prior bar) and at the same time went above the prior's bar H. So became buy signal bar. Since it's a bull bar closing nearing its high = OK to buy above and therefore it'll potentially become H1.

Then we have bar n°4 that is a bear bar, closing near its low. because of its tail on the bottom, with bar 3 they are micro DB. But this is not a signal bull bar (because it's bear closing near its low). The only situation in which bar 4 can be a "bad" buy signal bar is if it closed above its mid point, and then we broke above, that would make it H1, which is not the case here.

Since I am definetly missing something here,If anyone can help me please I would really appreciate.

Thanks !

Every bar whose high is lower than the previous bar is a potential H[n] candidate, whether it is a bull bar or a bear bar. If the next bar goes above this bar, then the H[n] has triggered. So in this case bar 4 is a H[n] candidate because its high is lower than the previous bar 3 [Plus its an inside bar. All inside bars are H[n] and L[n] candidates]. Al has marked bar 4 as a H1 because its coming after a new high on bar 3. If a bear bar is a H[n] candidate and gets triggered, its considered a bad buy signal bar( you usually want bull signal bars) and vice-versa for the L[n] case.

Thank you Rajesh