The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hi there. I need some help in terms of improving my trading management, in today's session I made 4 trades (3 positive and 1 negative) and still ended up negative, I know that if my RR is better and I only trade at least 1:1 I am going to improve. However, I really like to analyse all bars when I am trading and this makes me take profits earlier. I still think it is reasonable to take profits where I took them.

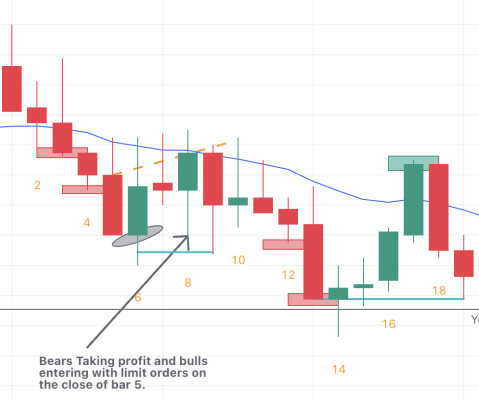

This is my entries of today. I enter in the red boxes and got stopped out in the green one.

I entered on bar 3 and on the low of bar 4, expecting a 1:1 with the bodies of bars 1,2 and 3, but got out in bar 8 (limit order at the low of bar 5) due to bar 6 being a bull trend bar and the possibility for a DB.

As I saw bar 6 and bar 7, I also got in for a test of the bottom of bar 5.

I also entered on the low of bar 12 and put the SL above the high of bar 11 (beginning of the bear BO) waiting for a 1:1. However, the market turned in bar 14 (bad follow-through below yesterday's low) and swiped all my profits.

I also saw the entry of bar 11 (wedge and good signal bar) but I rather have better probability so I normally wait for an okay follow-through bar to enter.

And I know I could had out my stop above bar 10 and not get stop out but I think the high of bar 11 was also a reasonable stop placement.

Was this a bad management ? and what can I do better to improve ?

The worse thing is that I think I am doing an okay job in analysing the market but with one mistake all my profits go away, do you think is better to just hold my trades for a 1:1 (not the scalping ones) ?

I'm relatively new to this so take my comments with a grain of salt. The only thing I would have done differently is when you got stopped out, I would have waited for price to break that previous LH on bar 8 first... Looks to me as though price rejected the previous LH resistance right where you got stopped out. Maybe set your stop slightly above the previous LH (bar 8 since that was the peak) that way your confident its a change of structure, if it does break.

Good job in the first place. However, I would have entered differently. Your first entry would have been my first too, but the second and third would have been Bars 9 and 18 which are right after the reversals. I would have brought down my stops to the most recent high (above Bar 8). Then counting the leg drops, I would have waited for a third leg drop before taking profit. Or worst case situation, a double bottom 3rd leg. If it truly is a swing trade your stops above Bar 8 should not be touched. So the mistake I see here is that you didnt place your stop properly