The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

I am confused about some of the comments around breakouts in the training materials. There is a comment that "80% of breakouts fail" quite early in the course materials.

But then in the "Top 10 Price Action Setups" it is noted that "Among the 10 best price action trading patterns, breakouts are my favourite because I like high probability trades."

Am I missing something?

Hi Mark,

The 80% rule applies to any kind of breakout attempt, from a bar going above prior bar all the way to attempting to break out of trading ranges: anything that attempts to breakout of something stands an 80% chance of failure. This is why you'll see Al mention that most of the price action on a chart is usually in some kind of TR and only a small percentage of 5M intraday bars are in breakout mode that succeeds. It's the successful breakouts (BO above some prior swing high/low + good follow through) that are very high probability to go for some kind of measured move.

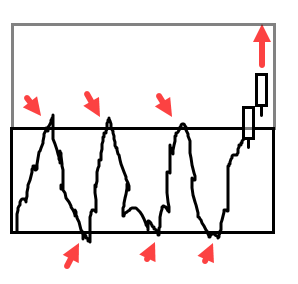

Just a hypothetical example above showing high probability of a BO attempt above or below of TR to fall back into the TR. Eventually a breakout will succeed and then it's high probability that it will go for some kind of MM.

Hope that helped and let me know if you want to chat more!

Cheers,

CH

_______________________________________________

Thanks, appreciate that - great response. Makes sense to me now.